Introduction 👋

This is the third article in our Protocol Analysis series. In this series, we use our investment template outlined in How to Analyse a Web3 Protocol to fundamentally and critically analyse a variety of crypto protocols, aiming to separate the ‘real’ from the hype. Let’s dive in!

Protocol: Dystopia Swap, a decentralised exchange and Automated Market Maker (AMM) using the ve(3,3) system of tokenomics and governance, that aims to provide efficient token swaps and deep liquidity for stablecoins and other assets.

Overview of Dystopia🗒️

Dystopia Swap is a ve(3,3) decentralised exchange (DEX) built on top of Polygon which, as we all know, is one of the earliest and cleanest experiences in the Ethereum Layer-2 scaling solution space.

At its core, the ve(3,3) AMM model aims to incentivise as many token holders as possible to participate in protocol governance through a system of locking and staking their tokens. ‘ve’ is an acronym for ‘vote escrowed’. The longer a user locks their tokens, the more ‘veTokens’ they receive, which grants them a higher proportion of trading fees and voting power to set the future direction of the protocol. Users can vote on which liquidity pools get the most token emissions (i.e., newly issued tokens as rewards). In the ve(3,3) model, the holdings of veToken holders are increased proportionally with token emissions, ensuring that stakers are not diluted. Locked positions can also be tokenised and traded as derivatives on exchanges, increasing liquidity and capital efficiency for stakers.

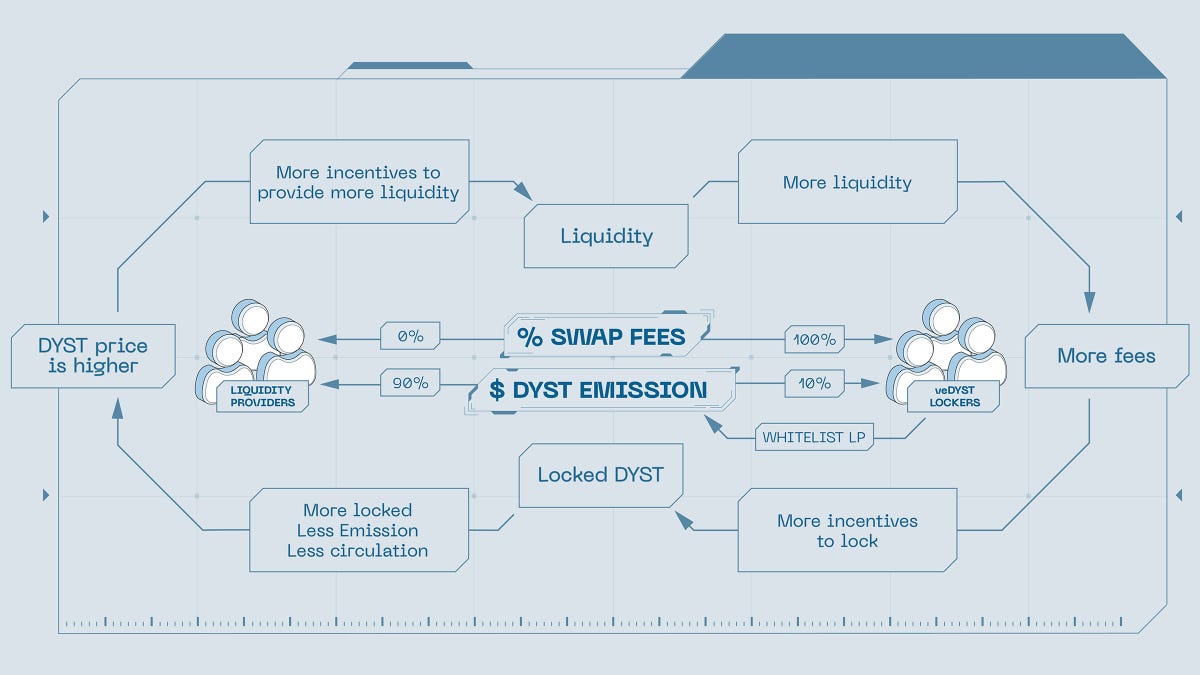

This diagram may be useful in roughly explaining how the ve-Token model works:

Different from other ve-DEXes like Curve, Dystopia offers swaps for both stable and volatile token pairs. Stable token pairs are those where the price of both assets is meant to be stable (e.g., USDC/USDT), while volatile token pairs are where the prices of both assets can vary significantly (e.g., ETH/SOL).

How Does Dystopia Work? 🤷

The point of any decentralised exchange is to provide deep liquidity with low enough trading fees and minimal slippage. To do this, LPs need incentives to provide that liquidity.

How does this incentivisation work on Dystopia?

There are 2 different stakeholders here. On the one hand, we have liquidity providers for different token pairs (similar asset swaps use the Curve swap model, while different asset swaps use the Uniswap v2 AMM style model), while on the other hand we have DYST token holders who can lock their DYST and obtain veDYST. For further details on the Curve and Uniswap models, read this article.

Dystopia aims to incentivise trading fees rather than liquidity with the ve(3,3) model. LPs receive $DYST token emissions as incentives and veDYST stakers receive trading fees for the pools they vote to direct emissions to. This creates a flywheel effect where the pools with the highest trading volumes receive the most votes, thus incentivising LPs to deposit into these pools for the rewards. Increased deposits make the best trading experience for users since they experience low slippage.

This can be summed up in the diagram below:

The Trends Supporting Dystopia’s Emergence 📈

Dystopia’s emergence can be seen as a continuation of the broader L1/L2 ecosystem trend, where every Layer 1 and Layer 2 blockchain has a native DEX. Designs for DEXes are continually evolving in the nascent Web3 space, and Dystopia’s design mirrors that of another DEX on Optimism, Velodrome. Dystopia is another experiment in the DEX space, and it will be interesting to see how their veToken model performs in practice.

Launch, Traction, Use Cases, and Future Roadmap 🚀

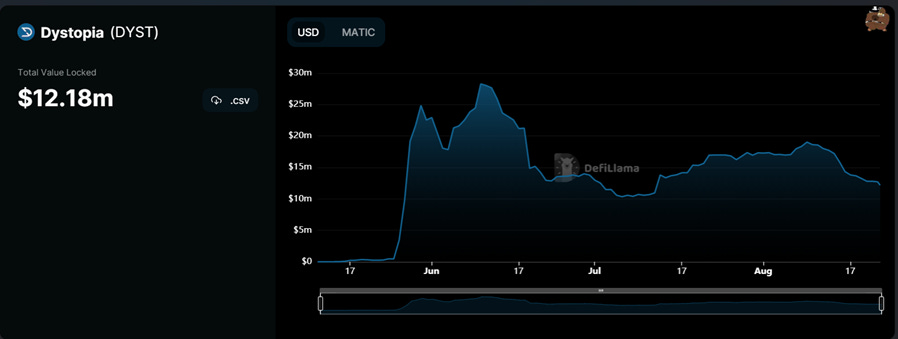

In just over three weeks since emissions began, Dystopia saw a peak of $28M TVL flow in (now at $12M), and over $1M in trading volume each day, all while offering over 20% APY on popular stablecoin pairs. Daily volume may increase materially in the very short future, as integrations with DEX aggregators such as 1inch and Paraswap have been completed recently.

Unfortunately, considering its nascency, there is not much more information about Dystopia’s traction or roadmap. This is definitely an area to reassess in the near future.

Dystopia’s primary use case is an interesting spin on the regular DEX model – while retail users will trade on the platform, much of the voting and governance is intended for protocols and builders to build up and bootstrap liquidity for their dApps, and Dystopia is explicitly intended to be the native DEX for Polygon, which, as we’ll see below, is reflected in its token distribution and governance processes. There aren’t any other obvious use cases for Dystopia yet – it simply represents an evolution or experiment in DEX design, built on Polygon.

Team 🤵♂️🤵♀️

The team behind Dystopia is the Tetu team. Tetu is a Web3 asset management protocol built on Polygon that implements automated yield farming strategies in order to provide investors with a safe and secure method of receiving reasonably high, unleveraged yield on their investments.

Although the team isn’t doxxed (i.e., their identity isn’t public), they do have a track record of building well in the Polygon ecosystem. However, this is something to be mindful of. While this isn’t a deal-breaker, since there are so many protocols that have done very well with pseudonymous teams (such as Dopex, for example), not being doxxed means that their track record cannot be judged. It is therefore difficult to judge whether the team is composed of the right set of individuals with the appropriate experience and expertise to be able to execute longer-term. Even though the ‘same team as Tetu’ is building Dystopia, which seemingly lends an air of trust to the protocol, in reality even Tetu launched only last year.

Thoughts from Using the Protocol 🖱️

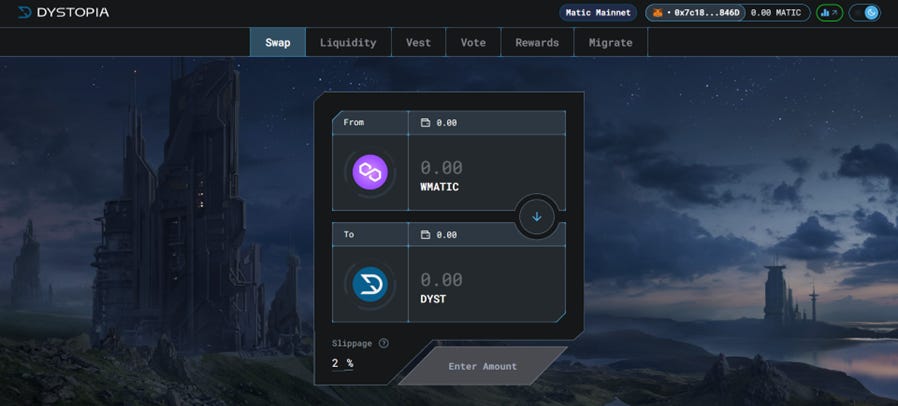

Dystopia has a clean UI which is easy to understand, and has very clear subcategories like swap, liquidity, vest, vote, etc.

Dystopia is a protocol for other protocols to use, similar to Curve, and dApps are meant to use it to incentivise liquidity for their trading pairs. Therefore, given its target audience, it can be assumed that the people interacting with the Dystopia Swap UI are seasoned crypto users and have gone through and understood the architecture of the protocol.

Given that Dystopia isn’t targeted towards retail users, the UI and ease of use are not the most important aspects of the protocol to focus on – although obviously, they shouldn’t be ignored! Rather, the next aspect that we will analyse is more crucial to Dystopia’s success: its tokenomics.

Tokenomics 💸

Value Accrual

Dystopia’s system primarily incentivises swap fee performance rather than total liquidity. Since veDYST holders dictate which liquidity pools get more emissions and receive swap fees as a reward, liquidity providers are encouraged to compete for generating the most swap fees. Dystopia also provides a bribe market to aid in rewarding specific veDYST voting activity. If you are a liquidity provider (LP), you naturally want more veDYST holders to vote for your pool, since you’ll get higher token emissions. As an LP, then, you can bribe veDYST holders – i.e., you reward them for voting for your pool.

Participants with different objectives are incentivised to cooperate via veDYST holders concentrating their votes into specific liquidity pools that generate higher swap fees, while LPs aim to receive as high a proportion of DYST emissions as possible by depositing liquidity in these higher fee-generating pools.

Some other facts and considerations are:

DYST tokens can be locked for 6 months, 2 years or 4 years.

veDYST holders govern Dystopia and drive DYST emissions with their votes for pools. 90% of the DYST supply will be distributed to LPs, and veDYST votes decide which pools will receive the incentives.

veDYST holders receive all trading fees from the pool they voted for; trading fees are 0.05%.

Liquidity providers in pools receive the emissions directed to the pool, but do not receive trading fees.

The amount of DYST locked in relation to circulating supply directly affects the rate of emissions so that the more DYST tokens are locked in veDYST, the slower the emissions.

An important point to make is that veToken protocols are risky even in the best of bull markets. If stakers want to exit and cannot due to the lockup period, they can become unmotivated and therefore not participate effectively in governance, having the opposite effect to what was intended. However, a caveat with this in Dystopia’s case is that the protocol is targeted primarily towards dApps that look to create and maintain their liquidity. Therefore, it is reasonable to assume that Dystopia will not face this problem to the extent that other similar DEXes would.

Token Release

DYST emissions are distributed in the following manner: 90% for Liquidity Providers and 10% for veDYST lockers. There is no maximum supply of DYST, but DYST inflation in relation to circulating supply will be drastically reduced over time. As the amount of veDYST decreases linearly with time, the perspective is that veDYST holders receive less rewards from emissions as their stake decreases. This is likely an attempt to control token inflation long-term, as well as an indication that user retention by Dystopia is sticky, i.e., the dApps on Polygon would continue to use Dystopia not because of token rewards, but rather due to its user experience, performance, and quality.

The emissions velocity of DYST tokens is dynamic and depends on the proportion of the total supply locked in veDYST. When the proportion of DYST tokens locked in veDYST is high, the the distribution of emissions to veDYST and Liquidity Providers is slower. As the LPs receive the most emissions, with 90% of all rewards distributed to them, their collective decision will dictate whether the emissions of DYST tokens will be more intense or steadier.

This "dynamic emissions" characteristic creates a situation where the total supply of the DYST token cannot be predicted accurately, as the choice of locking into veDYST (or not) will directly affect emissions performance. There is an inverse relationship between the amount of DYST locked as veDYST and the inflation rate of DYST emissions. For example, if 0% of the DYST is locked, emissions will be maximum, but if 100% of DYST is locked, emissions will stop completely.

The below graphs represent the emissions schedules under various assumptions (gauge rewards are rewards from liquidity pools):

As we can see, under the assumption that 70% of DYST is locked as veDYST, rewards (both gauge rewards and those for locking up DYST) shoot up when circulating supply is initially lower and increasing. This is probably to encourage more DYST holders to lock their tokens up. When compared to the scenario when 90% of DYST is locked up, weekly rewards remain much higher even when circulating supply is at its highest. Another point to note is the divergence in circulating supply and ve supply in the two scenarios: when 70% is locked up, circulating supply reaches 250 million, while it only tends towards 100 million when 90% of supply is locked up. This indicates that token inflation is much higher when lesser DYST is locked up, since LPs and DYST holders need to be continually incentivised, which also shows that user stickiness is lower.

These token dynamics signal that the success of Dystopia and the DYST token hinge on enough DYST being locked up. If a lower amount of DYST is locked up, tokens will keep getting issued at high inflation rates, which depresses the price of the token in the longer-term. Higher supply with lower demand means a lower token price.

Token Distribution & Vesting Schedule

100% of the initial token distribution was allocated to the Polygon DAO plus a few chosen dApps in the Polygon ecosystem in the form of “4-year locked veNFTs”. veNFTs represent locked DYST positions that unlock after 4 years. Over time, their ownership is meant to deplete via $DYST emissions, ultimately getting diluted to just 20% of the total supply after 4 years based on emissions projections (assuming that 90% of issued $DYST is staked, which is a pretty bullish assumption to make at this stage).

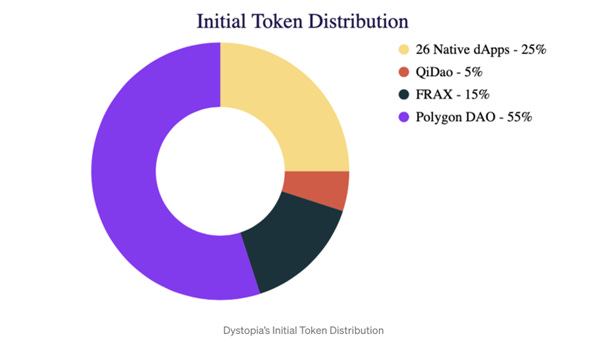

Below is a breakdown of the original token distribution:

The Polygon Ecosystem DAO — 55%

Genesis Liquidity Stablecoin Providers (FRAX & QiDAO) — 20%

26 Polygon-native dApps that qualified for Polygon Liquidity Mining 2.0 – 25%

By the end of 4 years, the distribution is meant to be allocated in the following manner:

The Polygon Ecosystem DAO — 11%

Genesis Liquidity Stablecoin Providers (FRAX & QiDAO) — 4%

26 Polygon native dApps that qualified for Polygon Liquidity Mining 2.0 – 5%

The first obvious observation is that the Polygon DAO gets a massive initial allocation. The Polygon DAO obtained 55% of all the initial tokens distributed, a number meant to reduce to 11% over time. This is a full 57x more voting power than any single dApp, each of which received 0.96%, which will eventually decrease to a minimum of 0.19%.

Why is this?

Dystopia gave the DAO massive power in an attempt to ensure that the DAO always acts in the best interest of the community and Dystopia users. The DAO must vote for the highest performing pools based on volume, which in turn generate the most trading fees. This guarantees that rewards will always flow to popular pools (which, theoretically, are those that bring the most value and utility for the Polygon ecosystem in general) regardless of targeted bribes and/or how users and dApps vote. This is obviously a centralisation risk, but zooming out, it is essentially a bet on the Polygon ecosystem, and its leadership, direction, and future growth prospects.

More so, all trading fees earned by the DAO will be used for grants within the Polygon DeFi ecosystem to support new native projects and builders. In this way, using Dystopia as Polygon’s main DEX is meant to ensure future growth for the entirety of the Polygon DeFi ecosystem. Initially, the DAO will hold 50% of the grant voting power and veDYST holders will have the remaining 50%. During these voting stages, the DAO can use these funds to provide liquidity in order to compound the yield and earn DYST to increase its potential for generating grants.

The DAO is, therefore, bestowed with significant power — major influence on voting for pool emissions and 50% voting majority on grant allocation. Is this a bad thing? Not necessarily.

This allocation enables Dystopia to create a unique selling point that differentiates itself from other DEXes. When deciding between what DEX to use, if they both have the same swap fees and deep liquidity, the one that generates benefit for the entire DeFi ecosystem would likely be the first preference. When deciding what DEX to provide liquidity to, if two DEXes both have high performing pools with similar volumes, the DEX that is guaranteed to distribute emissions from the ecosystem leader (Polygon) could be used. Through its allocation to the Polygon Ecosystem DAO, Dystopia is intended to be that uniquely positioned DEX.

Other than the purposeful allocation to the DAO, Dystopia’s airdrop to the 26 Polygon dApps ensured that each DAO received the same amount. As we covered briefly above, each Polygon dApp received 0.96% of the total allocation, far more than the 0.2% threshold required for whitelisting their native tokens for emissions eligibility at the beginning. Once whitelisted, these protocols can use their veNFTS to direct $DYST emissions to their liquidity pools at no cost to themselves. This equal distribution is incredibly important for the effectiveness of the $DYST rewards as incentives.

One of the obvious benefits of an equal distribution is that each protocol begins with the same ability to draw in liquidity deposits for their respective token pools. Every protocol needs deep liquidity for seamless trading of its native tokens, and if one protocol dominates the control of emissions, then users are incentivised to deposit in only that single pool. This initial emissions equilibrium enables both newer and established protocols to have a fighting chance at utilising Dystopia for their liquidity needs. Of course, projects and DAOs can provide their own liquidity to earn $DYST or purchase more $DYST to increase their voting power but beginning with an even playing field and then seeing how each project adapts will be an interesting social experiment that plays out.

Governance ⚖️

Dystopia's governance model follows the standards set by ve(3,3). DYST holders can lock their tokens for up to four years in return for veDYST, an NFT that grants boosted voting power on gauge weights to decide which Dystopia liquidity pools get directed the most DYST emissions. veDYST holders will receive all the trading fees from the pool they voted for, as well as 10% of total DYST emissions.

Given its large allocation of tokens and consequent control over Dystopia’s direction, it is important to note that the Polygon Ecosystem DAO is run by a multisig wallet of 6 doxxed DeFi leaders from Polygon, Aave, Frax, QiDao, and Dystopia. The DAO also aims to decentralise and be run by a Grants Committee voted upon by veDYST holders that will serve on 1-year cycles. This imparts more confidence that the decisions made by the DAO are in Dystopia’s interest.

Each voting ‘epoch’ to direct emissions to liquidity pools lasts for one week, with users being able to vote at any time during the epoch. At the end of each epoch, rewards are distributed for one week. Not much information is given about the voting model (e.g., one-token-one-vote, quadratic, etc.) employed by Dystopia. If it is the one-token-one-vote model, as is likely given how new Dystopia is combined with the fact that much of its focus has been on building its tokenomics out, we have covered the drawbacks of that model previously. More information about Dystopia’s voting model is required to holistically assess its governance.

Dystopia does have a Governance channel in its Discord, but activity is not high – there have only been a handful of messages since the start of June. It is, however, way too early to read into this since, again, the protocol only launched in May.

Performance 📉

Given the dependence Dystopia has on its token being locked up as veDYST, an important metric to analyse is the proportion of DYST locked up. To date, according to a Dune dashboard, ~79% of DYST tokens are locked up. This is an (obvious) reduction from the 100% of tokens locked up at launch in May 2022, but an increase from the low of ~64% in the first week of July 2022.

Dystopia’s token price has dropped 90% over the last 90 days according to CoinMarketCap, but this should be taken with a pinch of salt – Dystopia launched in the early throes of a bear market, and has had macro headwinds and the general collapse of crypto prices to deal with.

Gaps in our Analysis 🕳️

Firstly, we could not find information about funding. Also, since Dystopia is a very new protocol and token, there is a definite lack of information about its performance to date, with almost no information available on DeFi Pulse, DeFi Llama, Dune, Token Terminal, Glassnode, Baserank, or Lunar Crush.

Secondly, Dystopia has only been active for 2-3 months, so it is hard to judge its proof of concept. It may be a bit too early to judge the team’s execution or the product’s current focus and roadmap, and re-assessing what the product looks like and how it operates in about 5-6 months may be more optimal. There is no information in Dystopia’s documentation about its roadmap, even a short-term one, nor about comprehensive governance processes. This can be excused given how young Dystopia is, but its docs certainly need to improve soon.

Suggestions & Closing Thoughts ⌛

Dystopia Swap is an innovative update to the veToken model pioneered by Curve and Convex. It has seen a decent amount of traction since launch, but it is too early to read anything into this. As an investment, we see the following challenges to it to be mindful of. By betting on Dystopia, you are, in a way, betting on the success of the wider Polygon ecosystem. Ethereum scaling solutions have become a much more competitive space in recent months with flourishing ecosystems being built on all kinds of L2’s. So one would really have to have confidence in Polygon.

The tokenomics seem reasonably solid with enough incentive to lock up DYST. But due to the supply being controlled by Polygon and other dApps, it doesn’t seem to make to hold as a retail user and seems more useful for dApps to hold who want to provide liquidity for their tokens on the Polygon Ecosystem. Overall, Dystopia’s tokenomics represent a nice tweak to the veToken model by incentivising trading fees over liquidity in an attempt to align all stakeholders.

It is too early to judge whether Dystopia will be a success or a failure. At this point, all we can do is look at the facts we have and try to assess what its headwinds will be and what the main risks it faces are.

To join this journey into the worlds of tech, business, and Web3, subscribe below!

Disclaimer

This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the article authors and do not represent those of people, institutions or organizations that those authors may or may not be associated with in professional or personal capacity, unless explicitly stated. All content provided on this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. The owner will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information. Any views or opinions are not intended to malign any religion, ethnic group, club, organization, company, or individual.

👇🏽 please hit the ♥️ button below if you enjoyed this post.