This is the seventh article in our Thematic Analysis series. In this series, we talk about broader trends and emerging concepts in the crypto space, looking towards the future and analysing how Web3 is evolving in real-time. Let’s dive in!

Theme: The Creator and Ownership Economy

Introduction 👋

While there is no one universal definition for who or what a creator is, let alone the creator economy, for the sake of our discussion today, let’s begin by setting context with some key definitions.

Creator: An individual (or a group of individuals) that produces media with educational and / or entertainment value, with the intent of growing (and, in most cases, monetising) an audience.

Creator Economy: The rise of the creator class (led by digital distribution) that earns a majority of its income by creating content and monetising its audience in various ways.

Ownership Economy: Popularised by Jesse Walden of Variant Fund, the ownership economy is where the next generation of products / services will be owned and run by its participants via alignment of incentives using tokenisation. This permeates all industries – entertainment, decentralised finance, infrastructure, consumer, etc.

The below Venn diagram is helpful to understand the relationship between the creator and ownership economy.

Today, we’re going to break down the growth and history of the creator economy and where Web3 fits into the picture. Then, we’ll run through the current state of the creator economy and some of the key problems it faces, diving into the role that the ownership economy wrought by Web3 can play in resolving these problems. Subsequently, we’ll explore the current landscape of the creator-ownership economy and the tools available to creators, and finally try to predict how this economy will grow over the longer term.

History of the Creator Economy 📜

In 1996, Bill Gates wrote a somewhat prophetic essay titled ‘Content is King’ – you might have heard of this phrase. He wrote:

“One of the exciting things about the internet is that anyone with a PC and a modem can publish whatever content they create. Content is where I expect much of the real money will be made on the Internet, just as it was in broadcasting. For the internet to thrive, content providers must be paid for their work… The long-term prospects are good, but I expect a lot of disappointment in the short-term.”

Even though it has taken over two decades to play out, it is quite uncanny how accurate his foresight was. In fact, to better understand how the creator economy has evolved over time, we can categorise it into four different eras – the Hobbyist Era, the Distribution Era, the Independent Era, and Ownership Era.

The Hobbyist Era began with the rise of social platforms like Myspace, Friendster, and the early days of Facebook. These platforms were characterised by bi-directional follows, following people you knew in real life, and no value accrual.

The Distribution Era came about with the rise of the ‘influencer’ class of creators, alongside platforms like Instagram, YouTube, and Snapchat. These platforms were characterised by uni-directional follows, i.e., following people you had never met in person but who provided you with entertainment / educational value, and value started accruing to various stakeholders via advertising.

The advertising business model consists of:

Displaying still / video ads to users;

Paid endorsements of products / services;

Affiliate marketing.

Effectively, these platforms became a promotional channel for other businesses to achieve their objectives. As Mario Gabriele from The Generalist puts it, creators pay with resources invested in content creation, the audience pays for this effort with attention, and advertisers buy the attention accumulated by the creator.

The Independent Era was led by a move away from the Distribution Era platforms, as the primary means of revenue generation for creators. There was a shift from creators selling other brands to becoming the brand. Creators now started selling their own products and services by leveraging platforms like Shopify, Substack, and Patreon. This allowed them to not only capture more value but also deepen fan relationships.

Somewhere between the Distribution and Independent Eras, creators, after reaching some scale, began investing as a tertiary model for value generation. This is definitely nascent with only a minority of investors taking this leap (e.g., Animal Capital by the Sway Boys), but we believe this area is underexplored primarily because education and infrastructure to invest in their forte – the creator economy – was and is not available to the long tail of creators.

This brings us to the Ownership Era, which is Web3’s introduction to the creator economy. While we will go deeper into this segment a little later, this marks the introduction of new tools which blur the line between the creator and the audience and make the creator / fan relationship less transactional by generating value via the creation of micro economies for each creator, as opposed to one dimensional business models.

The below diagram, with credit to Mario Gabriele, demonstrates the above dynamics:

The State of the Creator Economy 🎨

In short, creators and users today create the most value and capture only some of it, while the platform itself captures disproportionate value.

This is so due to the following reasons:

Unsustainable Dynamics for the Long Tail of Creators

Since content can be reproduced and consumed infinitely, consumption is concentrated to the content made by a select number of creators. For example, if a doctor is 10% better than the rest, they won't attract 10% more demand – they will attract all the demand. Similarly, everyone wants to consume only the absolute best content, simply because they can. Therefore, earnings get concentrated to these select best creators, making earning a livelihood very unsustainable for the majority.

Stakeholder Misalignment

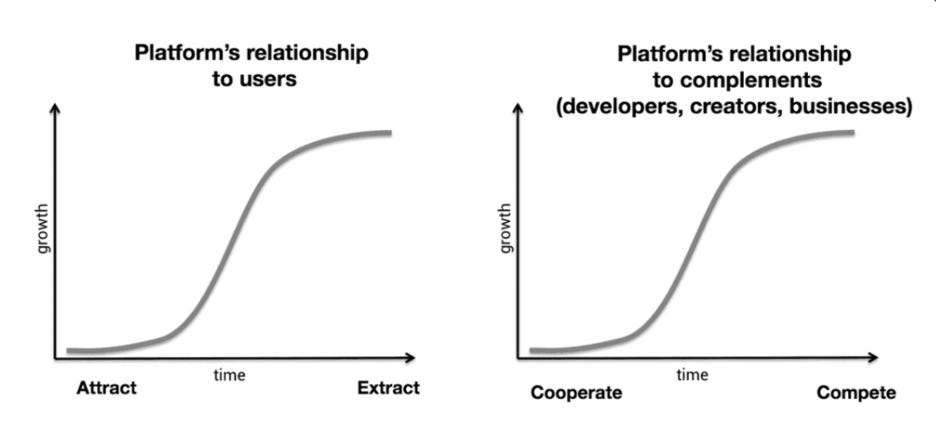

As noted by Chris Dixon, in the early days of a centralised platform, it behaves in a positive-sum manner to attract as many participants as possible. However, when participant growth hits the top of the S-curve, the relationship turns zero-sum and turns from collaborative to extractive. Now, the network effect is too strong for users to simply abandon the platform. You can understand this dynamic better here.

The fundamental issue here is that all centralised platforms (due to shareholders being a separate entity to platform participants), are required to be valuable as a company. They, unfortunately, can only do this when they extract as much value from the value generated by platform participants.

Therefore, for a platform to be as ‘friendly’ for creators as possible, it must be owned by them. Right now, Employee Stock Ownership Plans (ESOPs) are meant to align incentives between employees and the platform. However, these are limited by legal and financial infrastructure across geographies and socioeconomic backgrounds and, rather crucially, only address the platform’s operators rather than the creators, who are its cash cows and main users. Since creators are arguably the most value additive stakeholder, and ESOPs are not able to remunerate them well enough (or at all), there is currently no way for creators to effectively reap the benefits of the time they have spent on the platform.

In sum, creators do not own their content, 3rd party developers cannot control their code, all platform participants cannot influence the policies or decisions of the platforms they use, and the predominant business model is an opaque, advertising based one that gives outsized advantage to the closed-garden platforms.

So, what is the promise of Web3?

Enter Web3 and the Ownership Economy 🔗

As mentioned earlier, the ownership economy is the hypothesis that the next generation of products / services (across industries) will be owned and run by their participants via alignment of incentives using tokenisation. Ownership manifests itself via financial gain, governance rights, and / or social clout.

This world is enabled by Web3 technology, specifically the advent of tokens, which, akin to IP, HTTP, SMTP, etc., are a protocol-level innovation. Think about tokens as an internet-native property rights system – for the first time ever, you can literally own a piece of the internet. This piece can represent anything from a mere JPG to a part of any internet product / service you use. As examples, Bitcoin and Ethereum are the first user-owned networks at scale.

Using tokens as ownership assets, and coordination structures such as DAOs, creators can own not just the content they produce, but the platforms themselves. As the participants will be the owners, they can collectively decide policy and product decisions for the platform, with no external pressure for profit extraction.

Tokens, due to being internet-native, are different from equity in the following ways:

Accessibility

This allows anyone with an internet connection to interact with tokens while also allowing fluid and instantaneous transfer. Unlike equity, they are not limited by geographical boundaries. This easy accessibility allows ‘Patronage+’ to emerge. Coined by Jesse Walden, Patronage+ is a new paradigm where supporting creators is not only an act of altruism, but also one of investment. In other words, patronage with the potential for profit.

Programmability

One can codify rules within the token (the medium of value exchange) to facilitate commercial relationships, which today require 3rd parties to enforce. For example, one could program digital scarcity via NFTs, which allows creators to tangibly value their work that is digital in nature. This is more about restoring pricing power for creators, rather than artificially restricting consumer choices. You can read more about how NFTs will affect creators in our article on Web3 Music.

Another example of programmability is composability. Now, building on top of others’ work (e.g., remixing) does not hinder the original artist from getting financially compensated, as one can program royalties to flow to Wallet X, every time any value is transferred to Wallet Y.

Hyper-Specific Data Insights

Due to the on-chain nature of tokens, creators can verifiably get insights into the quality of a fan across varying parameters such as when an individual supported them, how much they have consumed their content, their quantity of financial contribution, etc. This allows them to incorporate the data into their future work and create more bespoke content for their fans, should they wish to do so. They can also offer hyper-specialised perks to their ‘true’ fans and, in general, engage with their fans much more effectively, allowing them to build a much tighter community that stands the test of time.

Impact on the Creator Economy 👩🏽🎤

Tokens invert the creator lifecycle. Under the Web3 model, creators face a Catch-22 – to make money, you need an audience, but to grow an audience, you need resources to fund content creation. Thus, new creators invest resources with only the hope of making the endeavour a profitable one. In Web3, creators can begin their journey by crowdfunding using a token (fungible or non-fungible). In this model, the ‘fan-owners’ have skin in the game and are therefore incentivised to act as evangelists for the creator and their work. You can learn more about this phenomenon in Li Jin’s article here.

Tokens allow for deeper monetisation by allowing creators to generate more value from their most ardent fans. This brings to life a tiered strategy of having product / service offerings for each level of fan while simultaneously increasing the upside potential for value generation from a creator’s super fans. Beyond monetisation, creators can imbue utility into their tokens, thereby making their fans (those that are token holders) active participants in content creation, as opposed to only passive consumers. Interesting experiments of this type are Shibuya and Mad Realities.

As tokens can fundamentally align platform growth and its participants, it could give rise to much larger and more robust networks than we’ve seen to date. As the platforms will serve users, and not shareholders, users might not want to optimise for share price, which completely flips Milton Friedman’s view, where the main goal of all corporations is to drive profits for shareholders. For the first time ever, we now have the technology to align incentives to optimise for other metrics. However, it is important to note that an easily tradable creator token does bring in the perils of speculation which can rapidly destabilise incentive alignment. A token, therefore, needs to be very carefully designed and if it is to be used to build a community, serious thought needs to be given to having a token in somewhat of a closed-loop ecosystem.

Lastly, Web3 can bring value back to digital content via digital scarcity. Over the last two decades, free-to-use platforms have commoditised and devalued content. As a result, the act of paying for content has significantly reduced. However, the ability to create digital scarcity has the potential to cause a reversal in this trend. The following is a useful quote to understand why this is important:

“If I do a job in 30 minutes it’s because I spent 10 years learning how to do that in 30 minutes. You owe me for the years, not the minutes.” – Someone on the Internet

While it is not beneficial for every piece of media to be digitally scarce, the ability for creators to make their work scarce unlocks a variety of use cases that can all be monetised. An artist, for example, does not need to let go of her Spotify streams – rather, she can use Music NFTs, limited edition drops, and other perks for her most ardent fans while maintaining a presence on Spotify to reach a larger, more general audience.

Current Landscape 🏞️

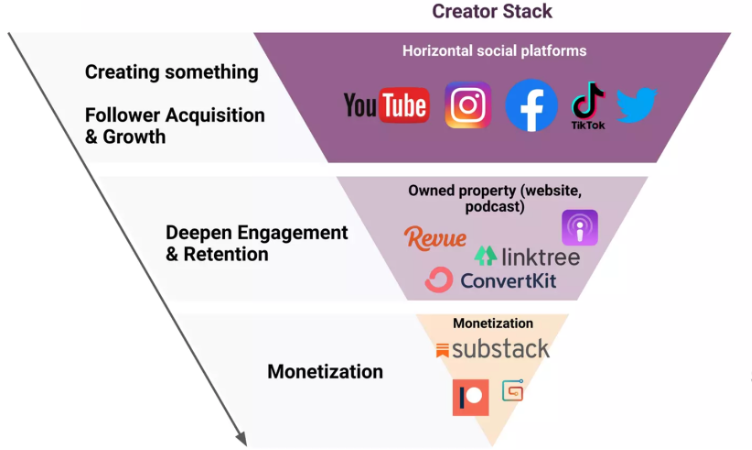

As per Clayton Christensen, the total addressable market for disruptive innovation is unknown and unknowable. For the creator economy this holds true because, due to new platforms, technologies, and societal trends (e.g., COVID), the willingness and ability for people to become creators increases. So, while market sizing is not possible, the category of tools can be classified into those that help in content production, growing / engaging an audience, and monetising and managing a business. The following diagram is a visual representation of the same:

If you want a more comprehensive list of tools in the creator economy that exist today, we recommend going through Shopify’s list.

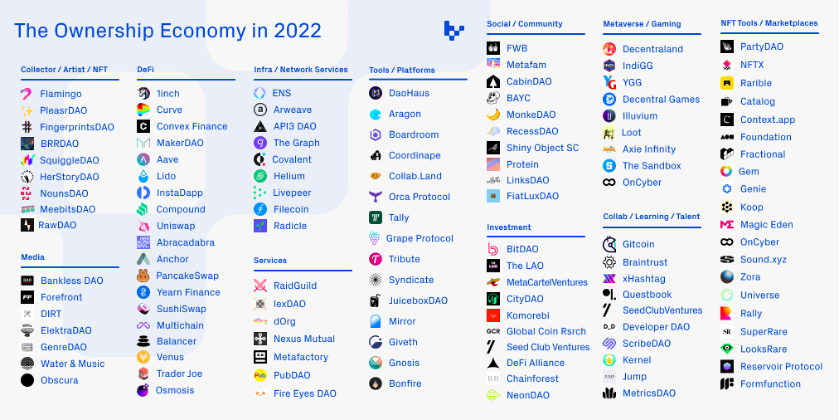

As for the ownership economy, the following diagram covers most of the categories being actively built:

That said, Web3 tools that are specifically built for the creator economy tend to fall into two buckets: rebirth and birth tools (similar to the classification in our Real World Assets article), i.e., tools that mimic Web2 solutions, and tools that are novel for on-chain needs, respectively. An example of a rebirth tool would be Audius, which is trying to become a decentralised Spotify. On the other hand, an example of a birth tool would be Collab.land, which provides software to token-gate online group chats – a need that was not possible before the advent of tokens.

Nonetheless, we believe Web3 tools for the creator economy will still broadly fall into the aforementioned buckets: those that aid in content production, growing / engaging an audience, and monetising and managing a business.

Closing Thoughts ⌛

While the picture we’ve painted looks almost utopian, there are a few reasons why such user-owned platforms have not yet widely proliferated. To begin with, user-owned platforms require a basic level of technical Web3 knowledge, and most individuals do not have this level of understanding to make the leap (and should not be expected to). There will need to be a critical mass on the new platforms to incentivise the hordes to migrate to the new platform, as it includes bearing significant switching costs. And, as we’ve said many, many times before, the UI/UX will need to be simplified much more to reach that critical mass.

The good news is that such platforms represent the first instance where we can bootstrap network effects using economic incentives (e.g., tokens).

Nonetheless, legal and cultural taboos are two other vectors that represent headwinds for mainstream adoptions.

While tokens can jumpstart networks, they are most definitely neither an alternative to product market fit, nor is it clear if they will lead to a sustained advantage over time in maintaining and growing a network. At the end of the day, you still need to build something people want. Case in point, OpenSea. It has no token but still is miles ahead of all its competitors (SuperRare, Rarible, etc.) that have launched tokens.

Beyond adoption, below are some potential future outcomes:

More capital to be deployed. To put this into perspective, as of mid-2022, Red DAO was the largest deployer of capital in digital fashion. Cumulatively, they had invested ~$10 million. Fashion is a multi-trillion dollar industry that can use digital means of engagement a lot more effectively than they are today.

More creators to become investors. While this trend commenced years ago (with Dr. Dre and Beats, Diddy and Ciroc, etc.), Web3 tools now allow smaller creators to invest in brands and products that they resonate with.

The creator middle class will increase significantly. As monetising creative pursuits becomes easier (resting on the dual assumptions of an increase in enablement tools and the willingness for individuals to pay), a much larger cohort of creators will be able to make a sustainable income from their creative works. Now, the 1000 True Fans thesis becomes all the more achievable.

A rise in influencer / content creator incubators. Influencer incubators in China have already scaled, such as Ruhan, while experiments in the US have already taken place, like Jake Paul’s Team 10. While this is an area with high potential, getting a minority percentage of exposure to creator revenues is a tricky subject legally, and the contracts may end up looking like the predatory ones that record labels have with artists. A potential mitigant is that the transparent nature of Web3 and blockchains can allow this to take place in a much more open and scalable manner.

All in all, there is a long road ahead. The potential for growth is high, and while there are numerous headwinds, these are not insurmountable. If the UI/UX and education challenges of Web3 resolve themselves over the long-term, there is a good chance that the creator and ownership economy reaches the zenith of its potential.

Disclaimer

This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the article authors and do not represent those of people, institutions or organizations that those authors may or may not be associated with in professional or personal capacity, unless explicitly stated. All content provided on this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. The owner will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information. Any views or opinions are not intended to malign any religion, ethnic group, club, organization, company, or individual.

👇🏽 please hit the ♥️ button below if you enjoyed this post.