Real World Assets

Thematic Analysis #6

This is the sixth article in our Thematic Analysis series. In this series, we talk about broader trends and emerging concepts in the crypto space, looking towards the future and analysing how Web3 is evolving in real-time. Let’s dive in!

Theme: Real World Assets

Introduction 👋

The tokenisation of real-world assets (RWA) has long been held as the ‘holy grail’ of blockchain technology. The ability to turn any illiquid asset into a liquid, freely tradable financial asset which accurately represents the asset’s value is expected to have the potential to add trillions of dollars’ worth of value to the global financial system. This is a Web3 use case with, as the name implies, real-world application, something that most crypto believers and naysayers have been screaming from the rooftops for. Imagine this interaction we’d have with a normie meatspace friend:

Normie Friend: ‘Well, what is a use case of blockchain technology and crypto? All I’ve seen are dog coins and stupid JPEGs!’

Genesis Block: The tokenisation of real world assets. Did you know that most assets in the world are illiquid and difficult to value and trade? Take the easiest example: real estate. If you wanted to sell your house today, the process is so manual and difficult to automate. With tokenised real estate, you’d be able to represent your house in the form of a token on the blockchain, prove your ownership of it, and immediately transfer your ownership to anyone in seconds!

Normie Friend: Ooh, that sounds cool! What are some other benefits of tokenisation?

Genesis Block: Here are a few:

Efficiency and cost gains from the reduction of risks;

Automated compliance with regulators;

The process of fractionalisation theoretically giving any retail investor in the world access to any asset, which is not possible at all today;

Transparency in terms of ownership;

The ability to use the composability and programmability of tokens and smart contracts to create new types of products;

Better pricing models and price discovery.

Normie Friend: This seems too good to be true. If what you’re saying is correct, then why are tokenised real world assets not more widespread? Why is most attention focused on pandas, apes, and now that I think about it, the entire animal kingdom rather than RWA?

Genesis Block: There are a bunch of issues that need to be sorted out. We’re still very early on. In summary, some of the challenges are:

Legal and regulatory, with the current framework not especially suitable for regulating tokenised assets, and the guidance given not providing enough clarity and confidence for institutions to dive headlong into this space;

The custody of digital assets is more technically complex than the custody of traditional assets, and the institutional-grade custody market is still developing;

Market demand is not yet fully established – valuation is a problem that needs to be solved, and so is market readiness in terms of adoption of Web3 infrastructure;

There are thorny questions around data protection, privacy, and storage;

Communication and connectivity between off-chain events and the blockchain can get complex;

Potential liquidity issues arising from bifurcation of liquidity and lack of demand for individual tokenised assets.

Normie Friend: Wow, that seems like a lot. You’ve piqued my interest. Can you go into more detail on the benefits and challenges, what the go-to-market could look like for RWA to achieve true adoption, and what the activity in the space looks like today?

Genesis Block: Sure! Let’s take four examples, although there are a lot of other projects building in this space as well. We’ll focus on two projects, Centrifuge and Toucan Protocol, walk through the Société Générale-MakerDAO deal, and the Monetary Authority of Singapore’s (MAS) Project Guardian pilot conducted alongside DBS, JP Morgan, and SBI Digital Asset Holdings.

Just FYI, other projects and products to keep note of are FortunaFi, RociFi, Chainlink’s DECO, Spectral Finance, and Masa Finance.

First, let’s start with a simple question: how should we define real world assets?

Defining Real World Assets 🔍

Tokenisation is the representation of pre-existing traditional assets (e.g., financial instruments, assets that exist in off-chain markets like real estate, music royalties, etc.) on a blockchain. A token represents that asset on a distributed ledger. The token derives all of its value from the real world asset and is therefore also impacted by any issues (legal or otherwise) that affect that asset.

An example would be a piece of art – let’s say Leonardo da Vinci’s Salvator Mundi, the most expensive work of art ever sold at $450 million. There could be a smart contract created on the blockchain that says, “this is a digital representation of Salvator Mundi that is worth $450 million and is the property of Badr bin Abdullah Al Saud”. The smart contract will then create 450 million tokens that each represent $1 worth of the Salvator Mundi and deposit them into Mr. Saud’s account. Mr. Saud can go onto a marketplace (i.e., exchange) and sell any number of these tokens to just about anyone and receive $1 for each token he sells. Let’s say you buy 1,000 tokens of the Salvator Mundi. Now you legally own $1,000 worth of a Leonardo da Vinci painting, and you know this token is legitimate since it was created on the blockchain and cannot be tampered with.

Jason Chen, in his Unreal Primer on Real World Assets, defines two types of RWA:

Birth Assets, where new assets are created using the properties of tokens and blockchains. These include new types of products that were not previously possible to create like Everlasting Options and Hashrate-backed Loans.

Rebirth Assets, where ‘existing assets are re-ledgered’. This regards the tokenisation of products we’re all familiar with – established asset classes like sovereign debt, mortgages, private debt like VC and PE funds, corporate loans, climate assets, trade finance, revenue-based finance, royalty finance, legal settlement finance, etc.

It is the latter we will focus on today, given the large Target Addressable Market (TAM) of Rebirth Assets, although it is important to note that the innovations that have led to the emergence of Birth Assets can also be applied to Rebirth Assets and improve them.

Benefits of Tokenising RWAs ➕

Efficiency & Cost Gains

Firstly, tokens on a blockchain can achieve ‘instant, atomic settlement’. Settlement, according to the Federal Reserve Bank of New York, is defined as “the final step in the transfer of ownership involving the physical exchange of securities or payment”. Settlement includes both the transfer of securities by the seller and the payment by the buyer. Today, settlement for securities operates on a T+2 or T+3 basis, i.e., settlement is only marked as ‘complete’ two or three days after the transaction date. This leads to a whole host of risks and capital inefficiencies for the system – there is heightened credit, counterparty, and liquidity risk, while a certain amount of collateral must be held on margin by the transacting parties to mitigate these risks. Tokens, on the other hand, are able to achieve ‘instant Delivery vs. Payment (DvP)’, essentially allowing the delivery of and payment for the asset to occur instantly and simultaneously, thus mitigating many of the aforementioned risks while reducing (or maybe even eliminating) any collateral that needs to be held, freeing up capital to be deployed elsewhere and boosting capital efficiency.

Secondly, smart contracts enable many currently manual processes to be automated. There are efficiency gains to be made in the issuance, distribution, and management of securities, securities servicing, other corporate actions like dividend/coupon payments and voting, and release of funds from escrow. The cost reduction is highlighted by the IMF, which says that DeFi has a cheaper cost of capital than a conventional loan since most of the cost is just the funding cost, while operational and margin costs are much lower than those faced by banks and non-banks across the globe.

Lastly, compliance costs may also reduce, with the programmability of tokens potentially enabling automated compliance with regulatory requirements. However, a challenge is that regulators need to be able to accept automated compliance and understand blockchain data, which they are far away from being able to do.

Larger Audience of Investors

The tokenisation of assets could allow investors in primary and secondary markets to directly access these assets. Tokens enable fractionalisation (dividing the asset into smaller chunks or denominations), which can lower the minimum requirements to invest in a specific asset. Therefore, retail investors will be able to gain access to a much larger variety of asset classes and risks that they are not able to touch today, giving them the ability to significantly increase their participation in capital markets.

SMEs will also be able to diversify their sources of funds. The tokenisation of securities combined with the liquidity pool format of lending that crypto-native investors have become accustomed to will enable any type of investor to fund SMEs. This can improve the efficiency of capital allocation in the economy and broaden access to capital for SMEs, allowing them to partake in more value-generative projects.

Transparency

Using the blockchain to represent ownership will provide enhanced transparency into beneficial ownership, i.e., it is straightforward to prove who owns what. This may reduce costs associated with maintaining share registries or transfer agents, with the blockchain having the potential to act as an immutable registry that updates in real-time. There is also increased transparency regarding transaction data, information around the issuer, and the characteristics of the asset, which can be accessed by anyone, anywhere, at any time. This transparency also allows for superior data and analytics capabilities, which can provide investors with greater insight into the performance of their portfolios.

Greater Liquidity & Accurate Pricing

Since illiquid assets cannot be easily sold and gotten rid of, they are imposed with an ‘illiquidity premium’, which reflects the higher risk of holding these assets. Illiquid assets, therefore, do not usually trade at par with their fair value, to account for the cost of illiquidity. Since tokenised assets are liquid by their nature, their illiquidity premium should theoretically be lower than that for traditional assets, therefore allowing tokenised assets to trade closer to their fair value.

Tokens also have the possibility to be listed on multiple marketplaces at the same time (akin to Zora’s mechanism), broadening the venues of distribution available for the asset. Atomic settlement further improves liquidity since there is no time lag in the exchange of ownership of assets, allowing those assets to be utilised immediately.

Another benefit from improved transparency is a reduction in information asymmetry between market participants, which can potentially improve price discovery, lowering the friction for new investors to enter and bring additional liquidity into the market.

Challenges in Tokenising RWAs ❌

Legal & Regulatory

When a token represents an existing real world asset, it is essentially a derivative of that asset. Economic value, therefore, accrues first to the legal real world asset, with the RWA token representing a ‘junior’ or less important claim on the asset. Unless each participant agrees to treat the ledger as the definitive legal record and that no value will accrue to the real world asset, there will have to be reconciliation with the real world services around the real world asset, which can significantly dampen the benefits of transparency, efficiency, and automation. However, examples of how such a legal agreement being enforced today are scarce, and it remains to be seen how such a system would operate. From a regulatory perspective, changes in law will need to be enacted that recognise securities on the blockchain as the definitive legal record and not just as a digital representation of something that primarily exists in the physical world.

There are also several existing regulatory requirements that can hamper RWA tokenisation and reduce their benefits. For example, if a PE fund is structured as a private direct fund, it is subject to a 2% cap on transferring out liquidity from the fund in a calendar year, i.e., if a fund is worth $100 million, no more than $2 million can change hands in a calendar year. This severely reduces the benefit of liquidity brought about by tokenisation. Another regulatory issue would be KYC/AML compliance requirements. An onboarding process that engenders as little user friction as possible needs to be implemented, while there are questions around how a single compliant digital identity used across dApps and marketplaces can be implemented. As an example, an outstanding question would be how stale compliance data is updated, or how compliance information can be updated when KYC requirements change.

Current regulatory guidance around security tokens and the classification of digital assets is woefully underdeveloped. Institutions do not have clarity around the legal definition of the assets they are holding, or which custody providers are most appropriate for their assets. This is a huge barrier to adoption by institutions, which reduces the overall uptake of tokenised RWAs since high volumes are necessary for the market to have enough liquidity.

Lastly, the legal status of smart contracts remains to be defined; these are not considered to be legal contracts in most jurisdictions. As such, issues around enforceability will abound until the application of contract law to smart contracts is clarified.

Custody

Custody of digital assets is more technically complex than the custody of traditional assets. There are multiple additional considerations like key management (escrow, storage, and restoration), security audit and testing, maintaining and upgrading wallet functions, etc. All of these mean that from an institutional perspective, it is not easy to both, set up a custody service or find the right partner who meets all of these technical requirements and also has attained the appropriate regulatory licenses, many of which (such as the requirement to be registered as a Special Purpose Broker Dealer) are cumbersome and expensive. Due to a relative lack of market demand and regulatory clarity, most financial institutions may not want to go through the process of setting up a custody service.

Market Demand & Readiness

Demand in the market today is not extremely well-established and institutional stakeholders do not have the Web3 infrastructure setup to be able to custody or interact with tokens, which is a chicken and egg problem: does the infrastructure come first, or does the demand? Moreover, there is a pertinent question around valuation of funds or assets if they are tokenised and listed for sale on a secondary market, especially if funds invest in non-Web3 projects. Real world illiquid assets are not valued in real-time and the process of valuing them can get complicated. GPs, for example, may not want their shares to trade at a discount and do not need to provide disclosures to continuously value their funds today, and may also not want to send along confidential data about their fund to prospective LPs who will want this data in order to invest.

On Chain <> Off-Chain

Tokens representing real world assets are affected by real world events, like someone getting injured on the land and making a legal claim, disputes about land ownership leading to claims, or intellectual property rights. It is not trivial for the owner of the RWA token to receive notice about these events, or the value of the token to automatically adjust based on the event. Since it is not easy to do due diligence on the underlying asset, it makes it tougher to set up a liquid secondary market.

Communication between off-chain and on-chain events takes place via oracles, which face their own reliability and robustness issues. It is crucial for oracles to be tamper-proof and accurate, and it will be difficult to ensure this for all off-chain events, especially the edge cases for more niche assets. For example, if a trade finance contract has been tokenised and successful payment depends on the shipment passing certain checkpoints, the shipment will need to be equipped with sensors that relay information to oracles, who relay it to the token holder. This requires state-of-the-art infrastructure and will be challenging and probably expensive to set up in many cases. Oracle manipulation also must be protected against, and while Chainlink is working on its DECO solution and there are likely to be other innovative solutions to this problem, it is still crucial that it be solved.

Liquidity Issues

If the asset is traded both on and off-chain, liquidity could get fragmented between markets, which may shift liquidity from traditional markets onto the blockchain and reduce liquidity in the off-chain markets. If prices diverge between on-and-off-chain markets, there is a risk of arbitrage between the markets.

Furthermore, assets that are tokenised may be individual ones which do not always have that much liquidity, lowering the benefit of liquidity. There also needs to be a critical mass of assets that trade on these markets in order to truly benefit from increased liquidity, which will take time to achieve.

Go-to-Market for RWAs 🎯

Keeping in mind the above challenges, none of which are minor and all of which require a relatively mature level of market readiness, demand, and innovation to solve, what is the go-to-market strategy for real world asset tokenisation?

There are three key considerations: the need for a common standard to enable interoperability between tokens and assets and targeting the appropriate markets and asset classes to begin with.

Establish a Common Standard

In the same vein as securitisation, which brought about a common standard (CUSIP) for the origination, ledgering, packaging, and distribution of mortgages, corporate loans, and consumer loans, tokenised RWAs need a common standard to enable ease of creation, packaging, distribution, and trading. There are many token standards that exist on the market today (ERC-20, ERC-721, etc.), with a couple aiming to create a common standard for security tokens:

ERC-3643, an ERC-20 compatible standard for security tokens.

ERC-1400, a framework for the tokenisation of securities, which includes features like automatically programmable conditions for legal and regulatory requirements, automated compliance, investor identification and whitelisting, and securities asset servicing and corporate actions.

ERC-1400 is more in line with what a common standard would need to have, with KYC/KYB and AML requirements, templates for legal considerations, jurisdiction-specific regulatory requirements, and corporate actions all embedded into the token standard. It is difficult to create a standard that covers all types of assets, but as long as the standard meets the minimum level of requirements that enables tokens to interoperate, it would be fit for purpose.

Targeting the Appropriate Markets

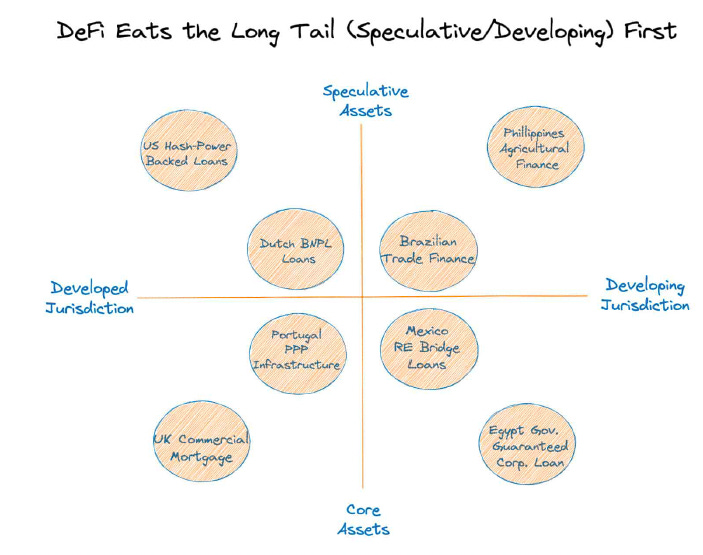

To pinpoint the ideal target markets for tokenised RWAs, it is important to step back and identify where DeFi has made the most impact. And no, it’s not in helping degens lever up and ape into a million shitcoins. It’s been on the underserved in emerging economies, who have been able to gain access to USD-denominated stablecoins and store their savings in currencies that do not frequently lose value. Most of this access has been targeted towards retail users, but there is high potential for businesses and SMEs in the developing world to benefit from a wider variety of financing options. Referring back to Jason Chen’s Unreal Primer, the right hand side of the below graph represents the markets that are most appropriate for RWAs:

Emerging markets also have a lot more to benefit from efficiency gains in terms of trust, cost, speed, process complexity, and intermediation. These economies have relatively more intermediation and less liquidity than their developed economy counterparts, enabling them to gain higher incremental benefit from tokenisation.

Targeting the Appropriate Asset Classes

Institutional investors will still use TradFi markets to access established asset classes, but DeFi and tokenised RWAs could fill the gap for the diversified, less institutionally established minority portion of their portfolios. The most suited asset classes would be the likes of revenue-based finance, trade finance, private debt, emerging market debt, etc., along with ‘Birth’ assets like hashrate-backed loans and loans backed by block rewards attained from validating or mining blocks. Origination is a crucial part of attaining high volumes of tokenised assets, making Web2 FinTechs like Pipe (revenue-based financing) and Taulia (trade finance asset originator) key components in supplying assets for tokenisation.

Trade and Revenue-Based Finance assets are suited to tokenisation since they are currently more manual and heterogeneous than other assets. From a manual perspective, smart contracts have the potential to automate away a lot of administrative overhead, while heterogeneity means that several individual assets can be packaged together (like securities), fractionalised, and distributed to investors with a wide variety of risk profiles.

From an emerging market perspective, the types of assets that would be most appropriate to tokenise and distribute (subject to regulation) would be safer ones that can hold and maintain stable value, such as tokens representing US treasuries. This will allow SMEs and other corporates in emerging markets to diversify their treasuries and gain access to a strong store of value.

Protocols Building in the RWA Space 🚜

Several protocols have noticed the opportunity to crack tokenised RWAs and have started to build in the space, with quite a few having launched and gained traction already. As examples, we’ll explore Centrifuge, Toucan Protocol, the Société Générale-MakerDAO deal, and the MAS’ Project Guardian pilot below.

Centrifuge

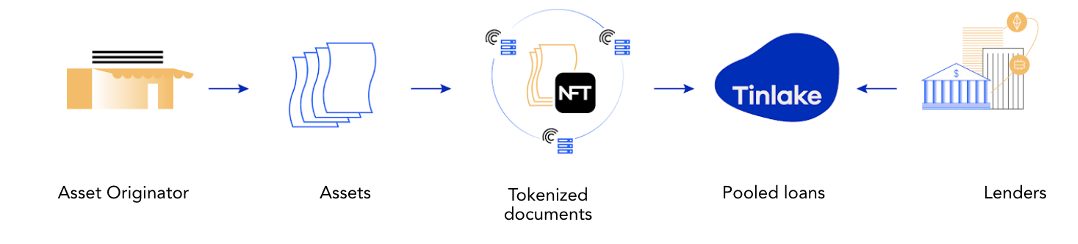

Centrifuge is a bridge for real-world assets into DeFi, aiming to bring down the cost of capital for SMEs and provide investors with uncorrelated yields. Its Tinlake product allows SMEs to access finance by creating pools of loans backed by collateral. According to Centrifuge, the average cost of capital for an SME is 15%, while the default rate is much lower at 2%, making the sector a much more appealing one to lend to and invest in. Centrifuge is built on Centrifuge Chain, a Proof of Stake blockchain built on Polkadot that allows users to bring their assets on-chain as NFTs.

On Centrifuge, asset originators (businesses) can finance RWAs like invoices or mortgages by tokenising them into NFTs and using them as collateral. For every Tinlake pool, users can invest in 2 tokens: TIN, the junior tranche or risk token, which gets higher returns but takes the risk of defaults, and DROP, the senior tranche or yield token that receives lower returns but is protected from defaults. Each asset originator creates one open-ended pool for their assets, where investors can deposit and withdraw capital at any time and the capital can be deployed by the originator unless it is withdrawn by the investor. To reduce risk for originators, a mechanism is used to match investments and redemptions and ensure that the pool’s risk metrics stay within a certain boundary and the DROP tranche is protected against loss. The pool operates as long as there are new assets to be financed and investors to provide capital.

Centrifuge also has a P2P network that provides a way to provide information needed to tokenise the asset into an NFT. Service providers assess and verify data (i.e., documents transported safely over secure channels in the P2P network) provided by the originator. The NFTs are privacy-enabled by holding only some data on-chain, allowing them to keep some or all attributes private, while tracking ownership publicly.

Asset originators are onboarded through a KYC process conducted via Securitize ID, and a contractual relationship is formed after it is passed.

The below diagram is a good representation of their model:

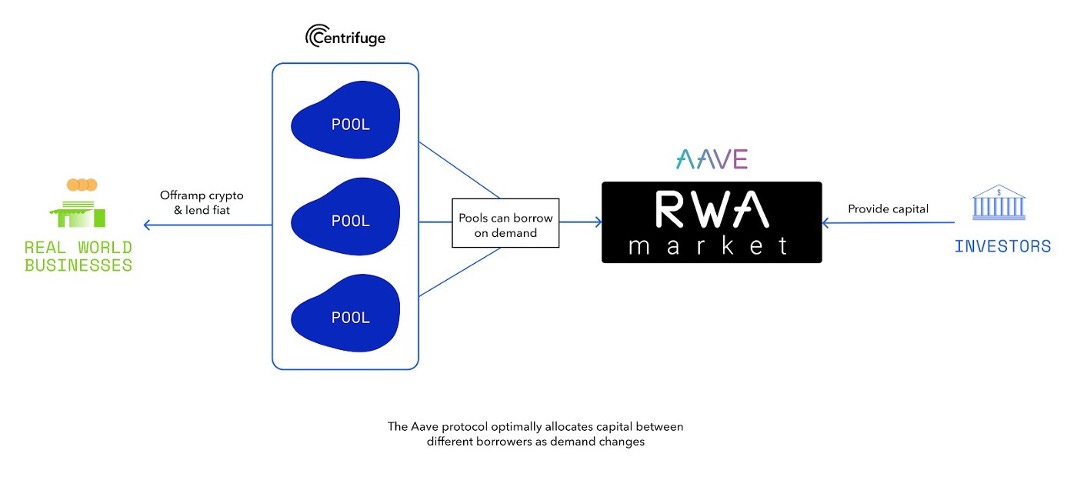

Centrifuge has launched an RWA market on Aave, allowing the Centrifuge RWA token to be used as collateral to borrow USDC.

The market launched with 7 pools, with LPs depositing USDC and issuers borrowing the USDC against their assets and convert it into value-generating projects. Aave is a cornerstone of DeFi and having a RWA market on it significantly broadens Centrifuge’s distribution and the avenues of liquidity for asset originators.

Toucan Protocol

The carbon credit market is likely to be one of the most important markets over the next couple of decades, although it is fragmented and has many issues today. Some of the main problems with the market today are the lack of transparency and verifiability of the source of carbon emissions captured in a credit, and inaccurate pricing – for example, the Chicago Board of Trade’s carbon market had to shut down because a ton of carbon was selling for less than a dollar, a price that was too low to have led to any kind of mitigation. There is a need for a transparent, open, verifiable market for carbon credits that allows users to trade credits with anyone across the world. Toucan Protocol is aiming to provide the infrastructure for this herculean task, with their main aim being to move carbon credits onto blockchains. They have built 3 products to assist with this:

The Carbon Bridge, which is used to tokenise carbon credits.

Carbon Pools, which group together tokens linked to credits with similar characteristics. This unlocks liquidity for these bundles of carbon credits, allowing them to be packaged together as a single token that can enables a better trading experience and price discovery.

The Toucan Meta-Registry, which stores project information, trading history, and retirement details about all tokenised carbon credits in an immutable, neutral, open ledger. Currently, the Meta-Registry is built on Polygon.

To alleviate the issue of carbon credits being of unreliable provenance, Toucan only tokenises voluntary carbon credits from respected standards bodies like Verra and Gold Standard and moves them onto the Meta-Registry as ‘TCO2’ tokens (a Toucan Carbon tonne). These have all the carbon credit data attached – project, year the impact took place, issuer, etc. These TCO2 tokens are retired (i.e., permanently taken out of circulation) using the Toucan Retirement Module, allowing companies to use them as carbon offsets. The Meta-Registry also solves the problem of needing a carbon registry account off-chain, which costs up to $1,000 a year and is an operational hassle. The transparency of the Meta-Registry also means that anyone can check the status of a specific carbon credit, regardless of which registry it was issued by, bringing a much higher level of verifiability.

Another key issue for traditional carbon markets is a lack of liquidity. The pooling together of carbon credits and representing the package in one fungible reference token unlocks liquidity. Toucan’s Crosschain Messenger also allows users to bridge carbon pool tokens between EVM chains, further increasing liquidity and use cases.

In essence, Toucan provides the infrastructure for more efficient, transparent, and open carbon markets. Anyone can use the tokenisation engine provided by Toucan to easily buy verified carbon credits and offset their emissions, or use them as financial assets in other ways – providing them as collateral on protocols like Aave, creating options contracts to speculate on them or hedge against some sort of climate risk, or even construct a carbon currency.

Société Générale <> MakerDAO Deal

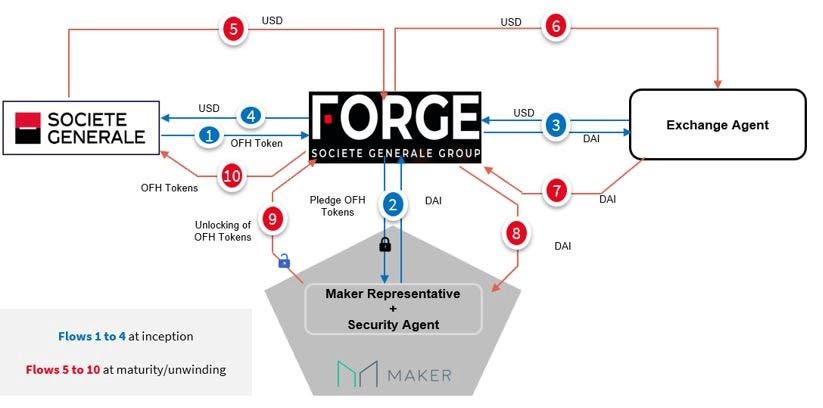

In 2021, Société Générale (SocGen), via its investment arm SG-Forge, raised $20 million in DAI, MakerDAO’s (currently) USD-pegged stablecoin, to refinance their on-chain covered bond issuance. They used their AAA-rated tokenised OFH bonds, which represent housing mortgages and earn 0% interest, as collateral.

The model works in the below manner:

First, SocGen transferred ownership of the OFH bonds to SG-Forge, which pledged the tokens into MakerDAO as collateral. In return, SG-Forge borrowed DAI, swapped it into fiat via an exchange agent, and transferred the fiat to SocGen. The unwinding process works the other way – SocGen transfers fiat to SG-Forge, which converts it into DAI via an exchange agent, deposits the DAI into MakerDAO, unlocks the OFH tokens, and transfers them back to SocGen.

This transaction is the first of its kind, one which shows how RWAs can be used across DeFi and potentially unlock significant capital efficiency. However, the complexity of the deal and the number of hoops that needed to be jumped through highlight the nascency of this space, the lack of readiness on the part of institutions to conduct these transactions themselves (since SocGen needed to use SG-Forge, which operates in somewhat of a regulatory sandbox), and the integrations and the reconciliation needed with the traditional world.

However, we are getting much closer. This is demonstrated by the recently released Project Guardian pilot report.

Project Guardian

Project Guardian is an evolution of the Institutional DeFi model begun by SocGen and MakerDAO. The pilot carried out transactions involving FX with tokenised deposits and separate transactions with government bonds on a public blockchain (Polygon), using Verifiable Credentials (VCs) to establish trust and compliance, along with modified versions of Aave (for lending and borrowing) and Uniswap (for exchange transactions). The project was built on 4 objectives:

Open, Interoperable Networks: Polygon was selected due to its high interoperability with Ethereum, its lower transaction fees, and its best-in-class BD team (only 50% tongue-in-cheek).

Trust Anchors: Trusted and regulated financial institutions issued VCs based on the interoperable W3C standards to traders, enabling them to transact on the blockchain. The VCs were attached to trade instructions to the DeFi pool and were verified on-chain to ensure that only compliant trade instructions were executed in the pool. Every authorised trader credential was irrevocably anchored to a trusted entity (usually the trader’s parent institution), and could be revoked, which would prevent traders from trading.

Asset Tokenisation: The pilot leveraged 4 types of tokenised assets: Singapore Dollar (SGD) deposits tokenised by JP Morgan’s Onyx, Singapore government securities tokenised by DBS, and Japanese Yen (JPY) deposits and Japanese government bonds tokenised by SBI Digital Asset Holdings.

Institutional-Grade DeFi Protocols: A modified version of Aave was applied to a foreign exchange use case, while a modified version of Uniswap was applied to the trading of FX and government bonds.

The pilot went through the complete lifecycle from trade order placement, execution, clearing, and settlement. The initiative seems to have met the fine balance of keeping the principles of DeFi in mind while catering for the strictures of regulation and compliance in the real world. A few key components stand out:

Privacy: Only the wallet address was disclosed, with the identity kept confidential. Transaction data was stored on Polygon, with details disclosed only to participants.

Settlement: Atomic settlement was achieved on-chain, while an update was made to a ledger off-chain for reporting purposes. This showcases how, in order to achieve true atomic settlement, no reconciliation with off-chain ledgers needs to be made.

Legal Standing: Legal agreements underpinned the pilot and were deemed to be determinative in the absence of regulatory clarity, once again demonstrating how regulation needs to be made clear to foster a Cambrian explosion of innovation in this space.

According to the participants, the project was able to validate two key aspects: the use of trusted FIs as trust anchors to issue compliant credentials, and the need for standards – technical ones for business logic and token standards for interoperability. Other benefits they highlighted were similar to the ones we walked through above, like transparency, lower settlement risk, and increased efficiency and trading velocity via atomic settlement. They also highlighted the work that still needs to be done in 7 key areas: legal clarity on frameworks, adoption incentives, guardrails and tools to enable faster development, end-to-end coordination between the blockchain and legacy systems, continuous improvements from working with, modifying, and testing DeFi protocols, alignment on industry-wide technical standards, and more refined business models that are fit-for-purpose.

Closing Thoughts ⌛

Genesis Block: So, Normie Friend, hopefully this has been a rather comprehensive and eye-opening view into the universe of tokenised real world assets. I hope you’ve learned a lot and figured out that we’re still very early on and there are many challenges that still need to be resolved. But we’re on the right path – what protocols like Centrifuge and Toucan are doing, and what TradFi players like SocGen, MAS, JP Morgan, SBI, and DBS are experimenting with are immensely important milestones for the development of this space.

Normie Friend: That was a lot! I think I’ve understood almost everything you’ve explained, so thanks for that. It’s been a long conversation, but I now see why you had to devote 5,000 words to the topic – let’s try to be a bit more succinct next time, though!

Genesis Block: Point taken and see you soon! Thanks for tuning in.

Bibliography 📖

Disclaimer

This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the article authors and do not represent those of people, institutions or organizations that those authors may or may not be associated with in professional or personal capacity, unless explicitly stated. All content provided on this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. The owner will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information. Any views or opinions are not intended to malign any religion, ethnic group, club, organization, company, or individual.

👇🏽 please hit the ♥️ button below if you enjoyed this post.