FRAX

Protocol Analysis #8

Introduction 👋

This is the eighth article in our Protocol Analysis series. In this series, we use our investment template outlined in How to Analyse a Web3 Protocol to fundamentally and critically analyse a variety of crypto protocols, aiming to separate the ‘real’ from the hype. Let’s dive in!

Protocol: FRAX, a partially collateralised algorithmic stablecoin which also provides liquidity systems and lending markets.

Overview of FRAX 🗒️

FRAX is a permissionless DeFi protocol that offers a range of DeFi products and services. The products that FRAX offers are stablecoins, two of them to be precise. The first one is FRAX, a USD-pegged stablecoin. It uses a combination of partial collateralisation (using fiat-backed stablecoins) and algorithmic rebalancing to maintain a $1 peg. The second stablecoin is called FPI and is pegged to the US Consumer Price Index. It employs a similar mechanism to FRAX to maintain its peg with the CPI.

FRAX also offers three services. Namely:

FRAX Swap: Automated Market Maker (like Uniswap)

FRAX Lend: Lending Market (similar to Compound or AAVE)

FRAX Ether: Ethereum Liquid Staking Derivative (similar to Lido stETH)

FRAX has been implemented on Ethereum as well as 17 other chains, including Polygon, Fantom, Binance Smart Chain, Avalanche, Arbitrum, Solana, and Moonbeam. It launched in late 2020 and has since become the second largest decentralised stablecoin after MakerDAO’s DAI. There is currently around $1.23 billion of FRAX circulating, which is pennies compared to juggernauts like USDT and USDC. But FRAX has the potential to eclipse them in the future and solve the holy trinity of DeFi (more on that later).

FRAX is backed by a who’s who of Web3 investors, as can be seen below:

While recent events have proven without doubt that the level of prestige of the VCs backing a project truly does not mean that it will be a sure-shot success, the above list of investors is a useful indicator that there is indeed quality and heft behind the project.

How Does FRAX Work? 🤷

FRAX Stablecoin

Stablecoins today fall into 3 buckets:

Fiat-backed stablecoins issued by centralised entities like USDT and USDC;

Crypto-backed, over-collateralised stablecoins like DAI;

Algorithmic stablecoins like the fallen giant UST.

FRAX has, in a way, fused the designs of DAI and UST to create a partially-collateralised algorithmic stablecoin. It has achieved this using a dual token system of FRAX, the stablecoin, and FRAX Shares (FXS), a governance token. $1 of FRAX can be minted or redeemed for $1 worth of FXS + USDC.

How does this work exactly?

The two token system allows for FRAX to be backed by both collateral (USDC) and an algorithm (burn and redemption of FXS). FRAX is minted when collateral and FXS are deposited into the FRAX protocol contract. The amount of collateral that needs to be deposited to mint 1 FRAX is determined by the collateralisation ratio (CR), which determines the ratio between collateral and algorithm that makes up the $1 FRAX value. The ratio adjusts automatically depending on two factors: FRAX’s price on the open market, and the amount of FXS liquidity available across all DeFi AMMs relative to the overall supply of FRAX. Here’s a diagram from Messari, with an example to help elucidate this better.

Here, 88% of 1 FRAX is backed by collateral, like USDC, and 12% is backed by the algorithm that manages FXS supply. For both minting and redemption purposes, the protocol obeys the CR, guaranteeing that 1 FRAX is backed by $1 of value. Whenever FRAX is minted, FXS is burned and vice versa. If the FRAX value were to drop below $1, displaying a lack of confidence in the system and peg of the stablecoin, the protocol would ‘step-up’ the CR by 0.25 until it reaches a sufficient peg. This can be done in reverse: decreasing the CR in times where FRAX is trading above $1. This fluctuation of CR is counterbalanced with FXS, where the remaining amount of backing for FRAX either mints or burns FXS.

This mechanism allows for peg stability while also being capital efficient, helping combine the best of both worlds. But you may be wondering how FRAX and FXS are any different from UST and LUNA. After all, even though FRAX is mostly collateralised (minimum 80%), it still poses the same death spiral risk that UST went through. The difference lies in the value accrual mechanism to the FXS token as compared to LUNA. If the FXS token has some fundamental value, in the event of a slight de-peg, users would (likely) happily burn FRAX to mint FXS and defend the peg. Moreover, the CR also represents the floor for the value of FRAX – for example, if all FRAX holders decided to simultaneously redeem the underlying tokens (i.e., a bank run), the total amount of redeemable value would likely be the average CR across FRAX’s lifespan (unless the USDC has been used FTX-style in degen hedge fund investments).

We’ll cover the value accrual mechanism for FXS in the Tokenomics section. For now, on to the next aspect of the FRAX Finance ecosystem.

FRAX Algorithmic Market Operations (AMOs)

Frax V1 introduced the concept of an ‘Algorithmic Market Operations’ (AMO) that operated as the protocol’s base stability mechanism by adjusting the CR. In March 2021, Frax V2 introduced a set of generalised AMOs that could build on top of this base stability mechanism. These AMOs can carry out arbitrary FRAX monetary policy on the open market so long as their actions don’t lower the collateral ratio or change the FRAX price. Examples of AMOs created from Frax V2 include:

Investor AMO: earns yield on USDC in Aave, Yearn, etc.;

Curve AMO: deploys USDC and/or new FRAX to Curve, Convex, and StakeDAO;

Liquidity AMO: provides liquidity to FRAX-based pairs on Uniswap and other AMMs;

Lending AMO: mints FRAX into overcollateralized lending markets for a fee.

These AMO’s allowed FRAX to be minted and deployed on a variety of other DeFi protocols. All the fees earned from these various mechanisms accrue directly to the FXS token. For example, one of the AMOs is to provide deep liquidity on the 3CRV-FRAX pool on Curve Finance. If, for example, the AMO had to mint and supply a lot of FRAX to maintain a robust and balanced pool, at a certain point those operations would have to stop as they would put downward pressure on the FRAX peg.

Most of the FRAX capital goes to the Curve AMO. The following benefits explain why:

Maximises liquidity of FRAX by being deployed in the 3CRV-FRAX pool;

Tightens the peg to $1;

Accumulates fees and LP rewards;

Grows earnings by utilising Convex to deposit LP tokens.

While holding such a dominant position on Curve helped to increase the overall circulating supply of FRAX, it left the protocol at the mercy of other DeFi protocols and prevented FRAX from having control over its monetary policy. To solve this problem, FRAX created FRAX Swap and FRAX Lend.

FRAX Swap

FRAX Swap is an Automated Market Maker (AMM) that helps traders execute large orders efficiently and is used by the protocol to increase the stability of the pegs for the FRAX and FPI stablecoins as well as return excess profits to FXS holders. It is fully permissionless and the core AMM is based on Uniswap V2.

Although FRAX Swap is designed as a general crypto protocol that can be used to provide liquidity for any trading pairs, its primary use case is to give FRAX more granular control over its monetary policy. The existing ‘buyback’ and ‘re-collateralise’ functions used in all AMOs have been replaced with a separate AMO that uses FRAX Swap, which processes ongoing buy-and-sell orders for collateral, FRAX, and FXS in an effort to support the peg, maintain the collateral ratio, and distribute protocol profits.

FRAX Swap can also be used by other protocols for the following:

Accumulate treasury assets like stablecoins by selling governance tokens over time;

Buy back governance tokens over time with DAO revenues and reserves;

Acquire another protocol’s governance tokens over time with the DAO’s own governance tokens;

Defend the ‘risk-free value’ (i.e., accumulated treasuries) of DAOs like OlympusDAO which have Protocol Controlled Liquidity that acts as the protocol’s floor value.

FRAX Lend

FRAX now has a custom lending market for satisfying stablecoin borrowing demand without exposing itself to other protocols’ risks. FRAX Lend allows users to create a borrowing market between any pair of ERC-20 tokens that have a Chainlink data feed. This approach contains risk to individual asset pairs without impacting the safety of other pools. For lenders, fTokens are used as interest-bearing receipts of deposits, similar to cTokens on Compound or aTokens on AAVE.

FRAX Lend also supports the ability to create custom Term Sheets for OTC debt structuring. FRAX Lend ‘pairs’ can be created with features like maturity dates, restricted borrowers and lenders, under-collateralised loans, and limited liquidations. The below diagram explains how this works:

While FRAX Lend markets can be created between any two compatible assets, it’s likely that the service will be predominantly used for FRAX-based pairs. The existing Lending AMO already allows FRAX to be minted on demand into overcollateralised lending markets. Since borrowers must post an equal or greater amount of collateral to make this process work, the FRAX collateralisation ratio does not decrease when more FRAX is minted. As such, any user with supported collateral can access a revolving line of FRAX credit without needing to source a counterparty.

FRAX Ether

FRAX Ether is an Ethereum liquid staking derivative similar to Lido. The FRAX Ether system comprises of three primary components, FRAX Ether (frxETH), Staked FRAX Ether (sfrxETH), and the FRAX ETH Minter.

frxETH acts as a stablecoin loosely pegged to ETH.

sfrxETH is the version of frxETH which accrues staking yield (similar to Lido’s stETH). All profit generated from FRAX Ether validators is distributed to sfrxETH holders. By exchanging frxETH for sfrxETH, the user obtains staking yield, which is redeemed upon converting sfrxETH back to frxETH.

FRAX ETH Minter (frxETHMinter) allows the exchange of ETH for frxETH, bringing ETH into the FRAX ecosystem, spinning up new validator nodes when able, and minting new frxETH equal to the amount of ETH sent.

Users deposit ETH with the FRAX ETH Minter and obtain frxETH in return (essentially a derivative of ETH). The Minter deposits blocks of 32 ETH to validators on the Ethereum network, earns ETH rewards from validation, converts the ETH into frxETH, and sends this frxETH to FRAX’s treasury. Meanwhile, users deposit their frxETH and receive sfrxETH in return. Over time, as frxETH from the FRAX treasury is sent to the vault that contains yield for holders of sfrxETH, the sfrxETH:frxETH exchange rate continually increases as it accumulates rewards.

The below diagram pictorially demonstrates how FRAX Ether works.

The Holy Trinity of DeFi 🔱

FRAX is the first DeFi protocol to encompass all three of the biggest use cases of DeFi, i.e., the ‘Holy Trinity of DeFi’ – liquidity structures, lending markets and stablecoins. With these use cases, FRAX now has complete control over all aspects of its ecosystem. But other protocols are not far behind in this endeavour.

Curve (crvUSD) and Aave (GHO) are both planning on releasing protocol native stablecoins in the coming months. This can be thought of as a convergence of services that the top DeFi protocols are all trying to compete for. It would be much easier to access all 3 services on one unified platform, instead of having to jump through ropes to access different use cases of the DeFi ecosystem. For the protocol itself, it leads to the following benefits:

Composability without relying on third parties;

New product offerings and additional revenue sources;

More efficient implementation of stablecoin-related strategies.

Although FRAX was the first to market with all 3 pillars integrated, time will tell whether this first mover advantage will sustain once bigger protocols like Curve and Aave (with higher TVL and capital flowing through them) enter the fray.

FRAX in Context of the Stablecoin Landscape 🌅

FRAX is just a tiny share of the total stablecoin pie, as the below diagram shows. The industry is still dominated by the big 3 fiat-backed stablecoins issued by centralised entities, namely USDT, USDC and BUSD issued by Tether, Circle and Binance respectively. Even when compared to MakerDAO’s DAI, FRAX lags very far behind.

However, FRAX’s protocol design may prove to be an advantage. It is ostensibly decentralised like DAI (ostensibly since its source of collateral is USDC, which is the flagship centralised stablecoin) but capital efficient like fiat-backed stables. It has maintained its peg quite well, even during periods of extreme market stress, such as the depegging and death spiral of LUNA and UST. This peg stability can be even more crucial in the future once more institutions enter the space and need a safe but decentralised stablecoin to transact and store their wealth in. However, from an institutional perspective, it remains to be seen whether FRAX’s model is completely fit-for-purpose and whether institutions would even be comfortable with any sort of algorithmic design. Only the test of time (and the Lindy effect) can answer that question.

Team 🤵♂️🤵♀️

FRAX Finance was founded by Sam Kazemian, an Iranian-American software programmer. He previously co-founded Everipedia (now IQ.wiki), a for-profit, blockchain-based knowledge base similar to Wikipedia. His crypto journey started at UCLA in 2013, where he mined crypto in his college dorm room, and now is a guest lecturer at UCLA focusing on crypto, computer science, and entrepreneurship. As the founder of FRAX, Kazemian has led the growth of the FRAX Finance ecosystem with the launch of innovations including FRAX V2, veFXS, FRAX Price Index (FPI), and FRAX Swap.

FRAX’s Chief Technology Officer is Travis Moore, an Italian-American computer programmer, who co-founded Everipedia with Sam Kazemian. Travis graduated from UCLA as a triple major in Neuroscience, Biochemistry, and Molecular, Cell, and Developmental Biology. He led the development of several projects at FRAX including the development of FRAX V2, veFXS, and the FRAX Price Index (FPI).

The third co-founder of FRAX is Jason Huan, who graduated with a BSc in Computer Science from UCLA in 2021, and was the founder of Blockchain at UCLA, a student-run blockchain community.

Thoughts from Using the Protocol 🖱️

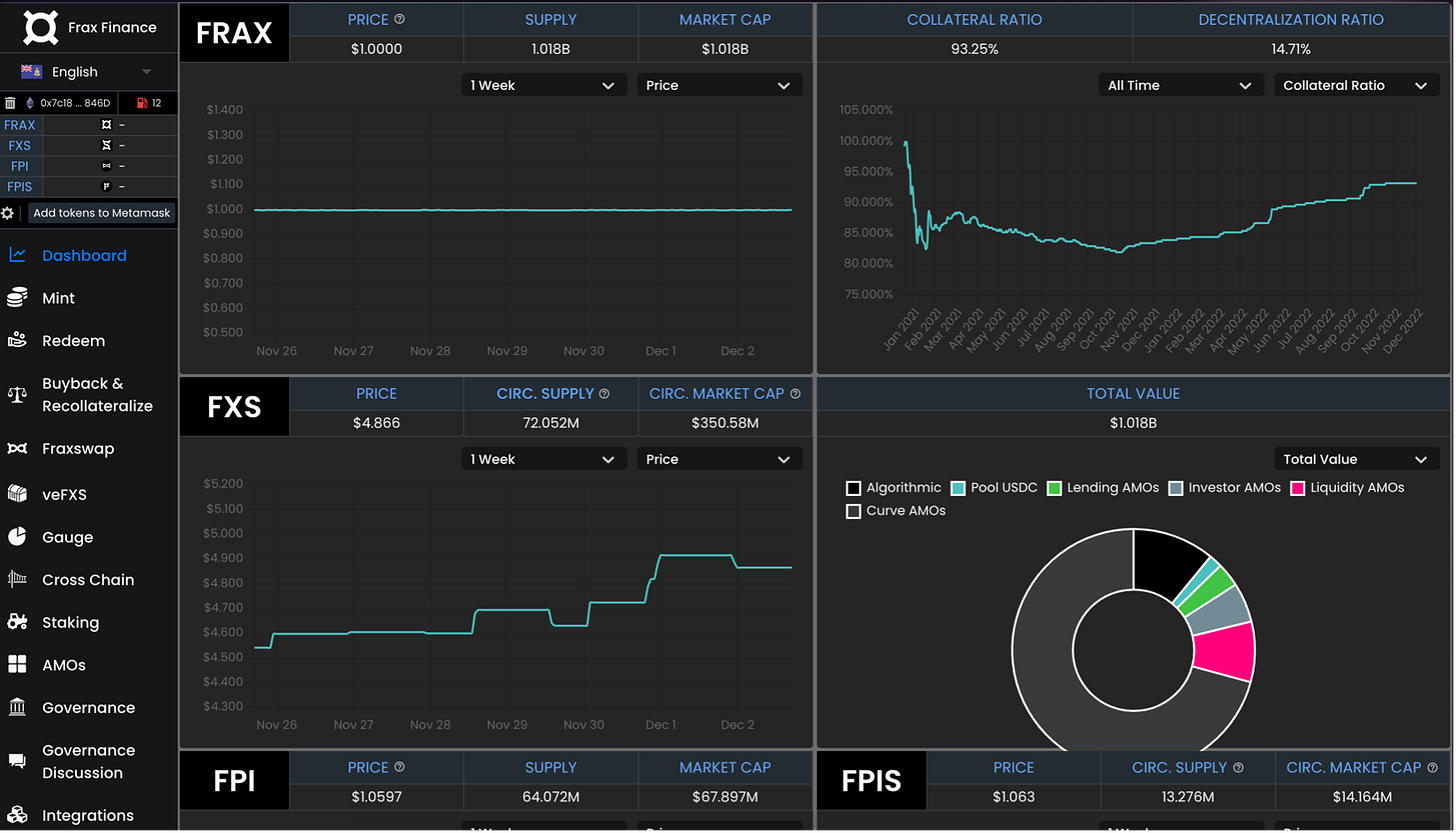

One of the key aspects that FRAX can improve on is its UI. Simply put, it is too confusing to use, especially for a retail user, although in all fairness, this may never be the target audience to use features like swap, lend, minting, redeeming, buyback and recollateralise, etc. As can be seen below, it is useful that all of the actions that can be performed are listed on the left, but it is almost indecipherable for a user who does not have enough of a background on the minute details of how FRAX works. This decision is understandable, however – FRAX is a heavily crypto-native product that is made for a very specific target audience, and its most retail-focused product, the FRAX stablecoin, should just be available to buy on most exchanges without users needing to worry about the mechanics of how it works. The same can be said of FRAX Ether and staking it. If, however, FRAX ever wants to turn FRAX Swap and FRAX Lend into retail-facing mass-market products, the UI needs to significantly improve and simplify.

Tokenomics 💸

Demand

FXS is the value accrual token for FRAX. The fair value of this protocol and token can be more accurately estimated compared to others due to the transparency of revenue metrics. Buying FXS is not only a long bet on FRAX demand and growth as a stablecoin, but also the revenue generating abilities of the protocol AMOs. For FXS to capture the upside of FRAX growth, there needs to be ample opportunities for stable-denominated yield which turns into burning of FXS. Therefore, FXS1559 was implemented to calculate excess value in the system above the collateralisation ratio and used this value to mint FRAX, purchase FXS on FRAX Swap, and buy and burn the FXS. Each AMO proposal uses FXS1559 to calculate excess value and buy and burn FXS, capturing value at the AMO level.

In addition to this buy and burn mechanism employed on FXS, FRAX also uses the veTokenomics model pioneered by Curve. As with most DAO governance, voting requires staking FXS into the vote-escrowed veFXS.

veFXS follows the same vesting pattern as Curve:

1 FXS token locked for 4 years generates 4 veFXS tokens.

Amount of veFXS decreases linearly as the unlocking date approaches.

Users can relock their veFXS at any time to reset / increase their veFXS balance. And just like Curve, veFXS is useful for voting on governance proposals as well as FXS gauges, which simply dictate where the supply of FXS will be distributed. Voters are incentivised to continue to lock up their veFXS to not dilute their vote over time.

An important aspect to note is that the veToken model can be a risky proposition in the volatile crypto market, where no one knows what will happen in a few months. Crypto winter has been known to swallow the market caps of scores of non-blue chip (and many times, even blue chip) tokens. If users do not have the ability to exit and the future of the protocol is in question, then their financial stake is at high risk. So, if stakers want to exit and cannot due to the lockup period, there is a good chance they become unmotivated and do not participate effectively in governance, having the opposite effect to what was intended.

To summarise, FXS has a clear value accrual mechanism where excess fees earned by the protocol through all of its different product lines are used to buy FXS and burn it, thus reducing overall supply over time. In addition, it employs a veTokenomics model that incentivises locking in tokens in exchange for veFXS to earn gauge rewards and prevent dilution of voting power over time.

Supply & Distribution Schedule

The FRAX distribution schedule and supply was fairly equitable. A majority of the tokens were allocated to the community for farming and reward incentives. Both the team and private investor allocations are completely vested, so there is no ultimate unlock or dump period to worry about.

The tokens were allocated in the following manner:

20% for the team, founders, and early project members, with a 12-month vesting period and 6-month cliff.

3% to strategic advisors or outside early contributors, with the tokens vesting evenly over 36 months.

12% to accredited private investors, with 2% unlocked at launch, 5% vested over the first 6 months, and 5% vested over 1 year with a 6-month cliff.

60% to liquidity programs, farming, and the community, via gauges and governance. The amount emitted halves naturally every 12 months but can be changed by an Improvement Proposal governance vote. Community governance can decide which pools, programs, and initiatives to support with the emission schedule, and no more than 60 million FXS can be allocated towards this due to the 100 million hard cap of FXS tokens released.

5% to the project treasury, grants, partnerships, and security bug bounties, decided at the discretion of the team and community.

Overall, the token distribution of FRAX seems fair, especially since the 35% to the team, advisors, and investors is in line with the distribution suggested by Lauren Stephanian and Cooper Turley here. Allocating more to the treasury may have been beneficial, but it is understandable given how the dynamics of the FRAX token depend upon accruing value to the FXS token and carefully controlling its supply and demand.

Governance ⚖️

The FRAX governance module is forked from Compound, as is the case with many Web3 protocols today. Governance is through FRAX Improvement Protocols (FIPs) and includes voting on issues like adding or adjusting collateral pools, minting / redemption fees, and the refresh rate of the collateralisation ratio. Full votes require 2 weeks of discussion followed by a token holder vote per the official governance process.

Users may propose new changes to the protocol if they hold a certain threshold of FXS (1% of the total votes, equivalent to 1 million FXS), or may combine their votes together to submit a proposal. Once a proposal has been submitted, it begins an active voting period of 3 days, where it may be voted for or against. If a majority is in support of the proposal at the end of the period, and the proposal has a minimum of 4 million FXS in favor, the change is queued into the time-lock where it can be implemented after 2 days.

FRAX aims to minimise parameters tweakable to reduce active management by governance, which is a noble (and intelligent) decision given the complexities of on-chain governance and the stagnation and risk it can introduce with long delays on implementing even the most basic proposals, as can be seen in the lengthy governance process above.

Traction & Performance 📉

The majority of protocol revenue for FRAX comes from its Curve AMOs, which ultimately end up being Convex farming rewards. The effect of this is that protocol revenues are highly dependent on CVX and CRV price. While FRAX often sells the rewards as earned, and thus won’t carry significant unrealised losses on its balance sheet, it is nonetheless a factor to be wary of.

As can be seen above, FRAX has a treasury of crypto assets like ETH, Convex, OHM, TOKE, etc., along with USD-based assets like those in the Convex FRAX-3CRV pool (a pool containing FRAX, DAI, USDC, and USDT in order to tighten the FRAX peg), and USDC and multiple interpretations of it like cUSDC (on Compound) and aUSDC (on Aave). The assets in FRAX’s crypto treasury are incredibly volatile, meaning that the treasury is immensely susceptible to large swings in value. The amount held in the USD-based assets has also decreased over time with worsening market conditions, especially seen with the drop in May 2022 that accompanied the Terra collapse. This can be seen below as well with the huge spikes in withdrawals in May 2022.

The total value locked across FRAX Finance is ~$1.23 billion, with $1.08 billion in FXS, ~$57 million in FRAX Lend, ~$56 million in FRAX Swap, and $34 million in FRAX Ether. The ~$150 million cumulative TVL achieved by FRAX Lend, Swap, and Ether is particularly impressive given that the products only launched in September and October 2022.

From a veTokenomics perspective, FRAX’s model seems to be working; more than 60% of circulating FXS has been locked as veFXS, and more than ~9.5 million FXS, almost 10% of the total supply (including non-circulating) is locked until 2023. In today’s market conditions, this is a positive sign since the temptation for users to want to withdraw is high and having more than 60% of circulating FXS locked up indicates that holders value the governance, yield, and gauge control rights granted by veFXS.

In terms of the price action of FXS, it has been fairly volatile and highly correlated with the broader market. However, it is important to note that drawdowns in price have not affected the peg stability of FRAX too much. With the buy and burn mechanism, there will always be buying pressure and demand for the FXS token which sets the baseline price for it.

Lastly, FRAX’s peg stability has been impressive. According to this Dune tracker, the 6-month standard deviation for FRAX’s peg has been only 0.0014, which holds up well compared to DAI (0.0013), sUSD or Synthetix USD (0.0031), BUSD or Binance USD (0.0015), GUSD or Gemini USD (0.0034), and even USDC (0.0012) and USDT (0.0013). It may even provide validation of FRAX’s part-algorithmic, part-collateralised model, although it is crucial to remember before sinking your life savings into FRAX that the peg only needs to sufficiently deviate once for a bank run and death spiral to occur.

Risks ⛔️

As a partially algorithmic stablecoin, there is some level of ‘faith’ backing the currency. The downside of this was seen in action with UST depegging and commencing a swift death spiral back in early May 2022. This was obviously impactful on FRAX. Aside from the abandonment of the 4pool plans on Curve (the UST-USDC-USDT-FRAX stablecoin pool), faith behind algorithmic stables completely evaporated.

The impact of the UST implosion can be clearly seen in FRAX’s total supply on the market as much more than a small blip on the chart, with the steep drop occurring in May:

Another situation was the FEI/Rari fuse pool exploit, which FRAX was a ~$12 million creditor to in one of its lending AMOs. After a ton of controversy, and a notable comment from Sam, the DAO decided to ultimately make all victims whole.

While this did not end up being a big deal in the grand scheme of FRAX, the precedent is important: FRAX has protocol operations (lending and AMOs) that generally put funds at risk. While these are exogenous risks and simply cannot be predicted (although in the volatile world of crypto, always assume the worst), it is important that there is some level of mitigation to ensure that exposure to a single protocol isn’t enough to completely upend operations.

Closing Thoughts ⌛

FRAX is an easy project to be bullish on. The product makes sense, the team ships as hard as any competitor out there, Sam Kazemian is level-headed and effective in his public conversation, and the protocol token checks all of the boxes for what we look for, i.e., some level of utility and value accrual.

With this being said, there are some very high exogenous risks as stated above. The stablecoin market is largely dominated by USDC and USDT, and FRAX backing is overwhelmingly in USDC. Regulation can play a big factor in this, especially given that we know that Circle has played on the same side as US lawmakers.

Additionally, competition will continue to emerge. Compared to these other protocols, FRAX will have the benefit of the Lindy Effect, especially with Terra out of the game. By continuing to build a robust ecosystem that brings any and all participants its way, the future looks bright for FRAX, although its peg must continue to stand the test of time before any definitive conclusion can be made.

Bibliography 📖

FRAX: A Fractional-Algorithmic Stablecoin

Disclaimer

This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the article authors and do not represent those of people, institutions or organizations that those authors may or may not be associated with in professional or personal capacity, unless explicitly stated. All content provided on this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. The owner will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information. Any views or opinions are not intended to malign any religion, ethnic group, club, organization, company, or individual.