This is the eighth article in our Thematic Analysis series. In this series, we talk about broader trends and emerging concepts in the crypto space, looking towards the future and analysing how Web3 is evolving in real-time. Let’s dive in!

Theme: The State of NFTs

Introduction 👋

Commencing in the summer of 2021, NFTs have successfully widened the scope of ‘crypto’ to a much larger audience. The primary reason for this is the technology’s ability to blend media and culture into the existing financial components of blockchain technology.

Given this, NFTs – implemented in their many forms – are meant to be the gateway to help onboard mainstream internet users. Not just the next 10 million, but 1 billion. Thus, it is important to occasionally take a pulse of the market so that we may recalibrate and reassess where we are in the adoption timeline.

Note: We will not cover the basics of NFTs in this piece. In other words, what NFTs are, why they are significant, etc. You can learn about those topics in our earlier article here. Also, a quick shout to Delphi Digital’s piece on NFTs; this article is heavily inspired by theirs, and should be thought about as a more digestible version of the same (with Genesis Block value-adds scattered across).

2022 Reality Checks ✅

As alluded to earlier, NFTs captured the 2021 zeitgeist in dramatic fashion, only to come crashing back down a year later due to macroeconomic headwinds alongside the rest of the crypto market. Nonetheless, as a whole, the asset class is definitely in a net-positive growth trajectory since the summer of 2021. This has led many to extrapolate what the technology would look like in its mature state. However, as we should have expected, there have been surprises. Let’s go over the three covered by Delphi.

Creator Royalties Trending to Zero

The ability to enforce creator royalties in a trustless manner was one of the primary features that allowed NFTs to rise in prominence. Yet, since mid-2022, we’ve seen a growing number of marketplaces making creator royalties optional, i.e., allowing buyers and sellers to decide if they want to pay the royalty. This trend coincides with Sudoswap’s launch, as it was the first exchange to not have royalties as a mandatory feature. Since, X2Y2, LooksRare, and others, have made royalties optional in an effort to stimulate trade activity in a slow period (such as the one we’re currently in).

Take Magic Eden as an example. Adding in the optional royalties triggered a collapse in the number of trades that included royalties. There is a seemingly obvious yet counterintuitive learning here. Initially, many believed that consumers didn’t prefer to participate in streaming royalties back to the creator due to the opacity of the process; instead, it looks like individuals mainly prioritise lowering the cost of their trade. While this is disappointing for creators, it does reflect the will of the market, and even though marketplaces like OpenSea have been outspoken about their stance in favour of creator royalties and have gone as far as restricting collections that do not enforce royalties on other trading venues, it is likely that NFTs that are cheaper for the end-buyer will see more volume. Over time, as the features across marketplaces become more similar and standardised, traders may migrate to the most economical platforms, forcing a low-or-no-royalty race to the bottom.

Solana NFTs

Solana NFTs witnessed a dramatic rally over the course of 2022, growing to be the second largest NFT ecosystem, and sitting at a total market capitalisation of ~$200M as of 13 February 2023 – surpassed only by Ethereum’s $1.5B+. It is likely that this adoption was led by Solana’s inexpensive transaction fees, high throughput, and relatively functional UX.

Unfortunately, on top of the macro downturn, this market was severely hit by the FTX implosion, leading to their largest collections DeGods/y00ts announcing that they will be migrating away from the Solana blockchain.

Music NFTs

While we’ve covered Music NFTs in great depth in our earlier piece, it is evident that there is a lot of work needed for them to realise their full potential. The primary reasons are how deeply intertwined the current infrastructure in the music industry is and the degree of influence / leverage the incumbents possess. The below Dune dashboards shows the change in primary market and secondary market volumes for sound.xyz, one of the premier destinations for Music NFTs.

As you can see, since March-April 2022, demand for music NFTs has fallen off a cliff. Nevertheless, similar to Delphi, we still view the fundamental case for Music NFTs as sound (pun intended), albeit the duration for that to actualise might take more time than expected.

Current Market Conditions 🏪

In hindsight, it is easy to say that NFTs were in a hype cycle and are now approaching the trough of disillusionment, as seen in Gartner’s Hype Cycle below. One example that puts this into perspective is the phenomena of gas wars, where bidders would bid up the price of their transaction fee to get their purchase order executed first – leading to the transaction fee to be higher than the actual NFT purchase price.

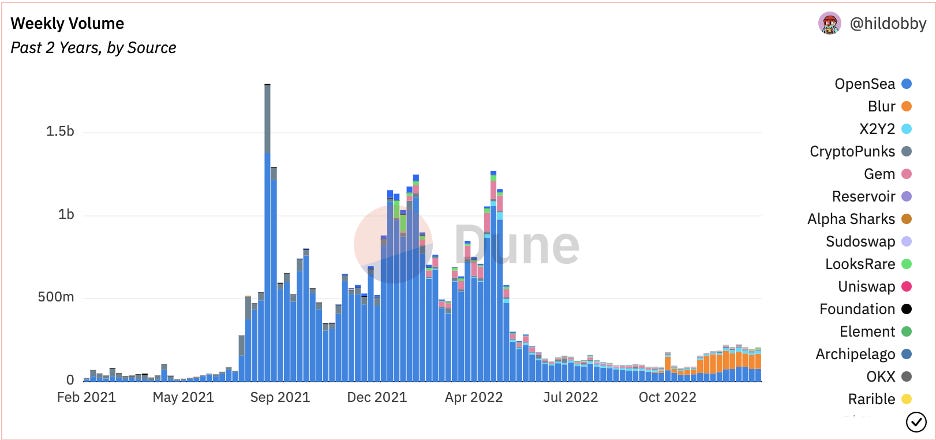

Coming back to today, the most noteworthy development has been OpenSea’s fall in dominance – at least in terms of volume traded. Blur, since its launch, has been the first competitor to seriously give OpenSea a run for its money, actually surpassing OpenSea volumes recently.

However, as you can see, as of 13 February 2023, OpenSea still dominates in terms of the number of trades executed.

Looking at the market as a whole – made up of PFPs, Fine Art, Generative Art, Game Elements, etc. – the progress in throughput and fee reduction (for example, via the development of L2s) has not been able to trigger NFT interest back to prior levels. This tells us that cost is not the only factor inhibiting mainstream adoption. It is also the overall perception of the industry, combined with the current macroeconomic environment and bear market, that are acting as barriers. And can you blame anyone? Most projects are copycats or half-baked cash grab projects, making it highly unappealing for newcomers who do not currently have any set-in-stone method for filtering through and finding the ‘good’ projects.

2023 Themes 🎢

NFT Finance

NFT Finance refers to the next step in the financialisation of media – the first being wrapping media assets as a non-fungible token, thereby giving it features such as having a 24/7 global market, scarcity-driven value, ownership provenance, etc.

Around mid-2022, we saw the emergence of a new suite of applications that gave users access to more sophisticated financial services, using NFTs as the base source of value. Here, we are referring to the financialisation of digital assets such as art, collectibles, etc., and not the arbitrary use of NFTs in other dApps (for example, Dystopia Swap or Ocean Protocol). To summarise, we can say that NFT Finance is where NFTs meet DeFi primitives, which can potentially add fuel to the NFT industry’s value creation velocity.

So, what are these primitives?

To begin with, we have lending and borrowing – arguably the most fundamental of all financial primitives. As you can see in the below diagram, cumulative borrowing surpassed the $500 million mark in late 2022, after a steady increase all year:

The main players in this segment are BendDAO and NFTfi, with X2Y2 gaining momentum in recent months. Collectively, the three represent ~90% of loan volumes. Other players in this segment include Arcade, Pine, JPEG’d, Drops, and NiftyApes. It is worth noting that despite the USD value of the loans being well off their peaks (primarily due to the decline in ETH/USD), the absolute ETH borrowings hit an all-time high in January 2023 on the NFTfi platform, indicating that this market is healthier than it may seem at first glance.

Another primitive that usually attracts new market participants is derivatives. With respect to NFTs, this will provide the market with a few use cases that are not currently accessible to most. Firstly, the existence of NFT derivatives will reduce the barriers for gaining exposure to these assets, specifically the blue chips; users can get financial exposure to a Bored Ape or CryptoPunk at a fraction of the price. Secondly, derivatives allow the construction of more sophisticated trade strategies (for example, using hedging), thereby allowing one to gain exposure to the NFT assets, without the increased volatility. Thirdly and finally, and this point holds true for borrowing and lending as well, we now have leverage introduced directly into the NFT market. Looking back, it is astonishing how inflated valuations got during the peak of the hype cycle, and without easy access to leverage at that. Considering that leverage is usually a primary driver of bubbles in any market, we could be looking at the catalyst that kickstarts NFT-Fi Summer (and eventually breaks the market…).

This segment has not seen traction to the levels of NFT borrowing and lending, but it is worth mentioning two interesting projects: NFTperp, a decentralized exchange for NFT perpetual futures (currently in private beta), and Hook Protocol, an options protocol that allows users to buy and sell call options on NFT collections.

Lastly, it would be remiss of us to not at least mention the other interesting projects building in ancillary segments within the NFT Finance space.

Artfi and Nibbl – NFT fractionalisation

Reservoir – provides API access to an aggregated NFT orderbook across all marketplaces

Astaria – reduces information asymmetry in NFT loan pricing

UpShot – low latency and higher accuracy NFT pricing engine

Metastreet – NFT credit market via tranching

Marketplace Unbundling

The next theme to keep an eye on is the unbundling of NFT exchanges. It is no secret that the exchange business is one of the best business models out there. It boasts high scalability, steady cash flows, and no dependency on any individual project’s execution risk. Therefore, it is no surprise that other competitors have cropped up to capture some of the pie.

Consequently, as we’ve seen above in the Current Market Conditions section, OpenSea has significantly dropped in terms of market dominance in recent times. However, if all marketplaces are essentially offering the same service (of matchmaking buyers and sellers), it is simply a race to the bottom with respect to the transaction fees incurred by the trader; a function of the creator royalties plus the marketplace commission. In this scenario, with OpenSea already having the deepest liquidity, one could make an argument for a winner-takes-all outcome for them. Yet, we are in fact seeing other players gaining adoption. Why?

Well, the large scope, myriad types of NFTs, and varying demographics of purchasers make the UX a critical component of these marketplaces. In other words, fashion NFTs, PFPs, fine art, in-game assets, etc. all have very different user purchase and interaction journeys, therefore creating a whitespace in the market for more verticalised players. An early example of this is Blur.

The reason why Blur has emerged as a serious OpenSea competitor (beyond airdrops and inflationary token incentives) is due to its laser focus on building a product for NFT traders. The insight that they had was their discovery that ~70% of volume on NFT marketplaces is not from regular NFT collectors, but from NFT traders. Thus, by offering a superior UI for this use case, and additional functionality like sniping and sweeping features, portfolio analysis, etc., they have risen to prominence.

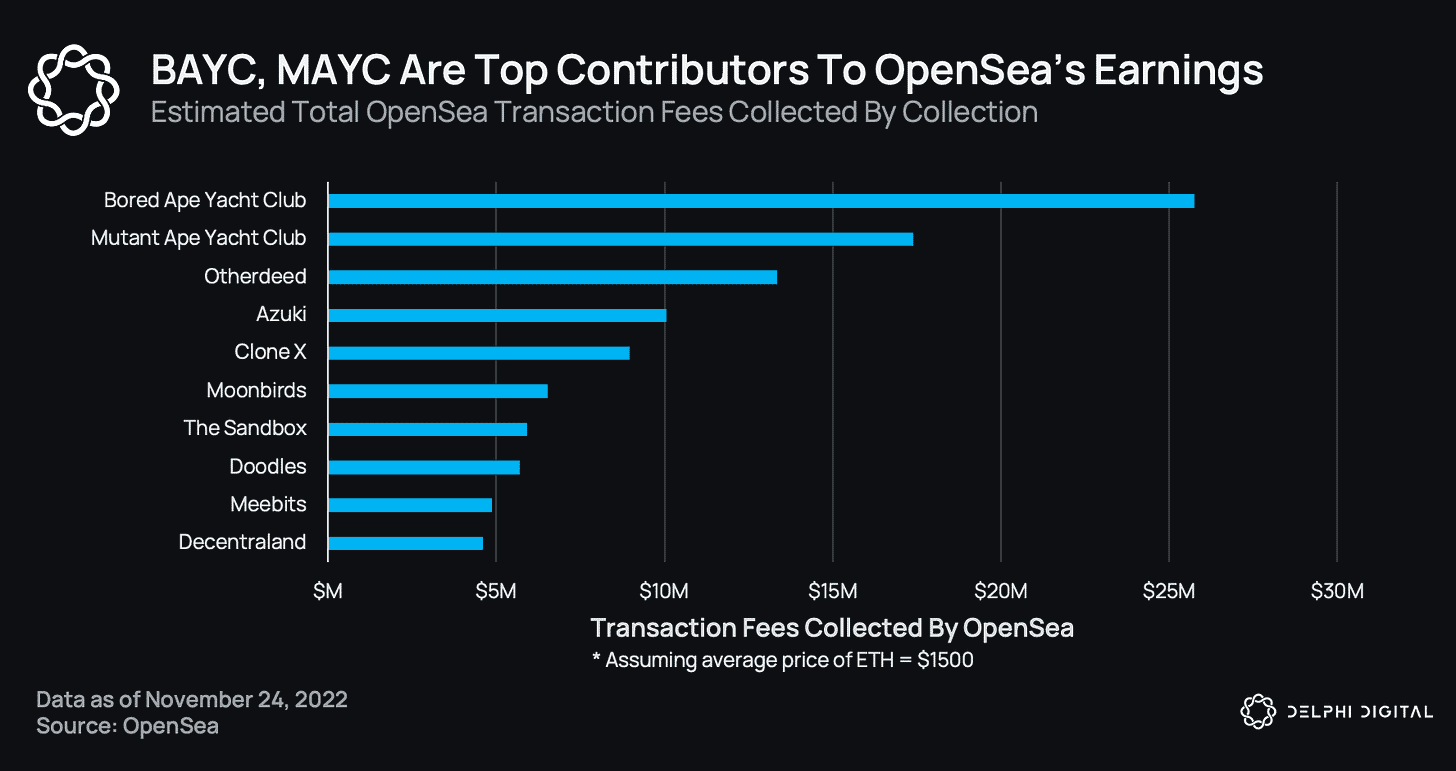

Similarly, there are players in other verticals such as Sudoswap (instant liquidity via NFT AMMs), Fractal (in-game NFTs), Sound (Music NFTs), Artblocks (Generative Art), etc. In fact, it makes sense for individual projects to launch their own private marketplaces because a large chunk of marketplace revenues is generated by a small number of projects. A case in point is the Bored Ape ecosystem on OpenSea – spinning up their own marketplace could mean an additional $40M+ in revenue.

The unbundling phenomenon is not new to Web3, and the most famous Web2 example is Craigslist. Craigslist has given rise to several vertical marketplaces, which, in many cases, are more valuable than Craigslist itself – for example, Zillow’s revenues are 10x larger than those of Craigslist.

All of this does not mean OpenSea is doomed or going out of business. It is simply indicative of the large potential for growth in the verticalised marketplace segment.

NFTs Going Mainstream

The third theme put forward by Delphi is one that is almost trite. Not just for NFTs, but for crypto as a whole – X is on the cusp of going mainstream. However, we do believe it is useful to go through their rationale and reflect on the type of adoption that has actually transpired to date.

The first reason is for why NFTs are going mainstream is Big Tech. In the last year or so, Instagram has enabled creators to mint, buy, and sell NFTs on Polygon (while also supporting other select chains); Reddit launched its collectible avatars with over 6M crypto wallets created; YouTube introduced NFTs in its new creator tools; and Apple allowed in-app NFT minting, buying, and selling (albeit not without controversy).

The second reason is big brands starting to get involved with this asset. We have names like Nike, Adidas, Gucci, Budweiser, Starbucks, Porsche, and more, all entering this space. The reasons for this can be boiled down to one or a combination of the following: additional revenue source, increased customer engagement / loyalty and thus retention, and reduction in customer acquisition cost.

Some of these objectives are already being met. Take revenue, for example. Since their launch, from primary and secondary NFT sales, Nike (via RTFKT) has generated $186 million, Dolce & Gabbana has done ~$23 million, and Tiffany, Gucci, Adidas, and Time Magazine have all done ~$11-12 million each. However, it is worth noting that most of the collectors of these mints have been from existing Web3 users. So, it may not be indicative of mainstream users making the leap yet.

NFTs as Social Tokens

Social tokens have been colloquially understood as ‘fungible tokens whose value is tied to an individual or community's reputation / success’. However, if we simply alter this definition from ‘fungible token’ to ‘verifiable digital asset’, then it is clear how NFTs have already started to be used as social tokens.

While social tokens help in the transfer of value from communities to its constituent members, without the need of intermediaries such as Patreon, OnlyFans, etc., going the fungible token and / or the non-fungible token route comes with their respective sets of pros and cons. We saw initial traction with fungible social tokens via communities like Friends with Benefits and sports clubs using Chilliz. However, going forward, we believe that NFTs will be the design of choice for communities. Large global name brands such as Cristiano Ronaldo and Steve Aoki have already launched their eponymous community NFTs.

Through a more first principles lens, NFTs trump fungible tokens in the following areas:

Broader design space;

Easier tokenomics;

Lesser regulatory scrutiny.

Nonetheless, as a community matures, similar to how BAYC launched ApeCoin, it may well be logical for them to launch a fungible token to further expand their community and increase the sophistication of the token design within their ecosystem (which can increase the degree of gamification).

Phygital

The last theme is the continued blurring of the lines between the physical and digital realms, specifically with regards to the role of NFTs in expediting this phenomenon. This technology has widened the design space for how users can interface between physical and digital, and this is likely to trigger (and already has triggered) much experimentation.

Most of these experiments have taken place in the fashion space. Examples include UniSocks (an NFT currently trading at ~$30,000, redeemable for a physical Uniswap branded pair of socks); an NFT by RTFKT AR that acts as a virtual hoodie wearable by CloneX avatars plus redeemable for a physical hoodie; and 9dcc, a luxury collection of t-shirts with embedded NFC chips that enable the NFT to move together with the physical item.

An interesting development at a lower level is the launch of the physical-based token (PBT) open standard that ties physical items to an NFT.

To conclude, we have reached a point where the technology to link physical items to NFTs is increasingly becoming accessible and standardised, providing a tangible benefit for issuing NFTs with physical garments by way of allowing brands to start developing social graphs, and lastly, as alluded to earlier, greatly increases the design space for expression and storytelling.

Bitcoin NFTs

A bonus theme to keep an eye on is that of Bitcoin NFTs through a project called Ordinals. The 2021 Taproot upgrade reduced the cost to store data on the Bitcoin blockchain, intended for future smart contract development. Thus, by inscribing arbitrary data on a Satoshi, the project turns a fungible token into an NFT.

Considering Bitcoin is, in many ways, the hardest store of value asset and a foundational, reliable blockchain, it is good for NFTs to exist on this ecosystem, for specific use cases. While it may not make sense for utility based NFTs to exist here, we believe it does make some sense for the fine art/collectibles segment.

Closing Thoughts ⌛

In conclusion, NFTs have had one hell of a rollercoaster ride, to say the least. However, as we’ve covered, there has been material progress in the infrastructure, applications, and quality of use within the ecosystem. We don’t see that reversing – NFTs are inherently interesting to more people because they lie at the intersection of technology, art, culture, and entertainment. They have the power to be the Trojan Horse that onboards the next big wave of crypto adoption.

Disclaimer

This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the article authors and do not represent those of people, institutions or organizations that those authors may or may not be associated with in professional or personal capacity, unless explicitly stated. All content provided on this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. The owner will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information. Any views or opinions are not intended to malign any religion, ethnic group, club, organization, company, or individual.

👇🏽 please hit the ♥️ button below if you enjoyed this post.