How to Analyse Profile Picture NFT Projects

A Template for Assessing NFT Projects

In this issue of the Genesis Block Newsletter, we’re going to attempt to break down how one can approach valuing Profile Picture (PFP) NFTs in their current state. Yes, the market is in its infancy, and some valuation methods will evolve (while others become obsolete), but we here at Genesis Block firmly believe that it is essential for us to start developing our mental models today, and constantly adjust them as our learning continues.

What is a Non-Fungible Token (NFT)? 🐵

Within the Ethereum ecosystem, the reserve smart contract platform today, the ERC-20 token standard defines tokens that are identical in their properties, making them fungible in nature. In other words, you don’t care which DAI token you receive (for the most part) since all of them are identical in form and function. Tokens built on this standard dominate the market, and power the entire suite of Decentralised Finance applications that have blossomed since their seeds were sowed in the DeFi Summer of 2020.

NFTs, as the name suggests, cannot exist on the ERC-20 standard. Thus, via an Ethereum Improvement Proposal in 2017, Dapper Labs (the company behind CryptoKitties), introduced ERC-721 – a new token standard that inherits all the major benefits from ERC-20, but, critically, allows each token to be unique. Now, every ERC-721 token is fundamentally different from one another. It matters if you get NFT A vs NFT B.

With that background out of the way, in practice, NFTs are nothing but digital files; they could be MP3, MP4, JPEGs, etc. However, it allows us to identify the original copy. For example, if you send me an image over email, we can't post facto determine which is the original copy. There is no master database that keeps a record. However, with NFTs, you can, thus unlocking a paradigm of digital scarcity.

There is a common misconception that posits that the inherent value of NFTs is nought due to the fact that anyone can simply create a duplicate copy of the JPEG (or whatever the file type may be). Amongst the uninitiated, the misunderstanding is understandable. However, a critical component to grasp is how said scarcity is verified. You see, “minting” (aka, creating) an NFT is simply the act of putting timestamped metadata on the blockchain, which says “Hey, this is the first instance of this file, and it belongs to address xyz”. This entry will forever remain on the blockchain. Thus, simply making a duplicate copy of the NFT won’t allow you to alter this metadata. It can only change once a fair transaction (purchase, transfer, burn, etc.) takes place as per the blockchain’s parameters. This is analogous to why making a fraudulent version of, say, a luxury watch, does not dilute the value of the original watch. If anything, it adds to it.

This analogy to luxury goods is helpful in understanding why people are paying such large sums for mere monkey JPEGs. The reason why luxury goods tend to be sought after is because their value is derived from price and scarcity. In other words, 1) the higher something is priced, the higher the demand, and 2) the less something is available, the higher the demand. While this seems irrational, the reason this phenomenon is observed in human behaviour is because we are social animals who love to signal our social status. The limited availability and high price-tag are not attributes of the product, they are the product. And they’re both extremely visible – just Google it. More so, due to the digital nature of NFTs, they allow for signalling at a much larger scale than physical luxury goods. The only people that can see you wearing designer clothes are the people who are in close proximity to you, but anyone in the world with an internet connection can see that you own a particular NFT.

In sum, an NFT is just a digital file (JPEGs, MP3s, MP4s) that is reliably scarce as it can be verified for originality. There are other features NFTs allow for (such as programmable royalties), but what this digital scarcity essentially does is unlock a game of bragging rights – it is starting to become part of culture. Over the course of 2021, thanks to NFTs, we have seen waves of new entrants onboarding themselves into the crypto world. DeFi could never do this; it could never appeal to the masses, since the financial world is a far more esoteric and convoluted field. On the other hand, profile picture (PFP) projects – NFTs that are often a collection of simple images (with a common aesthetic theme but varying visual elements), which signal that you are part of a specific community – are something everyone instinctively understands, and can participate in.

How to Analyse PFP Projects 💡

As PFP projects are one of the trailblazers in leading mass NFT adoption, today, we will take a look at how exactly one can approach valuing them. To caveat, this is no exact science. Valuation never is, but this is all the more true when it comes to PFPs or other digital art. Thus, use this as a guideline when approaching your research, and over time, you will develop an eye for it.

Team 👨💻👩💻

Just like any start-up or company, it is vital to assess the pedigree of the people running the show. A track record of executing projects in the industry (or other ventures) is always a positive.

A second consideration to make is, is the team anonymous? If they are doxxed (their real identities known) it makes it less likely for them to run away with the money they’ve raised, since it will tarnish their reputation and make it borderline impossible to grow a community. Without a vibrant community, a PFP project is dead on arrival. Take the example of Zagabond, the Azuki NFT founder, who abandoned 3 NFT projects in the last year. After this reveal, the Azuki NFT floor price (i.e., the current lowest price for which one can own an NFT in a certain collection or project) dropped from 30.49 ETH to 7.7 ETH in a few days.

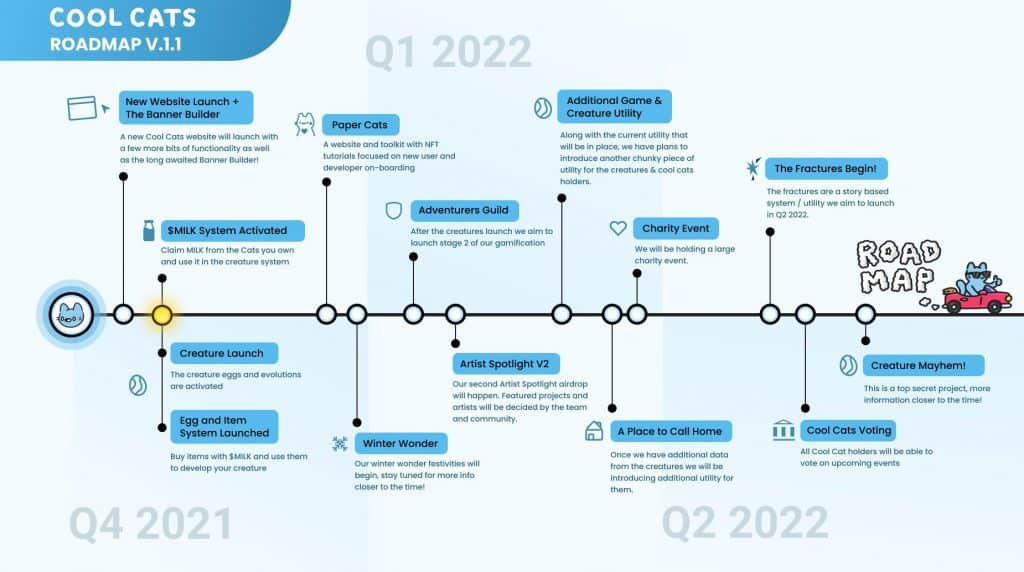

Roadmap 📍

The roadmap is essentially the major milestones the team are planning to hit, in an effort to develop their PFP project into whatever their end goal may be. While some projects like CryptoPunks have no explicit goal to evolve into something larger (as their value is derived from being the first PFP project), there are others who have accrued value to their project by adding additional utility to their NFTs. Case in point, Bored Ape Yacht Club (BAYC). The team at Yuga Labs have successfully transitioned BAYC – through release of lore, ancillary PFP projects, strategic tie-ups, metaverse developments, and more – into a full-fledged brand and media company.

Assessing 1) the team’s ability to execute on the promised roadmap, and 2) the alignment between the project’s mission and the roadmap milestones are critical in the future accrual of the project's value.

To get a sense of how much money they’ve raised, you simply need to multiply the total supply of the PFP project and the mint price (the launch price of one NFT from the collection). While this is not perfect, since it doesn’t account for royalties, it gives a broad indication of the funds the team has available. Thus, while the initial cost to the team is developing the art, advertising, and setting up their website, the total raise post mint is what is used by the team to further their project in whatever way they deem fit.

What does a typical roadmap look like? Well, the goal of most PFP projects is to evolve into an established brand. To do this, projects must grow the points of engagement within their ecosystem – you need to keep your members excited and wanting to stay. While adding secondary PFP collections (Bored Ape Kennel Club to Bored Ape Yacht Club, for example) can create short-term novelty, the only sustainable method to increase engagement is to provide tangible utility to the community members.

Some common ways projects are tackling this include:

Entertainment value via gamification. An example of this would be when all Bored Ape holders were airdropped a “Serum”, which mutated their Bored Apes to Mutant Ape, should they choose to use it.

Launching tokens that come with rights/utility of their own. For example, ApeCoin gives holders governance rights to the Bored Ape ecosystem, and can be used for transactions within forthcoming virtual worlds/P2E game.

Virtual worlds with digital land sales, curated experiences, etc.

A Play to Earn (P2E) game, where the NFT can be used to play the game.

Physical merchandise, including hoodies, socks, hats, etc.

Execution Ability / Commitment ✅

This is a critical factor, so it warrants its own header. Often, projects promise very grandiose milestones but are unable to follow through. There are teams that literally run away with the money, but it is also important to recognise that game development (and other such ambitious goals) is tough to execute for anyone – especially when you're on a tight budget. Assessing the viability of the roadmap is key.

For upcoming PFP projects with new teams this is difficult to gauge, but for existing projects, it is an incredibly helpful exercise to revisit the project’s past roadmap and see how closely it was met.

The Art 🎨

This is definitely one of the more subjective elements of evaluating PFP projects. But a good way to think about it is, if the art doesn’t resonate with you, how can you expect it to resonate with someone else?

You should be able to understand where the artist is coming from and get what they’re trying to create. Because only then will you care for the project and be a net-positive influence to the community.

The Community 👨👩👧👦

This is another subjective element of our analysis. Essentially, here we try to gauge the quality of the community. There is no way to do this other than actually navigating to the project’s Discord channel, and observing the following:

Is it welcoming?

What types of conversations are taking place?

What is the persona of the individuals who make up the community? Do they buy into the long-term vision of the project?

Is the community structured in a manner which is in line with the goal of the project?

How active is the team?

As a rule of thumb, members who are looking for a “quick flip”, are rude, primarily engage in price related conversations, and there is no engagement from the team, are all red flags. On the other hand, constant relevant discourse, welcoming members, and active team participation are signs of a healthy community.

Copyright ™️

Another way an NFT project might opt to provide its holders with value is via allowing them to own the copyrights to the specific PFP they hold. This includes allowing the holder to manipulate the PFP visually, create derivative content, license the rights, etc. Neither do all projects allow this nor are all the holder's inherited rights the same.

Projects launched under the creative commons CC0 (a particular licensing standard that effectively establishes any creative work as part of the public domain) standard, in our opinion, provides most value to the project, and hence the community, as it extends the ecosystem in a multitude of creative directions and at unprecedented speed.

The Numbers 🧮

What makes the NFT market unique is that it is digital and operational 24/7 365. This allows for there to be a range of real time statistics (price, volume, transaction history) that one can access and analyse. These can be viewed on the NFT marketplace itself – on OpenSea, Magic Eden, LooksRare, etc. When you buy into a project, you must know everything about it; this includes the numbers.

So, what exactly do you look for? We recommend starting with getting acquainted with the traits associated with the PFP collection, and how rare each of them is. Then you must get a sense of how the market is valuing these traits, which we can do by going over the current listing prices and past transaction history for individual NFTs. The more projects you study, the more your pattern recognition will kick in, making it easier for you to judge if any particular NFT is undervalued or overvalued, and allowing you to make an investment decision.

Other vectors to analyse include volume traded, which is the total quantity and value of NFTs traded in a given time period (usually, the more the better); and wallet diversification, which is how many unique wallets hold the NFTs (the more the better). Due to the public nature of blockchains, there is a whole lot of analysis that can be carried out by looking at on-chain data. Good places to start are places like the NFT marketplaces themselves (OpenSea, LooksRare, MagicEden, etc.), Dune Analytics, and Rarity Tools.

Closing Thoughts ⌛

NFTs, in spite of our focus today on PFP projects, can and will represent an amazing variety of things. In fact, this technology is as fundamental to Web3 as the webpage was to Web2. While the analogy is not perfect, NFTs, in some shape or form, will be at the base layer of the entire Web3 ecosystem once the industry matures.

A highly anticipated use case for NFTs is in gaming. Today, we live in a world where games live in siloes as most game developers create walled gardens. For example, what you do in Fortnite has no bearing on what you can do in Call of Duty. There is no way to transfer value from one game to another, especially if they’re created by different studios. NFTs will allow in-game assets to be monetized on the secondary market, creating new pools of liquidity which do not exist today (or exist only on the black market), thus allowing players to leverage the effort put in one game to benefit them in another. As you would expect, the secondary market for in-game assets also allows for players to monetise their time playing games, which is currently restricted to being a pro-gamer or having a large social following.

Beyond gaming, there is a whole suite of industries where NFTs can be utilised. These include Real Estate, Medical Records, Identity Verification, Academic Records, Ticketing, and many more. Essentially, any item that is not fungible in real life, can be represented on the blockchain via an NFT, providing it with all the benefits of the digital world. We truly have just scratched the surface of this technology. As alluded to in the potential use cases of NFTs, when they can be reliably linked to the real world, then will it hit the mainstream.

To join this journey into the worlds of tech, business, and Web3, subscribe below!

Disclaimer

This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the article authors and do not represent those of people, institutions or organizations that those authors may or may not be associated with in professional or personal capacity, unless explicitly stated. All content provided on this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. The owner will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information. Any views or opinions are not intended to malign any religion, ethnic group, club, organization, company, or individual.

👇🏽 please hit the ♥️ button below if you enjoyed this post.

Volume is important, as long as its natural and not wash trading, of which there is a lot in NFT projects.

I would also look at holders - look for whale collectors getting in early (again - naturally, not getting airdropped trash in an attempt to trick analysts)