Dopex

Protocol Analysis #10 - A Genesis Block x Tokenomics DAO Collaboration

Introduction 👋

This is the tenth article in our Protocol Analysis series. In this series, we use our investment template outlined in How to Analyse a Web3 Protocol to fundamentally and critically analyse a variety of crypto protocols, aiming to separate the ‘real’ from the hype.

For this article we have partnered with Tokenomics DAO who will be, you guessed it, handling the tokenomics part of this deep dive. Let’s dive in!

Protocol: Dopex, a decentralised crypto options exchange that aims to simplify the process of getting exposure to options.

Overview of Dopex 🗒️

Options are a type of derivative. They allow you to speculate on the price level of an underlying asset without having actual exposure to said asset. You can either go long by buying call options or go short by buying put options. You buy an option at a specific strike price (i.e., the fixed price at which the owner of the option can buy, or sell, the underlying security or commodity) and pay a ‘premium’ (i.e., the market price of the option) to the seller of the option. Your profit is the difference between the current price and the strike price (minus the premium you pay, of course). For a call option, you have the option to buy at the strike, while for a put option, you have the option to sell at the strike price. Therefore:

A call option is profitable when current price > strike price;

A put option is profitable when current price < strike price.

You can also use a combination of these two options to create more exotic strategies with specific payoff profiles. Options are cost-efficient, have convex payoff profiles (i.e., the relationship between the value of an option and the price of its underlying asset is non-linear, and small changes in conditions can induce larger movements in price) and can be used to hedge positions.

All-in-all, the options market is almost 20 times the size of regular equity markets in traditional finance (TradFi). Thus, it is fair to assume that the same shift will eventually occur in crypto. Currently, the options market lags significantly behind, with a majority of crypto trading volumes being spot and perps (>95% of total trading volume).

Dopex aims to change this by simplifying the process of getting exposure to options. They allow users to do three things: buy regular options (such as calls and puts) on a few assets, deposit assets into vaults that employ a specific options strategy, and get exposure to volatility using ‘straddles’. We’ll discuss all three of these in the next section.

DeFi options today can be placed into three buckets:

DeFi Option Vaults (DOVs): A structured product made with a combination of options.

Order Book Based Exchanges: An exchange like a CEX, where buyers are matched with sellers using an orderbook of bids and asks.

Option AMMs (Automated Market Makers): A decentralised exchange that pools liquidity in a smart contract, with the price determined by a mathematical formula.

Dopex is primarily centred around the DOV model. It is currently deployed on Arbitrum, Avalanche, and Binance Smart Chain. Let's dive into how Dopex works in detail below.

How Does Dopex Work? 🤷

Dopex allows you to trade options in multiple ways on a few assets (ETH, stETH, DPX, rDPX, BTC, GMX, gOHM and MATIC).

The first one is pure vanilla options, where users can buy or sell both call and put options on these assets. In other words, calls buyers and puts sellers benefit from price increases, while calls sellers and puts buyers benefit from price decreases. To go long (buying the option), you must pay a premium, while if you are short (selling the option), you will receive the premium. Since the market is nascent and limited, they only offer a few assets, and only at a few strike prices. Currently, the only type of vanilla options offered by Dopex are European (i.e., you can only exercise the option on the expiry date).

The second product they offer is Single Staking Option Vaults (SSOVs). SSOVs allow users to lock (stake) their tokens in vaults for a specified time period (weekly or monthly) and earn yield on their locked assets during this time period. Users deposit assets into a vault for a specific asset, at a specific time period, for specific strike prices – to use the TradFi lingo, these users are options writers. Options are then sold against these underlying assets to willing buyers. The SSOV depositors earn the premiums that option buyers pay, while Dopex additionally stakes the locked assets into other staking protocols for additional yield. This mechanism allows Dopex to cap a depositor’s upside up to the strike price, and compensates them with a fixed fee.

This strategy has unfortunately underperformed the broader market because crypto assets are highly reflexive. One bad day can wipe out months of steady gains, and the upside being capped exacerbates the problem. The downside not being capped further adds fuel to the fire, since the premiums earned have not been enough to cover for losses. Due to this loop of doom, Dopex started introducing more robust products for depositors to have a less risky way of earning yield. One of these is the Atlantic Option, and more specifically, Atlantic Straddles. Since this sounds (and is) relatively complicated, let’s break it down step-by-step.

Firstly, an Atlantic Option is a new type of SSOV where the option seller's collateral can be borrowed by the option buyer. To prevent the option buyer from purchasing an option and running away with the option writer’s deposit, the collateral can only be borrowed under specific circumstances, such as:

Liquidation protection for leveraged perpetual futures (integration with GMX);

Liquidation protection for leveraged bonds;

Creating option spreads via Atlantic Straddles;

Liquidation protection for collateralised debt positions (CDPs, like the positions opened when depositing collateral to a protocol like Maker to borrow DAI);

Creating backstops to token prices falling too much;

Creating synthetic straddles;

Insuring stablecoins.

The collateral is never in the buyer's wallet and is managed entirely on-chain via smart contracts created by Dopex. The collateral is essentially being used to create a hedged position in each and every one of the above scenarios. Let's look at one of the above use cases to illustrate this more clearly: Atlantic Straddles, since we’re sure you’re wondering what in the world a straddle is.

Straddles are an option strategy where a user buys a call option and a put option at the same strike price. They benefit if the price moves enough in either direction to compensate for the premiums paid. Here’s a brief example to help elucidate the strategy better.

Buy 1 ETH Atlantic Put with a strike price of $1,500;

Borrow 50% of the collateral ($750 USD);

Use the $750 borrowed to purchase ETH.

The payoff profile looks like this: let's say the put has a premium of $82. That means you pay $82 to have the option to sell ETH at the strike price of $1,500. If the price of ETH is less than $,1500 - $82 (premium) = $1,418, you’ve made a profit.

Now you also borrow 50% of the collateral and buy ETH with it. In this case it would be $750 assuming no funding fee. So, you have an ETH spot exposure of half the strike price. This means:

The put is in profit if prices go down enough;

The spot position is profit if prices go up.

The further away from the strike price, the more likely one of the positions will be in profit. The closer to the strike price, the more likely one of them will be in a loss.

There will be two breakeven points where the loss from one strategy equals the profit from the other strategy. This ends up being more capital efficient since buyers need only buy one option instead of two to get access to the same payoff profile. Check out the payoff profile and the breakeven points in detail below:

Atlantic Options are an innovative feature possible only in the on-chain world of DeFi. The use cases are just being discovered fully and could introduce completely new products that are only possible in DeFi. Kudos to Dopex for being on the cutting edge of innovation in this space!

The State of the Crypto Options Market 🏪

Even though there has been MUCH innovation in the crypto options space, the numbers tell a different story. Crypto options protocols lag FAR behind other DeFi verticals with a paltry $170 million in Total Value Locked (TVL), which is nothing compared to the $50 billion in TVL in DeFi today. Here are the top 10 biggest options protocols by TVL:

There are a few reasons why options protocols haven't gathered much traction:

Higher trading costs as compared to centralised exchanges like Deribit;

Limited amount of assets available to trade;

Limited strike prices to trade at, which leads to shallower liquidity, which leads to a worse trading experience;

Options protocols do not have as sophisticated UIs as those of centralised players;

SSOV offerings so far do not offer compelling enough strategies compared to other forms of yield generation.

Any protocol that can solve these problems has a massive chance of stealing market share from Deribit, the largest centralised crypto options exchange.

Team and Investors🤵♂️🤵♀️

The team behind Dopex has not been doxxed and purely consists of anons. Their chief is currently an anon known as tztokchad.

They have the following investors, who are mostly all anonymous Twitter crypto whales. While having a team that is anon is not necessarily a bad thing, it can take away credibility from what the team has achieved. Funding amounts have not been disclosed.

Thoughts from Using the Protocol 🖱️

Dopex has a very clean UI and all their protocol offerings are organised systematically, making it easy to navigate for the most part.

The problem from our perspective, however, is that to an extent, Dopex is ‘stuck in between’. In other words, it is not simple enough for an average retail user to come and use it (for example, there are no explainers), even though retail is likely their primary target market due to the ‘deposit and forget’ nature of DOVs. However, at the same time, Dopex’s UI is not ‘professional’ enough for serious options traders to actively trade using the platform. They should probably prioritise one over the other to dominate that particular niche.

Tokenomics and Governance 💸 ⚖️

Dopex has a fairly complicated token flow. It uses a dual token system consisting of DPX and rDPX, and also employs two other tokens – dbrDPX and dpxETH. Overall, it is made up of multiple parts which by themselves are simple, but put together require a bit of understanding, so bear with us. We’ve merged the tokenomics and governance section, more heavily focusing on tokenomics but with some of the tokens in the Dopex ecosystem having governance power.

Overall Tokenomics

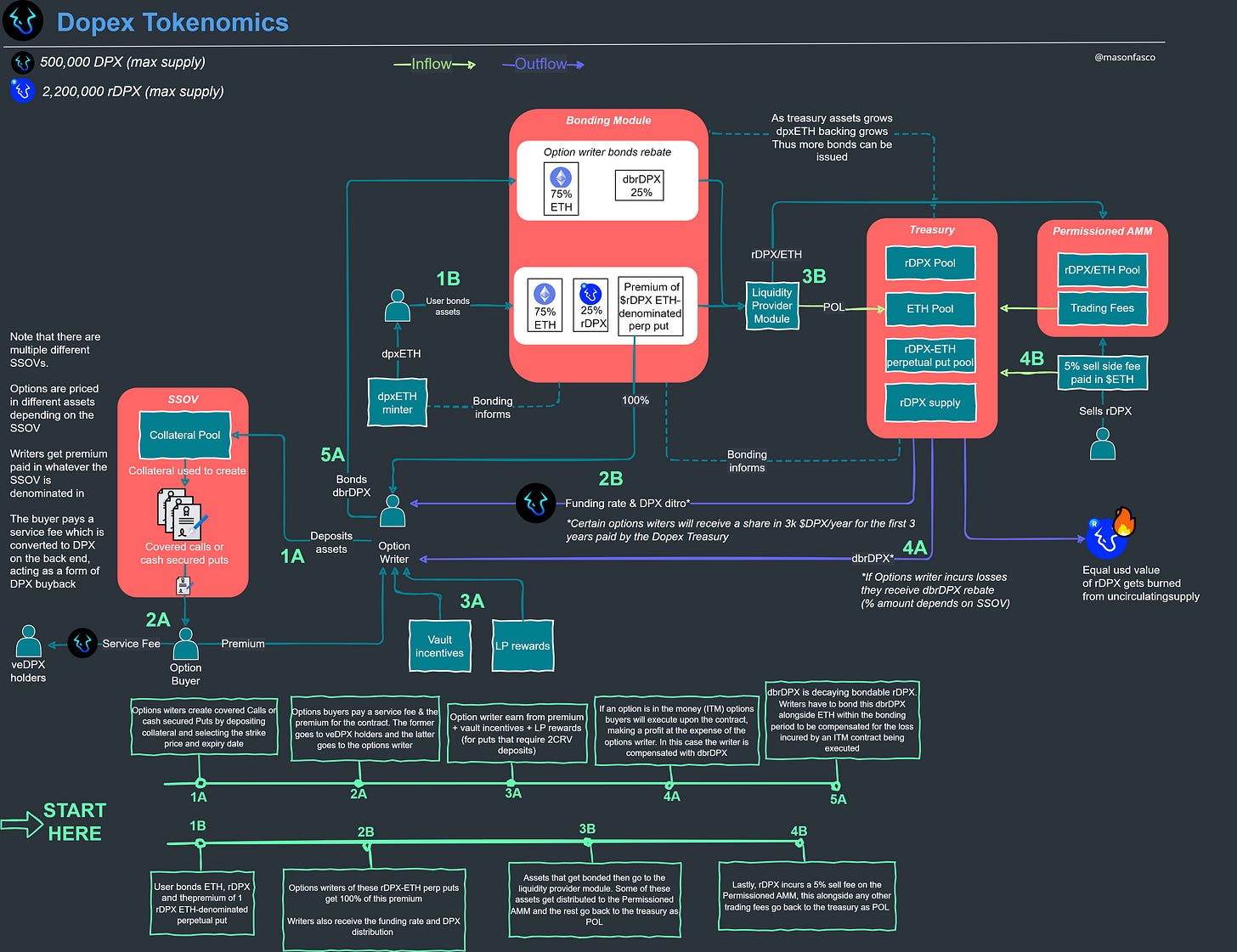

A zoomable version can be found here.

SSOVs

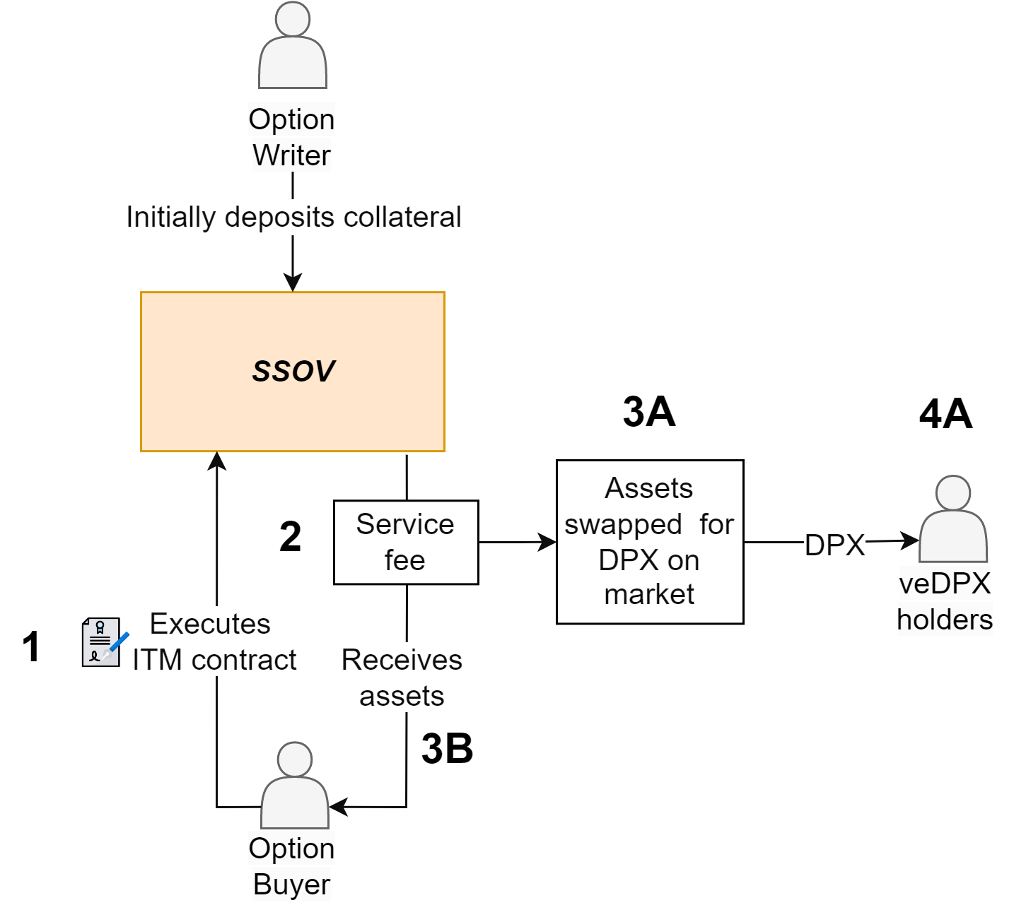

Dopex uses a dual token system, and we will look at the utility of each later on in the article. Being an options exchange, it makes sense to start our journey of the token flow from the POV of the options writers themselves. They can create Covered Calls or Cash Secured Puts by locking the required capital into a Single Staking Option Vault (SSOV) and selecting the strike price. SSOVs allow depositors to earn yield on their locked capital from premiums paid by buyers, vault incentives and LP rewards (for puts that require 2CRV deposits), in turn making depositing assets more enticing for writers but at the same time this also means that the position takes on more risk. In the Dopex system, writers are essentially liquidity providers (LPs).

These options can then be bought by users who have to pay a service fee and premium, with the former going to veDPX holders and the latter going directly to the Options writers. The yield options writers can expect from premiums paid by buyers is proportional to how close to ‘at the money’ (ATM) strikes are being locked into. The reason for this is that the closer the strike price is to the market price, the less risk the buyer is taking on, and thus the higher the price.

Rebate Mechanism

One risk that writers take on is that of their contracts finishing in the money (ITM). If this happens, the contract is deemed profitable and will likely be executed by the contract buyer, meaning that they will turn a profit by being able to acquire an asset cheaply or sell an asset at a higher value than market value, both at the expense of the options writer. Thus, the writer incurs a loss. The way Dopex compensates these losses is via their rebate token, rDPX, and the magnitude of the rebate depends on the Rebate Percentage of the vault from which losses were incurred – each vault has a risk profile, and governance determines what percentage of losses incurred should receive a rebate. The loss that the writer incurs is more akin to impermanent loss since writers don’t lose any USD notional value, however, they do have a chance of losing a percentage of their staked assets.

rDPX is distributed to the writers in a bonded form, known as dbrDPX. The only method in which the value of the rebate can be realised is via the standard bonding procedure, with the value of dbrDPX representing the required rDPX to be bonded along with ETH. As we will see, these bonded assets serve as the backing for Dopex’s synthetic assets, such as dpxETH.

Bonding Module

Now let's look at the other side of things. Users can bond assets in order to mint dpxETH, as mentioned above. We will dive into the utility of each of these tokens later on (i.e., why the user would even want to hold dpxETH in the first place). The reason a user would bond assets to mint dpxETH rather than just buying it on the market, however, is due to the discount they can get via bonding. If you’re interested in reading about how discounts are calculated in Dopex, see the Bonding as applied to rDPX section here.

Dopex uses a similar bonding mechanism as pioneered by Olympus. Users have two options (pardon the pun) when bonding assets:

Choice 1: they bond 75% ETH and 25% worth of rDPX

Choice 2: they bond 75% ETH and instead of the rest being rDPX, the user bonds the premium (i.e., the cost of the option) from one 25% Out of The Money (OTM) rDPX ETH-denominated perpetual put that covers the rDPX amount.

This is best understood with an example: the user wishes to bond $100. Let’s assume that the $rDPX is worth $100, $ETH is worth $1000 and the premium for the rDPX-ETH put is $5. This means that the user would have to provide the $5 premium for the put, $71.25 worth of ETH (75%), $23.75 worth of rDPX (25%).

The premium for Choice 2 gets split up between the writer of the ETH-denominated perp put and the Treasury, 75/25 respectively. These bonded assets are handed off to the Liquidity Provider Module where some assets get directed to the permissioned AMM and the rest go back to the Treasury as Protocol Owned Liquidity (PoL), which in turn forms the backing for the dpxETH that the user initially bonded their assets for. If you’re interested in reading about how assets get split between the AMM and treasury, see the Liquidity Provider Management section here.

As assets get bonded, an equal USD value of rDPX gets burned from the un-circulating supply that resides within the Treasury.

Permissioned AMM

Then we have the Permissioned AMM. This is a fully protocol-owned, gated access AMM – only whitelisted entities can be LPs, and currently, this is restricted to the Treasury. This AMM has a 5% sell side fee on rDPX, with the intention of acting as an incentive alignment mechanism since users do not want to incur high sell fees so they are encouraged to bond rather than sell their rDPX, thus growing Dopex’s PoL.

Peg Stability Module

One thing that isn’t depicted in the token flow diagram is the Peg Stability Module (PSM). This is responsible for keeping the synthetic assets, currently only dpxETH, at peg. There are 3 scenarios that the PSM accounts for:

Scenario 1: dpxETH > 1.01 ETH

In this scenario, dpxETH can be minted with 100% ETH. This enables arbitrage, resulting in the rebalancing of the pool and the peg being regained.

Scenario 2: dpxETH < 0.99 ETH

The v2 Treasury has a privileged function to swap ETH for dpxETH on Curve. This contract can only be called by veDPX holders with >1k veDPX and specified admin addresses. This again enables arbitrage, which rebalances the pool and allows the peg to be regained.

Scenario 3: dpxETH > 1.01 ETH

veDPX holders with at least 1k veDPX can redeem dpxETH for its underlying backing in the form of 75% ETH and 25% rDPX. This means that users can buy underpriced dpxETH on Curve and redeem it for 1 ETH worth of rDPX and ETH in a 25:75 ratio, again allowing arbitrage which results in the rebalancing of the pool and the regaining of the peg.

There is centralisation involved in the Permissioned AMM and PSM, with only admin addresses and whitelisted entities able to profit from the arbitrage required to maintain the peg and the LP profits from the AMM. This may be in order to more closely control and grow the AMM and PSM in the early stages of their growth but is a definite cause for concern given the pseudonymous nature of the team.

Utility

Dopex uses a dual token system (DPX and rDPX) and also offers synthetic assets (dpxETH). Let’s dive into the utility of each.

DPX

DPX is the primary governance token of the platform. Voting rights include being able to change rewards rebates for SSOVs, SSOV DPX emissions distribution, and the strike threshold for options. Dopex has also employed the veToken model, meaning that all of the above is only possible if the user locks their DPX, in turn receiving veDPX, the token with the governance rights.

Furthermore, veDPX holders partake in fee share collection from service fees that options buyers have to pay when executing an ITM contract, but there’s a twist: upon payment, these service fees are denominated in whatever asset the SSOV is designed for (i.e., if a user buys stETH, the service fee will also be denominated in stETH), which then gets swapped for DPX on the backend and distributed to veDPX holders. Essentially, veDPX holders are growing their share of the platform, not accruing fees per se. This also means that the service fee being swapped for DPX acts as a form of buyback mechanism.

rDPX

rDPX is Dopex’s rebate token and is issued in the form of dbrDPX (see Rebate Mechanism section above for more). The interesting aspect of this design choice is that rDPX never really hits the market since the only practical choice left to the options writers who incurred the loss is to bond it. This means that sell pressure is offset from rDPX. It also means that there is likely to be more sell pressure on dpxETH, which puts more pressure on the PSM module. The reason is that an options writer who incurs losses and receives dbrDPX as rebate will bond it, receive dpxETH and sell this on the market since they wish to recover some of the value they lost. It should be noted that if they wish to hold ETH and dpxETH is stable and provides yield via Curve then maybe they will be happy in holding dpxETH, but this is speculative. The pressure on the PSM module, however, is beneficial for those profiting from the arbitrage opportunities to maintain the peg, which is another point of concern.

rDPX is also used as collateral for, and required to mint, synthetic assets (dpxETH). Those of you with a keen eye may be quick to point out that having a volatile token be part of your synthetic asset backing is likely high risk, and you’d be right. The clever solution for this was to allow for a type of value backstop for rDPX backing of dpxETH. This is the reason for the rDPX ETH-denominated perpetual puts pool, as the value of rDPX decreases, the value of the rDPX-ETH put increases, thus it allows for the backstop of rDPX to the collateral value of the purchased put.

Perpetual puts will target 25% OTM rDPX in ETH terms, meaning that the minimum backing of each dpxETH will be 93.75% ETH.

dpxETH

dpxETH is the first synthetic asset issued by Dopex. It is pegged to ETH, derives its price from AMM mechanics (i.e., supply & demand of liquidity on market), and is not redeemable for its underlying assets (unless there is a Scenario 3 de-peg).

The goal and reason for creating a synthetic asset is for it to be used as a collateral type in Dopex products, notably Call SSOVs, Options perpetuals, Options Scalps, and Inverse Straddles.

Distribution and Unlocks

DPX

Operational Allocation (17%): Distributed across 5 years. This allocation is used to initially handle governance, incentivize the development of community suggestions, and help grow the platform with newer features/upgrades and account for other operational costs.

Farming or Liquidity Mining (15%): A farming period is set to 2 years.

Platform Rewards (30%): Distributed over a period of approximately 5 years. These rewards will incentivize the use and upkeep of the Dopex platform.

Founder’s Allocation (12%): 2.4% is initially staked in liquidity pools, while 9.6% is vested for 2 years distributed using a drip system via a smart contract.

Early Investors & Token Sales (26%): Early investors receive 11%, with 50% vested over 6 months, while 15% is allocated for the token sale.

This distribution has a low allocation to founders of which an average vesting period applies; this is good especially given the pseudonymous nature of the team. However, even though the early investor's allocation is lower than the industry standard, it has a less favourable vesting period in that 50% is unlocked at TGE and the rest is only vested over 6 months. This may add early sell pressure on DPX and may lead to misaligned incentives.

rDPX

rDPX does not have a fixed emission schedule since it is minted and distributed as compensation for any losses incurred by options writers, and the magnitude of this compensation depends on the vault in which the loss occurred and what compensation percentage has been set to said vault via governance. This means that rDPX emissions are non-linear and somewhat dependent on market forces.

dpxETH

dpxETH is minted upon users bonding assets. Note that as the treasury grows, more bonds can be issued.

Value Creation and Capture

The value Dopex creates is that of bringing one of the most profitable options platforms to the crypto market via their interesting design, which allows for increased cost efficiency and attractive risk profiles vs. simply holding and even LPing a token, and potential of higher ROI (if you know what you’re doing). As the DeFi space grows and options become more attractive, Dopex could capture a considerable portion of this growth.

This value is captured at two points within the system:

The OHM-like bonding allows for the accrual of PoL.

rDPX price appreciation due to the side-stepping of rebate sell pressure and favourable burn mechanic. Furthermore, since rDPX is linked to dpxETH minting, which is to be used in a range of Dopex products, it also tags along for the ride and maps Dopex’s product demand via bonding to an extent.

Lastly, there is veDPX (locked DPX) which has a less appealing value capture profile since it is primarily used in governance.

Demand Drivers

DPX

As mentioned in the DPX Utility section above, options buyers have to pay a service fee which gets converted to DPX and is then distributed to veDPX holders. This market buyback is a form of monetary policy and can be considered demand. Similarly, demand for DPX can come from users who are looking to increase their ownership of the platform via said distribution.

Furthermore, when dpxETH is experiencing a major de-peg of <0.85 ETH (see Scenario 3 in Peg Stability Module section), users who hold more than 1k veDPX can call contracts to perform arbitrage via the PSM. Thus, demand for DPX can come from users who wish to arbitrage the peg. Granted, this is a weak demand driver since if the incentive to hold a large quantity of DPX relies on dpxETH depegging frequently (i.e., performing poorly) something is amiss.

rDPX

rDPX has quite a curious demand profile. It is a rebate token, but since sell pressure is offset due to it being distributed in the form of dbrDPX it takes less of a hit on the holdability front. It is also required to mint dpxETH via bonding, meaning that in some regard its demand is tied to the demand for dpxETH and how well the peg can be maintained (since in a major de-peg it can be redeemed as collateral and thus be sold). Lastly, an equal USD value of rDPX is burned upon bonding, which in turn reduces max supply. This is a meme-worthy point.

dpxETH

In the initial stages of its rollout, its utility to users will simply be to mine liquidity rewards on Curve. Thus, anyone looking to farm yield on their ETH may deem holding dpxETH an interesting option. However, as mentioned above the goal is for it to become a major collateral type in Dopex products.

Observations / Thoughts

rDPX Supply & Demand Dynamic

There currently isn't a way for rDPX to actually hit the market since losses are paid in dbrDPX which can only be bonded along with ETH, and the fact that upon bonding assets an equal USD value is burned from the un-circulating supply in the treasury. Although this may sound like perfection to rDPX maxis, we find ourselves asking how dpxETH is to be minted if rDPX is in low supply on the market. It should be noted that as the price of rDPX increases due to lower circulating supply, less will be required to bond; however, this may result in slippage problems for larger buys and could be a bottleneck for dpxETH growth. This is an easy fix as demand can be estimated and rDPX could be issued at a favourable rate so as to not hinder dpxETH growth.

It seems like the goal of rDPX has shifted from rebate token to that of synthetic bootstrapping token. We assume that dpxETH won’t be the last synth that Dopex issues, thus this dynamic has to be kept in check so as to not result in any undesirable forced decisions (say, voting to expand rDPX supply to bootstrap another synth) later down the road.

Value Exit

There must always be a point at which value exits the system, and if there isn’t, the system is a categorical Ponzi. In Dopex, the permissioned AMM is gearing up to be the most liquid place to trade rDPX/ETH. Selling rDPX on this AMM incurs a 5% fee, and this is done to incentivise the bonding of this rDPX rather than selling it. However, if the user desires to exit their position they are essentially being incentivised to translate this sell pressure to dpxETH since bonding rDPX along with ETH mints dpxETH which the user will sell on the market.

It is too early to tell if this value exit vector is better or worse than having normal sell side pressure on rDPX. If the sell side fee incurred upon selling rDPX is changeable by governance, then we assume we will find an equilibrium at which this dynamic is sustainable. For now, it remains speculative.

Rebate System

Options writers get compensated for losses in the form of dbrDPX (bonded rDPX). In order to actually realise the value of the rebate they have to bond ETH along with the dbrDPX representing the rDPX portion of the bond. This again translates sell pressure to dpxETH. Furthermore, dpxETH mint rate is dependent on the backing within the treasury, and if there is not enough backing then dpxETH cannot be minted. This aligns rather concerningly with Scenarios 2 & 3 in the PSM, in that if a de-peg of dpxETH occurs, the treasury is used to rebalance the pools on Curve and regain the peg. All-in-all, this means that if this were to happen at the same time as a group of options writers finding their collateral being depleted by ITM options buyers executing upon their right, they may have issues being able to redeem the value in the rebate. Again, this is currently speculative and requires further investigation.

DPX Fee Share

As mentioned above, veDPX holders receive DPX distribution from the service fees paid by options buyers. This DPX buy back essentially re-allocates DPX to holders with strong hands. This makes sense. However, as the real yield movement has shown, yields in assets that are denominated in, say ETH, are quite attractive to users and are a considerable demand driver, meaning that there are two types of users who could see locking DPX as an attractive strategy; (1) those wishing to accumulate more DPX and (2) those wanting to earn ETH yield.

Thus, if service fees were denominated in ETH, veDPX holders who wish to accumulate more DPX would simply buy it themselves, and at the same time the fee share demand driver would entice some users to simply lock DPX to accrue ETH. The current system feels like a missed opportunity to capture both types of users.

Traction & Performance 📉

Dopex launched in late 2021 and had a volatile start with huge swings in TVL, with TVL peaking at the end of March 2022 at around $160 million. Since then, the TVL has fallen off a cliff and is currently hovering at around $30 million. This drawdown in TVL is obviously in part due to the broader market downturn. The price of DPX also behaved similarly, reaching a peak of $4,000 in Jan 2022 but currently residing at around $380.

On the plus side though, DPX and rDPX holders have both been increasing steadily. This is likely due to the innovative updates to the protocol as well as the unique tokenomics expected from the update to rDPX that we discussed above. The success of rDPX’s tokenomics model in avoiding sell pressure for the token is showcased by more than 60% of rDPX holders having held it for more than 6 months, and almost 50% for more than a year. However, the number of holders is pretty low at 825.

The number of weekly active users of Dopex has, along with the rest of the market, cratered. However, it is looking like the volume of new users is trending slightly upwards after reaching a bottom around July 2022.

Risks ⛔️

The risks associated with Dopex are as follows:

Broader risk of on-chain options not seeing enough adoption in the short and medium term.

Risk of alternative options models being more efficient (such as a hybrid of option AMMs and orderbook exchanges, or an off-chain/on-chain model).

Anonymous team – rugpull risk (however slight).

Lack of innovation from the team (although we can safely say they’ve been shipping hard in the bear market).

Closing Thoughts ⌛

All in all, Dopex is on a promising path. They have some interesting products that look to help their users considerably and they are slowly (but surely) expanding into new realms with their recent rDPX v2 tokenomics update and their plans with dpxETH are ambitious to say the least.

One interesting aspect of the system that they’ve created is that, even though the tokenomic model is quite complex, it is shielded from the end user (i.e., they don’t have to worry about how it works). On the other hand, they seem to be playing heavily into dpxETH being a key component of their ecosystem (collateral token, essentially becoming the new rebate token, etc). They have a decent amount of fail-safes and backstops built in for a de-peg not to be a problem, but only time will tell.

Dopex’s biggest opportunity (and challenge) is to create a virtuous flywheel between its large, intertwined suite of products. Its preeminent position on Arbitrum, head start on the rest of the ecosystem, and the huge opportunity offered by the DeFi options market puts Dopex in the perfect position to capitalise and become a DeFi mainstay in the years to come.

Bibliography 📖

Disclaimer

This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the article authors and do not represent those of people, institutions or organizations that those authors may or may not be associated with in professional or personal capacity, unless explicitly stated. All content provided on this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. The owner will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information. Any views or opinions are not intended to malign any religion, ethnic group, club, organization, company, or individual.

👇🏽 please hit the ♥️ button below if you enjoyed this post.