Introduction 👋

This is the ninth article in our Protocol Analysis series. In this series, we use our investment template outlined in How to Analyse a Web3 Protocol to fundamentally and critically analyse a variety of crypto protocols, aiming to separate the ‘real’ from the hype.

In this case, rather than breaking down a protocol, we’re going to analyse a DAO. Let’s dive in!

Protocol: New Order DAO, a Venture Incubator DAO that aims to build and grow DeFi protocols by providing them with growth opportunities, networking, fundraising, and functional and technical support.

Overview of New Order DAO 🗒️

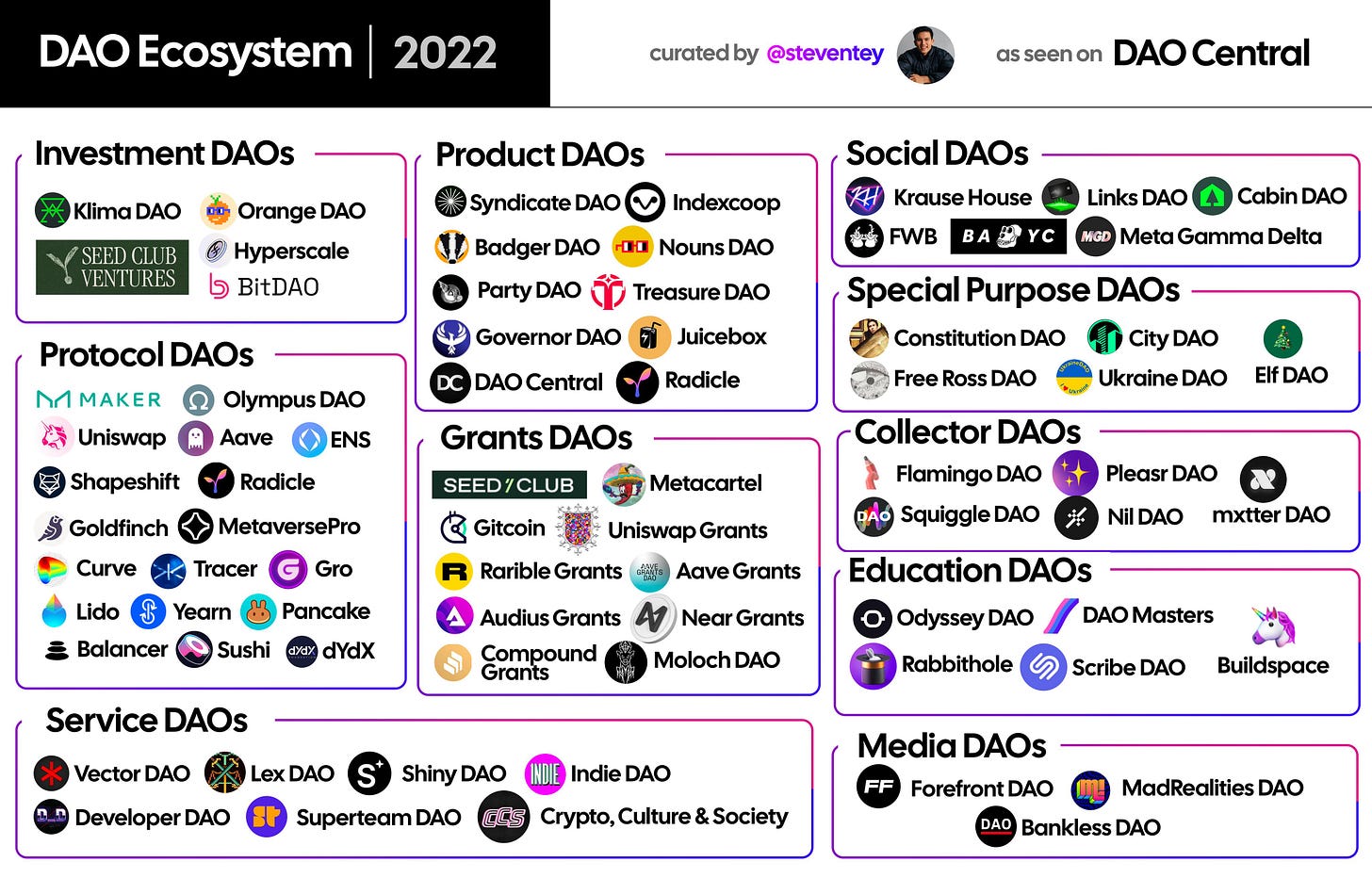

The DAO landscape has expanded significantly over the last couple of years, with DAOs of sorts catering to a multitude of use cases. The below market map illustrates this:

One of the primary types of DAOs are Investment DAOs, which pool together capital and invest it in projects – akin to an on-chain VC. In the off-chain ‘real’ world (aka meatspace), VCs traditionally invest in start-ups and provide them with support and growth opportunities. That model has now expanded in both directions – there are VCs which only provide funding and have a very ‘light touch’ approach to interacting with and providing support to founders (the Tiger Global model), and there are VCs which play a very hands-on role in building and growing the start-ups they have provided capital to. The latter model now most commonly refers to venture incubators, accelerators, and builders (yes, it is confusing terminology), and was famously popularised by Y-Combinator, which provides the start-ups in its cohort with seed funding, advice, and connections.

New Order DAO is attempting to bring the venture incubation/acceleration/building model (which we’ll now refer to as Venture Development for the sake of simplicity) on-chain, in the format of a DAO. New Order’s aim is to build an incubator for DeFi projects with all decisions (e.g., choosing the projects to incubate, providing services and support to help incubated projects grow, deploying the treasury, etc.) made via decentralised governance.

To date, New Order has raised $4 million from reputable VC firms like Outlier Ventures, Digital Finance Group, and Ledger Prime, along with the Near Foundation, and has also raised $6.8 million from a Dutch Auction on SushiSwap’s MISO Launchpad. This is a healthy runway to last New Order through the bear market if managed prudently, and is a necessary backstop given the paucity of safe yield opportunities in DeFi today along with the current market conditions depressing the value of the tokens received from incubated projects. New Order’s goal is to launch 20-30 projects per year, which, to say the least, is ambitious. Given the funding it has received combined with the state of the market, it may be better for New Order in the near term to more selectively choose the projects it incubates.

To date, New Order DAO has incubated [REDACTED], OptyFi, H2O, Frogs Anonymous, and Y2K Finance, and is in the process of bringing Motherboard, Sector Finance, and Wynd into the fold.

The New Order Venture Development Model 🧱

New Order DAO’s criteria for the projects it chooses to incubate are:

A focus on the Web3 ecosystem

Aid in introducing new asset classes to DeFi

It must be interoperable across chains

It is a new project and not a fork of an existing one

These criteria are stringent and directed enough to be able to focus New Order’s attention and primarily attract projects that meaningfully drive the DeFi space forward. The fourth criteria seems to be especially important – being directed to most effectively organise and exploit DeFi’s Money Legos is more value accretive than just modifying existing code.

When a project is selected to be incubated by the DAO, there are 5 core services New Order offers them:

Growth Opportunities

Networking

Fundraising

Token Design & Protocol Architecture

Development & Security

In return, New Order receives a portion of the token supply of its incubated projects and earns additional yield by managing this supply through various DeFi strategies. All income received by New Order is intended to be ‘used first to ensure the long-term viability of New Order, and to fund continuing development and improvement of the New Order Network.’ New Order has also pledged in its Constitution not to distribute or sell incubated project tokens for at least 2 years post receiving them, which grants projects a runway to develop before its token faces any potentially significant selling pressure and simultaneously signals New Order’s commitment to the cause.

An example of the connections and visibility New Order brings to its incubated projects is its partnership with Outlier Ventures to launch a DeFi Accelerator Program. The program, which lasts for 3 months, is targeted towards projects ‘past the concept phase’ and offers a lot of perks: a DeFi mentor and investor network, an optional interest-free loan, expertise in token design, fundraising, business planning, pitch practice, legal, marketing support, etc. The first DeFi Base Camp ended in July 2022 with the graduation of 6 projects, which raised a combined $3 million in 3 months.

Incubated Projects 🧪

In its first year and a bit of existence, New Order’s incubated projects have undoubtedly innovated in the DeFi space. [REDACTED] was an instant hit at launch, with its Hidden Hand and Pirex products being quickly adopted. The tokenomics is also well constructed, incentivising users to hold and stake BTRFLY, the native token, to earn revenues. Frogs Anonymous, a decentralised Web3 research collective has also gained popularity, while Y2K Finance seems promising. New Order also seems to be expanding its scope outside of DeFi, illustrated in its selection of Motherboard, which develops DAO tooling and aims to accelerate DAO development, as one of its next two incubated projects.

Below is a brief description of each of New Order’s incubated projects:

[REDACTED]

[REDACTED] Cartel has two key products: Hidden Hand and Pirex.

Hidden Hand is a ‘bribe marketplace’ for DeFi protocols. Protocols deposit a ‘bribe’ into Hidden Hand, which is distributed to users in return for their voting power. [REDACTED] takes a 4% fee from each bribe, with half being sent to the treasury and half sent to those who lock BTRFLY in the protocol. Creating such a market aligns incentives between those who have excess voting power and those who need more voting power. Hidden Hand is a primitive that is used across DeFi protocols, and its ease of use and product-market fit brought it a lot of popularity immediately post-launch. The graph below shows how weekly bribe fees earned through Hidden Hand have stayed relatively consistent since April 2022, even though the peak was reached in September 2022.

Pirex creates liquid ‘wrappers’ for illiquid tokens. vlCVX, or vote-locked CVX, is an illiquid token that cannot be traded or transferred, with holders eligible for a portion of Convex platform fees and voting on Convex governance proposals, including the crucial bi-weekly votes of the weights to assign to Curve gauges. To find out more about the Curve-Convex relationship, read this. Users lock CVX in exchange for ‘pxCVX’, and Pirex takes the CVX and continuously locks it to receive vlCVX. Every 2 weeks, pxCVX holders are eligible to claim bribe revenue earned by Pirex, boosting their yields. [REDACTED] has extended Pirex to GMX to earn the rewards from that ecosystem as well. Since launch in September 2022, Pirex’s TVL has more than doubled in ETH terms, highlighting its success even in this bear market.

Lastly, BTRFLY is the governance token of the [REDACTED] ecosystem. Its value is backed by the intrinsic value of [REDACTED]’s treasury and the revenues earned by the protocol and can be locked for rlBTRFLY (revenue-locked BTRFLY) in 16-17 week epochs (cycles) to earn BTRFLY inflation and share in protocol revenue. 50% of Hidden Hand’s revenue, 42.5% of Pirex’s revenue, and a proportion of treasury earnings are distributed to rlBTRFLY holders. To date, 82% of BTRFLY’s supply has been locked for rlBTRFLY, demonstrating the success of [REDACTED]’s strategy.

H2O

H2O is a stable asset backed by the OCEAN token. In a previous article, we walked through how the OCEAN token itself does not have much intrinsic value, making this somewhat of a risky proposition. In H2O’s v2, data token sets will be used as collateral for H2O, providing a much more direct, tangible source of value, and acting as a sort of index for the best and most utilised datasets.

OptyFi

In the vein of Yearn Finance, OptyFi optimises yields across chains, executing on-chain strategies that allow for leveraged, multi-step yield strategies, fulfilling New Order DAO’s criteria of cross-chain interoperability, machine intelligence in its smart contracts, and being an original project and not a fork.

Frogs Anonymous

Frogs Anonymous is a research collective founded in April 2022, which aims to bring research together from diverse, decentralised contributors (full disclosure: Genesis Block is a contributor as well). Frogs Anonymous has recently re-organised as a SubDAO within New Order DAO (which we’ll touch upon more in the Governance section below). In the near future, its three core aims are of greater contributor involvement, more public bounties, and more DAO content.

Y2K Finance

Y2K Finance has been creating quite a stir since its launch in November 2022, with total deposits reaching a peak of 10,188 ETH or $13 million in early December, and settling at a total of 1,785 ETH or $3 million as of 5 February 2023. Y2K provides ‘exotic peg derivative’ products which enable participants to hedge or speculate on the risk of a pegged asset (or a basket of pegged assets) deviating from their fair implied market value. It has 3 products (launched and in the pipeline):

Earthquake, a structured product that creates fully-collateralised insurance vaults that underwrite the volatility risk with pegged assets – e.g., if a basket of stablecoins or a real-world asset deviates from its underlying pegged price too much.

Tsunami, a lending market for pegged assets based on Collateralised Debt Obligations (CDOs).

Wildfire, an on-chain Request-for-Quote (RFQ) orderbook for the trading of Y2K risk tokens (i.e., a secondary marketplace).

The three new projects incubated by New Order are:

Motherboard

Motherboard provides tools to run a DAO, such as:

Onboarding and Contribution Management

Treasury Management

Accounting System

Analytics

Collaboration Tools

New Order will provide technical, fundraising, strategy, and marketing support, and Motherboard will be fully owned and operated by New Order DAO.

Sector Finance

Sector Finance is a structured product protocol that is building risk-adjusted structured product vaults using a risk engine that scores and categorises crypto-specific risks. Sector provides two types of products: Risk-Tranched Vaults, which aggregate yield-generating strategies according to their risk levels, and Single-Strategy Vaults, which are unbundled versions of the strategies used in the Risk-Tranched Vaults that allow investors to directly deposit to their strategy of choice. Sector will be built on Arbitrum, and the strategies will be integrated with multiple blockchains, including Ethereum Mainnet, Optimism, and Moonriver.

Wynd

Wynd falls under the ‘Decentralised Physical Network’ or ‘DePIN’ category, aiming to enable users to monetise their unused bandwidth.

The Trends Supporting New Order DAO’s Emergence 📈

DAOs excel most in aligning disparate individuals across geographies on a common mission. Initially at least, their best suited use cases are ones where there may not be a need for speed and scalability, and a culture can be created and propagated across the DAO that binds contributors and creates a community. New Order DAO fulfils this mandate. A Venture Development DAO can create a consistent culture that inculcates a community of like-minded individuals, and New Order’s criteria for incubating projects shows how it is attempting to define the type of DAO it wants to be and the types of projects it wants to be associated with. Moreover, there is a need in the Web3 space for a decentralised incubator that stays true to Web3 ideals, and New Order DAO fills this gap. All in all, there is a clear space for New Order in the DAO and DeFi ecosystem, and its potential success could offer a template for future Venture Development DAOs to copy.

Team 🤵♂️🤵♀️

Given that New Order is a DAO, and the contributors are decentralised, spread out, and mostly pseudonymous, there is no ‘team’ as such to speak of. However, New Order was founded by a flesh-and-bones human being: Eden Dhaliwal, who was previously Head of Crypto-Economics at Outlier Ventures between 2017 and 2020 and has been part of the blockchain ecosystem for a long time, having been the co-founder of Toronto Blockchain Week, a mentor at TechStars, and, promisingly for New Order, the previous founder of xyz futures, a Venture Creation firm.

Tokenomics 💸

Token Distribution & Release

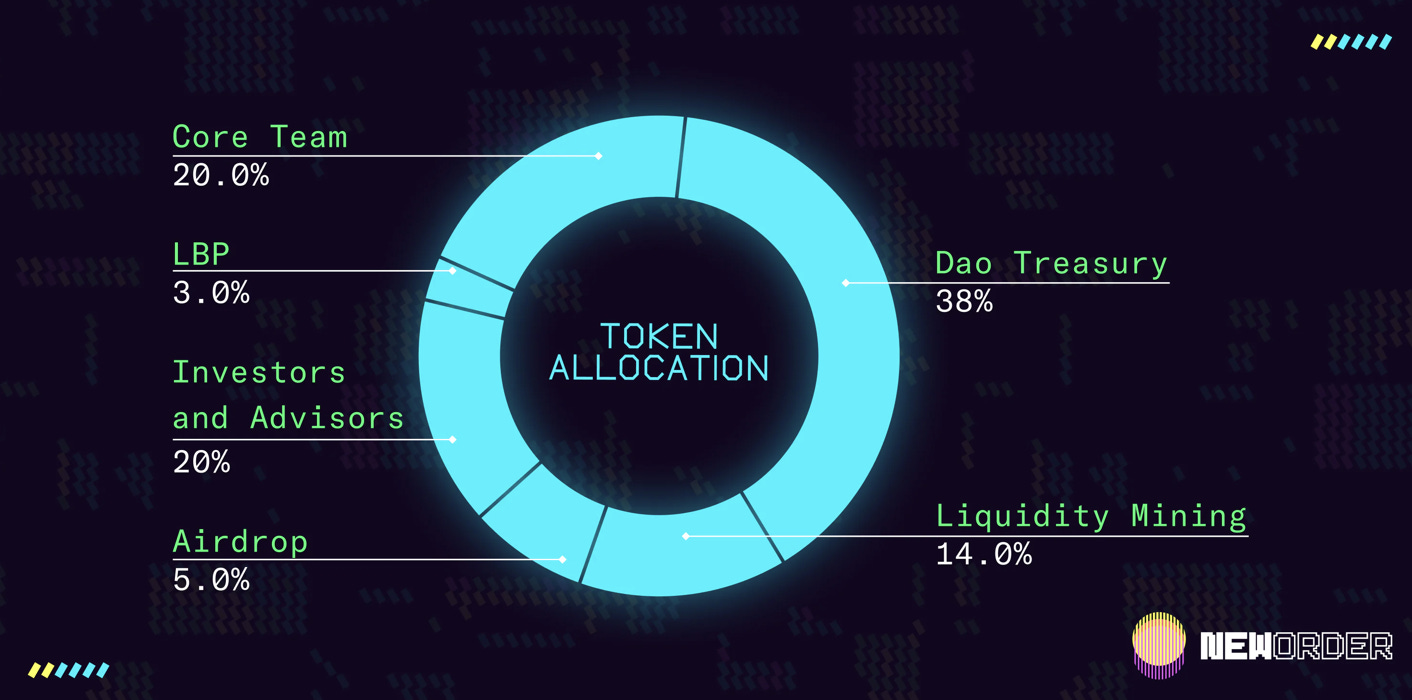

New Order’s native token is NEWO. With a max supply of 800 million, NEWO’s token distribution is fairly balanced:

The Core Team has a 1-year cliff with a 4-year vest, while investors and advisors have a 6-month cliff with a 2-year vest. 38% of the supply being allocated to the treasury and 14% to liquidity mining seems fair, although the vesting period of investors and advisors seems to end a bit soon. The core team and investors and advisors controlling 40% of the token supply is balanced as well, especially given that a good proportion of investors are individuals investing via the MISO Launchpad raise. Another positive aspect of New Order’s distribution is that the treasury will be governed by NEWO holders, which will be a core value accrual mechanism for the NEWO token.

Value Accrual

The New Order treasury receives between 5-15% of each incubated project’s token supply, and NEWO holders are a direct beneficiary of this: they are exposed to the growth of the treasury by governing the incubated projects. The treasury is managed by the Treasury SubDAO, and NEWO holders vote on the employed strategies, including assets like stablecoins, large cap cryptos, incubated project tokens, and NEWO. Holders also are eligible to receive airdrops from New Order’s incubated projects, adding further value to NEWO.

veNewo

To incentivise the continued holding of NEWO tokens, New Order has implemented a veTokenomics or vote-escrowed tokenomics model where NEWO holders lock their tokens up for a pre-determined period of time and get perks for doing so, such as gaining exclusive access to governance power, boosted token emissions, treasury yield, and sole access to airdrops by incubated projects. This is meant to ensure that the most aligned tokenholders drive DAO governance and run New Order. The below table displays the share of treasury yield for veNEWO holders based on the non-NEWO treasury size:

The minimum locking period is 3 months for a 1x boost up to a maximum of 3 years with a 3.3x boost. To make sure that veNEWO is not subject to speculative activity, it will not be a transferable token and will not trade on liquid markets and can be thought of as a ‘reputation score’ that indicates the commitment of the tokenholder to New Order. Locked NEWO cannot be unlocked until the end date of its locking period or unless a protocol emergency arises (which has not been defined so far but would likely have to pass through governance to implement).

To date, the total amount of NEWO locked is at 108 million, while the circulating supply of New Order (from CoinGecko) is 173 million, meaning that locked supply makes up 38% of total supply, which is very healthy.

Overall, NEWO’s tokenomics model is value accretive in its aim to align the interests of all contributing tokenholders. NEWO (or veNEWO) also acts as an index of New Order’s incubated projects, giving retail and institutional investors with a conviction in New Order easy access to investing in the ecosystem, while the veNEWO system helps to ensure the longer-term sustainability of the DAO. However, the success of the tokenomics system also depends on another key component of New Order’s model: governance.

Governance ⚖️

New Order’s governance mechanism uses a standard voting system with a twist: it is built upon the core tenet of enabling efficient multi-chain governance.

New Order will use a multi-chain vote aggregation module that will group votes across chains gas-efficiently and aggregate them on Ethereum, and then use Gnosis’ ‘SafeSnap’ module to enforce execution of governance on-chain. SafeSnap is an integration of Gnosis Safe (a multi-sig wallet used to create proposals) and Snapshot, which is a platform for off-chain voting. SafeSnap enables decentralised execution of off-chain votes, which brings with it the obvious trade-off that all votes are not immutably stored on-chain. However, New Order seems to have chosen this trade-off to easily enable multi-chain voting and attempts to further reduce the risk by integrating with Kleros, a decentralised arbitration service, for dispute resolution processes. The precise benefits of using Kleros are still to be determined, and it will take a stress-test situation to truly understand how robust the model is.

The governance process does not necessarily need to be very fast, especially compared to protocols like Aave, Maker, and Curve where risk parameters need to be constantly monitored and updated. Therefore, New Order’s 2-10 day lag in governance proposals passing does not pose an issue and given that the types of decisions needing to be made (treasury allocation and choosing projects to incubate) can have multiple options and require as much community participation as possible, may actually be a blessing.

Another core aspect of New Order’s governance model is SubDAOs.

subDAOs

There are 5 SubDAOs in New Order – Venture, Marketing & Community, Engineering, Treasury & Governance, and the newest one, Frogs Anonymous. Each SubDAO needs to apply for a budget every quarter and appoints a signer for the multi-sig. A signer is a SubDAO leader, i.e., a community member elected by each SubDAO to lead it, which enables the community to collectively run the DAO rather than centralising control in the core team. At genesis, the multi-sig has been constructed as a 6-of-9 wallet – meaning that for decisions to pass, 6 out of the 9 signers must approve. New Order further aims to align the incentives of signers by giving them a salary and a budget. A fair compensation model will go a long way in ensuring that the best performers stick around and effectively lead the growth of New Order.

The below budget for Q1 2023 shows how New Order allocates its budget and compensation per quarter.

The compensation per member of each SubDAO is:

Venture: $20,510 per quarter / $82,040 per year

Marketing & Community: $16,625 per quarter / $66,500 per year

Engineering: $23,800 per quarter / $95,200 per year

Treasury & Governance: $12,500 per quarter / $50,000 per year

While the amount for Treasury & Governance may seem low, both members contributing to it are part of other SubDAOs. However, it does indicate that perhaps more resources need to be allocated to this SubDAO, along with dedicated members, because it is not simple to effectively manage a treasury. The premium paid for the engineers is relatively low compared to the cost of engineers in the market, indicating that New Order has done well in this department, while the compensation for the other two SubDAO’s seems fair.

Voting Processes

Decisions over the treasury will be controlled by a community-driven Gnosis Safe multi-sig (5-of-9), which will ‘fully mirror the community driven decisions, only protecting from existentially malicious attacks’. At this early stage of development, this protection is needed, and over time, the multi-sig will be lifted to decentralise the protocol. New Order will decentralise over time, and when all DAO operations move to Kleros and SafeSnap, the DAO will reach its maximum level of decentralisation. There may be opportunities to move to fully on-chain voting across chains in the future, and it would make sense for New Order to incorporate a move to this model into its roadmap if and when possible.

New Order’s governance model seems to be well-designed, although questions persist over the effectiveness of Kleros as a dispute resolution mechanism, and the long-term use of SafeSnap and off-chain voting. However, these issues are minimal, and the SubDAO model will enable New Order to allocate resources more efficiently and further streamline operations. Kinks will likely be ironed out over time, especially over issues like budget allocation, and the model seems to be one which has a good balance between decentralisation and scalability.

Traction & Performance 📉

In its first year of operation, New Order has incubated and accelerated 18 projects, raised a very impressive $85 million for teams, and seen $30 million in total value locked across its incubated projects. These are commendable numbers, especially in the depths of the bear, and are very valuable for the DeFi ecosystem. The size of New Order’s community is small but growing at 1,194 total tokenholders.

New Order’s treasury is worth $8.4 million.

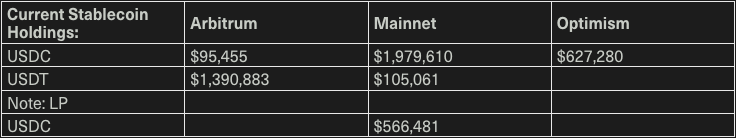

85% of it is denoted in NEWO ($7.8 million), which should be discounted for the sake of conservatism since the entire market cap of NEWO is ~$6 million and it will be impossible for the market to absorb the additional NEWO liquidity at current market prices. While the Dune dashboard above shows that the amount of stablecoins held is ~$1 million, according to New Order its stablecoin holdings are:

This is a healthy backstop if deployed prudently.

New Order has grown steadily over the last year and its most impressive metric is undoubtedly the funding and support it has distributed to its incubated projects.

Closing Thoughts ⌛

Effectively banding together from across the globe and collectively deploying capital and expertise to help grow innovative products is the true selling point of DAOs. A Venture Development DAO like New Order is healthy for the ecosystem, and its growth thus far and its tokenomics, governance, and venture incubation models are balanced and will help the DAO grow carefully and sustainably. The governance mechanism aims to decentralise as much as possible while attempting to avoid stagnation through its SubDAO structure, and the tokenomics (in theory) is well-structured to effectively align committed contributors. New Order is a protocol worth watching, and if you fancy, contributing to, which we’re going to definitely be doing more of!

Disclaimer

This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the article authors and do not represent those of people, institutions or organizations that those authors may or may not be associated with in professional or personal capacity, unless explicitly stated. All content provided on this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. The owner will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information. Any views or opinions are not intended to malign any religion, ethnic group, club, organization, company, or individual.

👇🏽 please hit the ♥️ button below if you enjoyed this post.