Web3 Music

Thematic Analysis #5

This is the fifth article in our Thematic Analysis series. In this series, we talk about broader trends and emerging concepts in the crypto space, looking towards the future and analysing how Web3 is evolving in real-time. Let’s dive in!

Theme: Web3 Music

Introduction 👋

Music is an industry rife with conflicts of interest and shocking contradictions. The industry boasts the most followed people on earth, yet the vast majority of artists cannot make a sustainable living off of their craft. However, NFTs and other Web3 technologies are promising to change this unfortunate reality. Today, we dive into the history of the music industry, the promises of Web3, and how the current state of these technologies are impacting the music industry.

Current Music Industry 🎺

To begin, let’s briefly go over a few of the entities that make up the industry value chain:

Songwriters / Composers who put together the melodic, harmonic and lyrical elements of a song;

Recording Artists, or the creators of a song;

Publishers, who hold the composition copyrights (the collection of notes, melodies, phrases, rhythms, lyrics, and/or harmonies);

Record Labels, who hold the copyrights of the sound recording (a particular expression of the underlying composition);

Distributors, whose primary responsibility is o get the music to where individuals are consuming music (earlier it was retail stores, today it’s on digital service providers);

Digital Service Providers (DSPs), i.e., platforms like Spotify, Apple Music, etc., where we listen to our favourite songs.

It is important to note that the aforementioned stakeholders (recording artists, publishers, labels, etc.) do not exist in silos and often perform several functions under one roof. With that context, let’s take a small detour through history.

Since the early 1900s, the medium of music consumption has been in a constant state of flux, from vinyl to radio to cassettes to compact disks to the Walkman to iTunes to streaming services like Spotify and Apple Music today. In spite of this rapid evolution, the core structure of the music industry has remained unchanged.

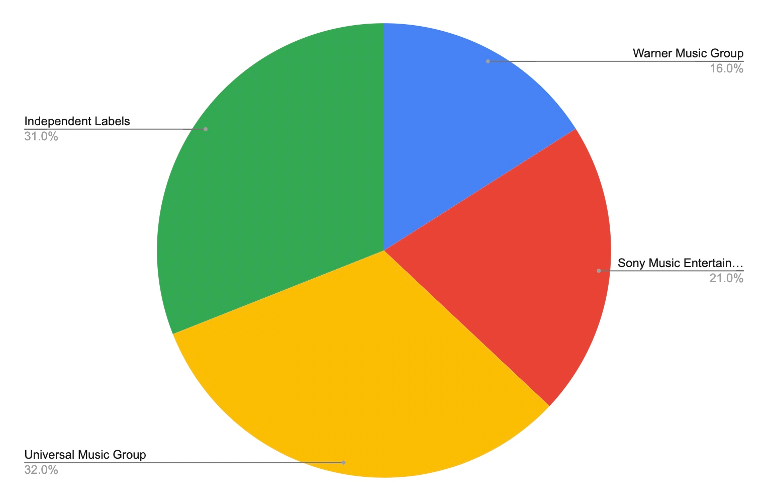

The record labels (specifically the Big 3 of Universal Music Group, Sony Music, and Warner Music Group), have a near monopoly-like influence on the industry. This is so because in the pre-digital era, they were the ones who discovered talent, financed production, and had strong ties with hardware manufacturers and the distribution channels (primarily retail stores). Because of these legacy structures, these labels acquired a majority of the music rights, which has enabled them to continue their influence in the current digital era (despite the physical manufacture of vinyl, compact disks, etc., and distribution to retailers becoming a thing of the past).

As a corollary, these middlemen in the form of record labels end up capturing the bulk of value that is generated by the industry. To put things into perspective, only ~12% of the value makes its way back into the pockets of artists. Historically, the rationale for this split made sense (to some degree). However, with physical manufacturing obsolete and digital distribution available to all, people are seriously questioning if the labels are providing value to the artist commensurate with the value they are capturing.

Now that we have a basic understanding of how the music industry works, let us briefly go over the main issues identified by many from the industry. Note, all of these, too, are closely intertwined with one another.

Industry Value < Cultural Value of Music

While the music industry is valued at ~$40 billion, it is dwarfed by the $300-400 billion gaming industry. While one can claim that this discrepancy is due to individuals valuing gaming ten times more than music, some indicators point to the contrary. For example, the list of the world’s wealthiest musicians demonstrates a relatively consistent pattern – artists generate massive cultural recognition through their music and capitalise on it in an entirely different industry. Case in points being Dr. Dre and Beats/Apple, Kanye West and Yeezys/Adidas, Rihanna and Fenty, Diddy and Cîroc. Additionally, six of the top ten most followed individuals across social media are musicians.

Lastly, a look at the total industry size over time supports the claim that there are more fundamental/structural reasons that have restricted the music industry’s value, relative to other forms of entertainment. As you can see below, from 1999 to 2018, the revenue from music consumption in the USA has actually declined by ~25%!

Inadequate Creator Monetisation for the Long Tail of Artists

With an estimated ~12% take rate on revenue generated by their music, it is not surprising that the vast majority of artists are unable to sustain a living only from their craft. As such a miniscule figure accrues back to the artist, to achieve an income of ~$40,000, an artist would require upwards of 5 million streams. To state the obvious, achieving this consistently, release after release, is another ball game all together.

Too Many Middlemen

Due to the large number of variables required to bring a record into fruition, the legacy infrastructure the industry copyright law has been built upon, and the varying laws across geographies, it is no surprise that a plethora of middlemen have cropped up, all taking a slice (of varying proportions) of the pie along the way.

The Business Model of Record Labels

In a world where data was not as abundant as it is today, the record label business was a lot like the business model of venture capitalists. You deploy capital by betting on several teams, most of them go to zero, and a small minority of them return to provide asymmetric outcomes, making back your total fund corpus, and then some.

This was because it was one, very expensive to produce a record, and two, extremely difficult to predict which artist would do well prior to having a fully produced record released to the public. Effectively, labels had to pick which artists they wanted to invest in on very limited data points. This resulted in them capturing a large proportion of the artist’s future cash flow as compensation for their initial risk capital. In many instances, labels acquire ~80% of future revenues generated by all the artist’s work for a set duration, which only comes into effect after the initial investment is recouped by the label. Therein lies the problem.

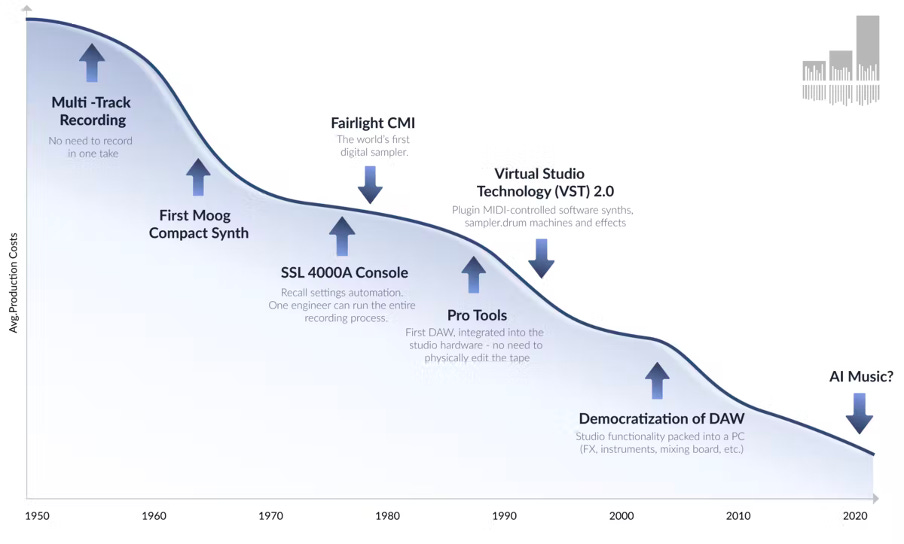

Today, the cost of music production is at an all-time low, while the cost of music discovery is at an all-time high, arguably making marketing the most important tool of a record label’s toolkit. The critical question to answer, then, is: is it worth it to give up ~80% of future cash flows for predominantly marketing services?

Metadata Inconsistency

Metadata across the industry is not standardised, leading to several inefficiencies in key facets of the industry value chain. For example, with the rise of DSPs, each platform has its own proprietary search algorithm, thus requiring an artist to input a wide variety of metadata on each of these platforms. As you can imagine, in the hustle of meeting deadlines, things quickly go awry. The end result is a significantly suboptimal artist discovery experience and inefficient royalty distribution. The latter is worth emphasising because with metadata being inconsistent across geographies as well, it becomes very difficult to identify when exactly a legitimate royalty is earned, leading to lag times of months, in some cases years, for the royalty to finally make its way back to the artist’s bank account.

Technology Commoditising Music

The unfortunate reality is that while the consumer experience of listening to music has never been better, it has come at the price of commoditising the art form. The unprecedented advancements in technology have fuelled the meteoric rise of passive music consumption, making the concept of meaningfully paying for music access foreign (like the $1 per track model of iTunes). While artists advocate for the open accessibility of music, their ability to generate revenues from only music consumption is rapidly declining. This is best exemplified, once again, by how the pay-out an artist gets for 1 million streams on any given DSP.

Misaligned Incentives

To conclude, we now live in a world where labels derive most of their revenue from artist streams, but artists derive most of their revenue from non-streaming sources (live performances, merchandise, etc.). This is primarily because of the way music copyright law is structured (which is well beyond the scope of this article). Nonetheless, this contradiction perfectly encapsulates why many stakeholders claim that the industry is broken and is in much need of an evolution.

The Web3 Music Promise 👨🏽🎤

Having covered the current drawbacks of the system, let’s go over how Web3 technologies can help offer a solution.

While token-incentivised decentralised networks help in creating permissionless and censorship-resistant platforms for artists to publish their content, Non-Fungible Tokens (NFTs) have the potential to provide the greatest unlock for artists and their fans from a monetisation and engagement perspective. For perspective, before we get into the weeds, ~25 NFTs sold at 0.1 ETH is equal to revenue from ~1 million streams on a DSP like Spotify or Apple Music. Even though it is important to note that 0.1 ETH is no small amount, this example does show how small an audience one must reach or one’s art must resonate with compared to the current Web2 monetisation channels.

From a fan and artist perspective, there are many benefits that music NFTs provide.

Social Status & Bragging Rights

As discussed in our article ‘How to Analyse Profile Picture NFT Projects’, the verifiably scarce nature of NFTs makes them a very good ‘signalling’ tool. A music NFT can signal a variety of things – for example, being a purchaser in the genesis collection of a new mainstream artist can prove to your friends that you discovered the artist much earlier. This behaviour is unquestionably prominent amongst music aficionados – a game of pride – but never before has it been verifiable. In addition, if you purchase a high value NFT in the secondary market dropped by, say, Drake, it not only signals your fandom for the artist but also your financial clout.

Speculation & Financial Appreciation

For the first time ever, speculating on artists is not reserved to major music institutions. Retail can now capture a proportion of the upside if we discover an artist before they catch mainstream attention. Building on the first example, if you did buy the genesis NFT of an artist who has just gone mainstream, chances are the NFT is now worth a whole lot more than what you paid.

At a grassroots level, this possibility will catalyse the rise of a new class within the industry – scouters and curators, individuals who spend their energy on finding new talent and promoting it to an appropriate audience, with the hope that the music catches on and significantly increases in cultural, and consequently, monetary value. In essence, we can say that this is a new paradigm for artist discovery.

With fans or speculators having a vested interest in the artist’s career, they act as on the ground missionaries, under the guise of organic growth.

Direct Fan-Artist Engagement

Due to the provenance of the blockchain, token-gated experiences act as new channels for fans to engage with artists. Of course, early access to content for NFT holders is an obvious use case, but offering actual 1-1 face time with the artist, behind the scenes access to concerts, collaborating on song production, etc., are other mediums of artist-fan engagement that are being actively being experimented with. Artists have never been able to tap into fan data to such a granular degree. Now that artists can verify the identities of their original fans from day one and effectively reach them, the design space to provide specific experiences is only limited to the artist's imagination.

Royalty Lead Time

On a similar note, as Web3 technology is built on top of the internet, royalties can now be attributed and distributed in real-time. From years to seconds – talk about several orders of magnitude improvement.

Novel Monetisation Channel

NFTs, and Web3 technologies at a more macro level, are often perceived as the enemy of the current music industry in an ‘Us versus Them’ portrayal. The truth is that Web3 acts as a complementary set of tools to the current system. Specifically, it acts as a monetisation channel that offers the potential to actually make a sustainable living. Most importantly, this claim holds true for the long tail of artists as well. Due to the reduced size requirement for an ardent fan base, monetising via NFTs can be done by even the most indie of indie artists.

Interestingly, all this is possible without sacrificing the open nature of art, or in Web3 lexicon, composability. Now, artists can build on top of the work of other artists, without compromising value accrual back to the original artist. For example, if a song’s constituents (bass line, melody, etc.) are minted as individual NFTs, a second artist can simply use one of these NFTs in his/her new music NFT, and the on-chain royalties will always be triggered.

Lastly, these novel monetisation mechanisms provide artists full autonomy on how they should be implemented. Direct NFT sales, micropayments per stream, subscription-based access, selling future royalties (a concept David Bowie pioneered decades earlier) are just some of the options that are at the disposal of the artist.

The Current State of Web3 Music 🎧

The current landscape of music in the Web3 world is showing classic signs of fragmentation. Understandably so, since the technology is new, and by some measures, less than three years old in the context of music.

As you can see in the image below, almost every facet of the industry is being experimented with, all the way from the means of production (through the likes of Web3-native Digital Audio Workstations like Arpeggi), to distribution (through marketplaces like Sound.xyz, Catalogue, Royal, etc.), to consumption (through platforms like Audius, Emanate, etc.), to even management (through Web3 native agencies and labels like DOOMSDAY X, Hume, etc.). Of course, a lot will be written off as an experiment, but the few that stick, have a chance of shaping the entire trajectory of the industry.

If you’re an artist and fan looking to actively indulge in Web3, there are a few basic courses of action that are being followed by most. For starters: research, research, research. Reading this article is a good starting point. But once you’re aware of all the tools and projects being built, you must get your hands dirty. A few ways to do so are:

Minting or buying a music NFT collectible. These include one of ones, or one from a particular edition, i.e., buying 1 from 40 NFTs of the same song.

Minting or buying a music NFT which provides fractional ownership. This is a good way for artists to generate current cash flows by leveraging future royalty pay-outs, while fans who believe in the artist can capture the upside if the song or artist does well.

Minting NFTs available in only specific locations. This is a great way to identify and reward fans that actually show up to any of the artist's events, as physical presence is the only way one can access these NFTs.

Utility NFTs. These are NFTs which have attached benefits to them. This could be allowing NFT holders direct access to the artist, access to specific gated content, rights to the NFT art – it could be anything really.

Worth mentioning is that these don't all have to be disparate use cases. A single NFT can, and often does, fit into more than one of these categories.

Predictions & Closing Thoughts 🔮 ⌛

As of now, the most popular use case of music NFTs is that of collectibles. Quite underwhelming, given the immense potential this technology has to revamp the industry. For context about 85,000 songs are uploaded to Spotify per week, while less than 100 songs are minted per week in aggregate. But it’s a start, nonetheless.

In the long term, there are a few scenarios we expect to play out. These are probabilistic outcomes – no one can know for sure.

Consolidation

As we’ve seen with almost all industries, over time, consolidation tends to arise due to efficiency unlocks. We’ve seen this happen all the way from the oil and gas industry in the 1800s to e-commerce today. Similarly, we expect the same to occur amongst the various Web3 music projects. A case in point is the distribution channels. We have several marketplaces (Catalogue, Sound, Royal, etc.), all essentially providing the same service – minting music NFTs. Granted, they are positioning themselves for slightly different use cases – Catalogue for one of ones, Sound for editions, Royal for fractional ownership, and so on. However, we envisage one of two outcomes:

As music is a large enough vertical to warrant its own marketplace, there will be one music marketplace that consolidates liquidity, or

All these platforms develop differentiated UXs but are built on a protocol like Zora, effectively bypassing liquidity fragmentation but still catering to a hyper-specific set of users.

Middlemen Will Still Exist

While we can expect a significant volume of industry interactions to take place on-chain, there will still be the need for various middlemen as they are today. If a song is played halfway across the world, with differing level of technological maturity and differing copyright laws, it is likely that we will still require entities who are experts in the jurisdiction to correctly identify and pass along royalties back to the rightful owner.

Web2 x Web3

As discussed earlier, Web3 is not here to replace Web2; it exists as a complementary layer. Thus, due to the massive UX unlocks by DSPs such as Spotify and Apple Music, it is unlikely we will see the adoption of such platforms slow. Their flywheel of onboarding the widest variety and highest volume of users is well under way. Such network effects are difficult to break.

Instead, a hybrid system is more likely to be on the cards. With the large number of eyeballs on DSPs, we foresee a future where Web2 plays a large role in music discovery and consumption, whereas Web3 plays a large role in artist monetisation. In terms of discovery, getting your song on to popular Spotify playlists or the Spotify homepage will remain prime real estate. And in terms of monetisation, the more streams you get on a DSP, the more valuable the artist’s NFT will become.

Music VC DAOs

As mentioned earlier, a new class of financially aligned curators is likely to arise. Taking one step forward, it is possible that a collective of such individuals come together and form a DAO, scaling their activities to a larger degree. This particularly is something that Multicoin Capital is very bullish on.

Copyright Law

Going back to the gaming versus music comparison, an important reason why the gaming industry blossomed relative to music was because of their approach towards copyright law. With the rise of platforms like Twitch, YouTube, and other social media giants, it was evident to all that user generated content (UGC) was the next frontier that would impact these industries. The difference is that while the large music stakeholders (primarily the labels) took an aggressively draconian stance on UGC, gaming embraced it. This antagonistic stance (stemming from Napster, LimeWire, etc.) towards smaller creators building on top of established creators is what eventually led to the demise of SoundCloud and led to a whole host of friction between artists, fans, and the labels.

Web3 represents a second chance. It is imperative that copyright law is not exploited to a point that stifles Web3 music innovation.

Disclaimer

This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the article authors and do not represent those of people, institutions or organizations that those authors may or may not be associated with in professional or personal capacity, unless explicitly stated. All content provided on this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. The owner will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information. Any views or opinions are not intended to malign any religion, ethnic group, club, organization, company, or individual.

👇🏽 please hit the ♥️ button below if you enjoyed this post.